Consolidated Group revenue up 5.3% to ₦208.9bn

- Nigeria revenue up 6.1% to ₦202.4bn

- Group gross profits up 1.1% to ₦133.5bn, 63.9% margin, affected by gas disruption

- EBITDA up 1.6% to ₦129.3bn at 61.9% margin

- EBIT up 0.8% to ₦112.0bn, 53.6% margin

- Earnings per share down 11.0% to ₦5.63 as some Nigerian operations become taxable

- Net debt of ₦200.0bn

- ₦119bn paid in respect of 2013 dividend

Dangote Cement released its 2014 Half year results showing an 11% dip in profit after tax and a flat revenue growth. Expectedly, the results got many wondering if this was a blip or if this indeed is the beginning of the end of the earnings growth that has been associated with this company in recent years. I sought for answers myself and decided to participate in their earnings call last Friday. These were the 10 things I took out from it. [upme_private]

- Gas – Gas is a very important factor to Dangote Cement’s revenue and cost of sales stability. Without Gas they can’t produce at optimum capacity and they also incur huge direct cost. Quoting the company CEO

Disruption to our gas and LPFO supplies has weighed on both our sales and margins and hampered our ability to supply Nigeria’s healthy demand for cement. We have built coal facilities to serve Lines 1 & 2 at Ibese and Line 3 at Obajana and are embarking on a programme to equip all our kilns in Nigeria with the ability to burn coal in preference to the more expensive LPFO we use at present.”

Gas supply stability is a huge problem for the company and the CEO did in fact call the situation “precarious”.Last year, a drop in Gas affected Q3 results as the company could not attain the N100billion in sales it achieved in Q2.

- Coal – The company is looking at using coal as a permanent alternative to Gas. Coal is not a cheaper alternative as it cost 1.5x more than Gas. LFPO is more expensive than Coal. The are also looking at going into coal mining.

- Expansion Plans – The company’s expansion plans is in full gear with new lines coming on stream in Nigeria whilst plants in other African countries are approaching various stages of completion. According to the company,

One new lines at Ibese and the new line at Obajana have been commissioned and are under trial production and the fourth line at Ibese is under commissioning and, we are confident they will be producing commercial quantities of cement in the near future.” “Our plants in Senegal and South Africa have been installed and the commissioning process has commenced.” “Across Africa we continue to make progress in opening new plants to serve the continent’s growing need for cement and later this year we will open our plants in Zambia, Ethiopia, Cameroon and Sierra Leone.”

- Nigerian Operations – Nigerian operations still contribute about 96% of Revenues. Out of the N209billion in revenues posted, Nigeria earned N202.3 billion and up 6% from the prior year. Nigeria as a market and location is therefore integral to the success of the company.

- African Operations – Revenue dropped by more than 50% for the first half of the year compared to the prior year for their West and Central African operations (excluding Nigeria). They mainly attributed this drop to their Ghana operations which was hampered by the currency debacle currently facing the country as well as price restrictions imposed by the government. On the contrary their East and Southern African operations saw a 900% rise in sales as it rose from N311million to N3.1billion. Their South African subsidiary Sephaku Cement commenced operations and was a crucial factor for the massive increase. In general they expect about 1.5mmt in sales from their African operations and 15mmmt from Nigeria by the end of the year.

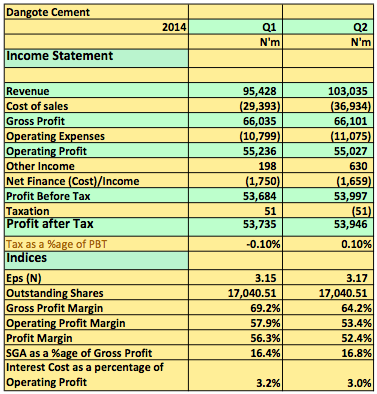

- Operating Expenses – There was a massive N3.4billion drop in operating expenses in the second quarter of 2014 (April to June). The company CFO attributed this drop to a write down in certain areas of operating expenses which they no longer incurred in the second quarter. They took the hit in the last quarter of 2013 and first quarter of 2014 where they incurred N15billion and N13.4billion in opex respectively. Dangote Cement averages about N11billion in Opex since 2013 and incurred N10billion in Q2 2014.

- Taxes – The company started paying taxes as Pioneer status for one of their lines recently expired. They incurred N5.4billion in Q1 and N6.2billion in Q2. I expect taxes to top N25billion by year-end.

- Sales Guidance – Despite the challenges seen, the company CEO D.V.G Edwin suggested they expect sales to grow between 15-20% by the end of the year. He said they expect about 15mmt (million metric tonnes) from Nigeria and 1.5mmt from its African operations.

- Dividend Guidance – The CEO also expect dividend payout to be in line with last year but gave no exact figure. If they maintain the same dividend payout ratio as last year, I don’t expect dividend per share to rise above N7.5. This is because I do not see Earnings Per Share growing by more than 1.5% this year.

- Receivables – The company provisioned N2.6billion in receivables during the year attributing it to sales which they may not be able to recover. The CFO explained they no longer sell on credit and do not expect to incur additional un collectable trade receivables. In fact, Gross Trade receivables dropped by about 56% from N9.3billion at the end of last year to N4.1billion the first half of this year. The company also has intercompany receivables of over N202billion which represents expenses the parent has splashed on its various African subsidiaries. It expects to recoup the money in future and charges interest on the receivables. It expects to get the money back once the entities start making money.

Finally

If there is one conclusion I drew from this earnings call, it is that the days of continuos double digit earnings growth may now be over. The gas factor and other external issues may reoccur down the line and do posse top line risk, however taxes and interest payments are the main reason why growth will stall for now. Dangote Cement EPS will still grow but not at 32% CAGR that it has post in the last 5 years. The size of their operations suggest a correction is close and anything between 8-12% will be absolutely welcomed to me.

[/upme_private]

![[BUY,SELL OR HOLD] Is Red Star Express Worth My Money?](https://nairametrics.com/wp-content/uploads/2015/08/buy_sell_hold.jpg)

Hi UgoDre,

I would like to provide some feedback regarding your login/registration system. It seems to be really frustrating as I cant get to log in and I have had to sign up for new accounts just to get around this process but this doesnt even work as my IP address then gets blocked

Hi, I am very sorry about this. My programmer is working on it. Meanwhile pls send me an email with your preferred user name. I will set you up myself.

Seems its time to invest in the coal market,but is 15% growth

guidance by the CEO feasible given slower 2nd half for cement coys.What happens to DangCem if Nigeria faces the ghana situation due to an Oil shock.Would cement price remain stable given the current 32.4 /42.5 grade standoff

The CEO seemed pretty much confident they will achieve 20% actually as he has his contingency plans in place to mitigate the risk of Gas shortages. The Ghana situation will affect them as they earn their revenues in Naira in Nigeria. As per grade of cement, they only manufacture 42.5 cement grade. Thanks for your comments.