FBN Holdings 2013 9 Months Result ↓

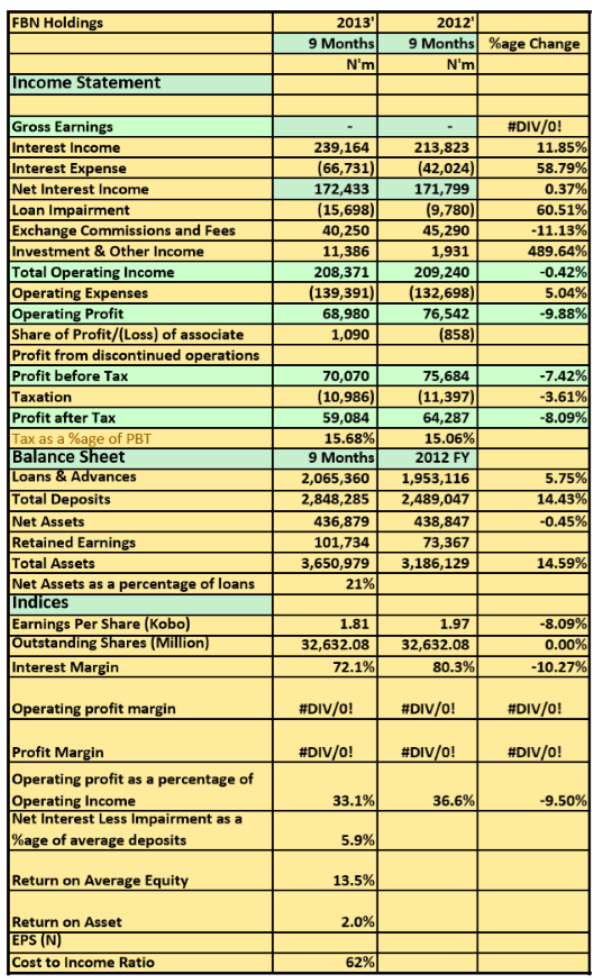

FBN Holdings Plc released its 2013 9 months results showing an 11.8% rise in Interest Income from N213.8billion (2012 9 months) to N239billion 2013 9 Months. Net Interest Revenue was however flat at N172.4billion (N171.7billion 2012 9 Months). The Group’s operating income was also flat at N208billion. Pre-tax profits at the end of the period was N70billion compared to N75.6billion posted at the same period in 2012.

Key Highlights[upme_private]

- This result follows the last interim result that was released by the company which we also reviewed on this blog.

- Net Interest Income went down this period compared to last year due to high interest expense. For example, interest expense rose 59% for FBNH compared to 7% for Zenith and 20% for GTB respectively in the same period.

- The reason for this was apparently due to rising deposit rate, an area where the bank had done better than its peers in the past. It paid N32billion on deposits in the first 9 months of 2012 compared to N63billion in the same period 2013.

- The same impact was felt with commission and fees as it dropped 11% to N40.2billion year on year. This also was as a result of a drop in C.O.T income as well as the cancellation of ATM charges. Both were due to regulatory pressures.

- We also noticed things were pretty much worse on a QoQ basis as Net Interest Income dropped this the most in the period July to September 2013. For example Q3 Interest Income was N88billion compared to N74billion and N76billion for Q2 and Q1 respectively this year. However, Interest expenses was highest in Q3 at N28.7billion compared to N17.7billion and N20.2billion in Q2 and Q1 respectively. The same trend was observed for commission and fees

- Loans and advances for FBNH has also been slow this year. The bank has increased its loan book by just 5% compared to 12% for Zenith Bank and 18% for GTB. However, at N2tr in loans the banks loan book is more than double GTB’s and almost double Zenith’s. The bank surely must be concentrating on ensuring its current loans are performing instead of increasing lending. It by far is the highest lender in the sector.

- Despite all these challenges what should worry shareholders is the continued write offs in loans and advances. The Group wrote off N5.7billlion in loans this quarter (July – Sept) taking total write offs this year to date (9 months) to N15.6billion compared to N9.7billion a year earlier. This was the major factor for the drop in pre-tax profits this year.

- Operating expenses included a strange line item called “Regulatory Cost”. Astonishingly it cost the Group N18.8billion (2012: N6.9billion). The company did not provide further details for a cost that is about 13.5% total operating expenses. This helped push Operating expenses by 5% to N139billion compared to N132billion same period last year

- Despite all the worried the Group’s indices is still in line with the average for the big 5. Net Interest margin is about 72% and ROE at 13.5% is acceptable.

This result currently threatens FBNH position as the largest bank in terms of market share of revenue and profits. Already, Zenith Bank and GTB already did better in the first 9 months of 2013. Based on what we have seen, a 10% drop in EPS for the group when it releases its 2013 FY results will be mostly welcomed. We just hope 2014 will be a better for the company and believe their ability to lower loan losses and stabilize deposits will be big boost. However, this result may just also be an insight into what the likes of Zenith and GTB may face in the coming years. The era off high interest margins without increasing lending may just be over.[/upme_private]

Thanks for the analysis bro,nem as also released its q1,q2,andq3 2013 result,will you mind doing an analysis of that too

Will look into it

It seems that the FBN loan book has a lower quality than those of its peers.double that of GTB and zenith yet with lower returns and higher loss provisions.

I hope the C.O.T reduction and amcon dues would not adversely affect the banks.

Yes and that is a major concern. A poor loan book can make or mar a bank. I do however feel they need another year to cleanse their books