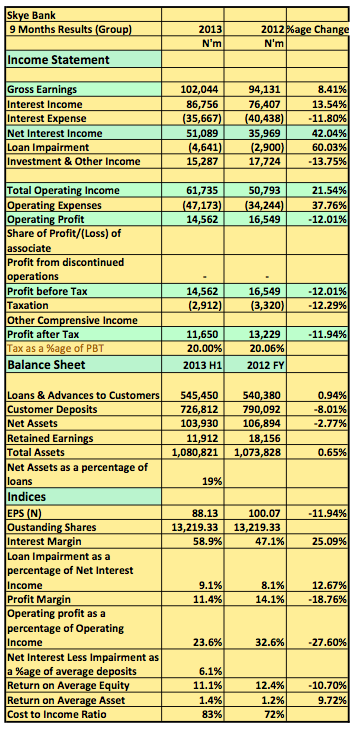

Skye Bank 2013 9 Months Snapshot ↓

Skye Bank released its 2013 9 Months results showing an 8.4% rise on Gross Earnings to N102billion. The bank also posted a 42% rise in Net Interest Income to N51billion (2012 9 Months: N36billion). The bank also posted a 21% YoY rise in Operating Income to N61.7billion compared to N50.7billion a year earlier. Pre-tax profits at the end of the year was N14.5billion compared to N16.5billion a year earlier.[upme_private]

QoQ

Key Highlights

- poor pre-tax profits was mostly due to rising operating expenses as well as a N4.8billion loss suffered in investment income in the 2nd quarter of this financial year.

- The third quarter didn’t fair any better as income from other income failed to add significant value to bottom line. N641million earned from other income apart from Interest is just too small to make an impact

- Customer Deposit also dropped 8% which is a worrying sign for the bank and a red flag for investors

- Skye Bank is in our portfolio and is a candidate for sell in the next few months

- Skye Bank was bought for its cheap price relative to book value. However, book value that continues to depreciate can’t be called a bargain.

- I took a huge risk on the bank when I recommended it as a buy for our Portfolio. It appears things just got worse following that last review.

- It’s probably time for the MD to go. The bank needs a lift

Skye Bank released its 2013 9 Months Unaudited Results in the website of the NSE[/upme_private]

looking back post acquisition of ”Afribank” ! um