The Nigerian Stock Exchange All Share Index opened today at 38,831 and closed trading at 39,695 representing a 2.2% gain. This market was bullish today as newer stocks joined the top ten gainers list. This is unlike the prior weeks when the likes of Transcorp and Union Dixon dominated trading.

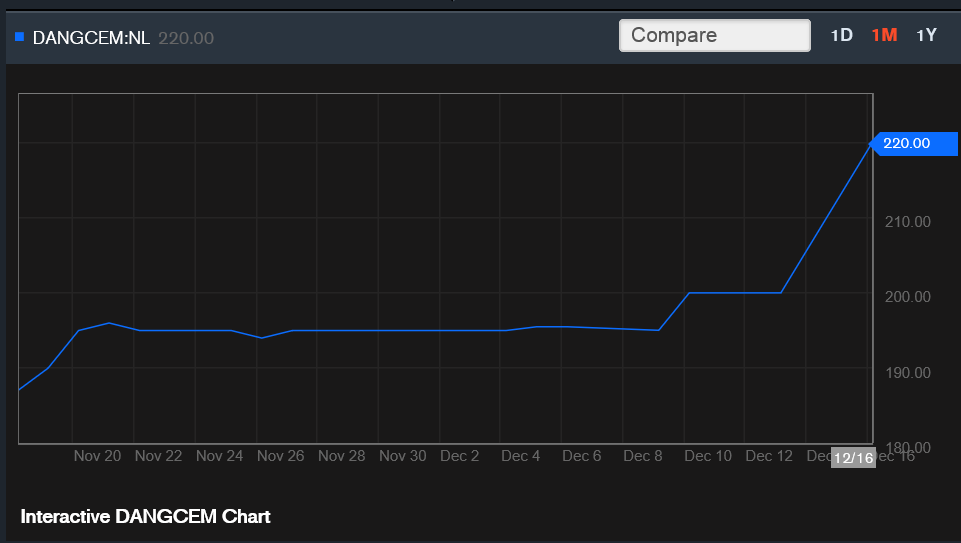

Three of the stocks in our recommended for purchase this week were included in the top gainers list. These were Continental Re Insurance, Zenith Bank, Africa Prudential & GT Bank. However, the Elephant of them all Dangote Cement, topped the gainers chart rising 10% to N220. It is a Stock in our portfolio and one we continued to buy when the price was between N187 and N190. This makes us smile as a major increase in the value of Dangote Cement is usually directly related with an increase in value of the All Share Index.

Why has Dangote Shares risen this much? This is basically because of news that the company plans to invest about $16billion across its investments in the next 4 years. In a market where news more than anything else drive the value of stocks its a no brainer that the share price will increase.

Is the price increase however sustainable? Currently, we have a buy position for Dangote Cement at below N200 even though it’s probably worth about N230 by our estimates relying on its PEG ratio and a desire to hold for an average of 5 years.