I was recently approached by my Account Officer asking that I get some of my contacts to place some money in a fixed deposits. He says banks are now under pressure because of the “undue pressure” the CBN is creating for local banks. So, I asked him what their rates because the last time I asked it was just about 5% for N1m and 6-7% for N10m and above and 9% for N100million. He responds that rates have gone up now and that the bank could over a minimum of between 7% – 9% for rates above N1million.

Now, how in this world is a right thinking person supposed to keep his money in a fixed deposit when Treasury bills offered better rates?? If you don’t think this is an indecent proposal then maybe this will help you out;

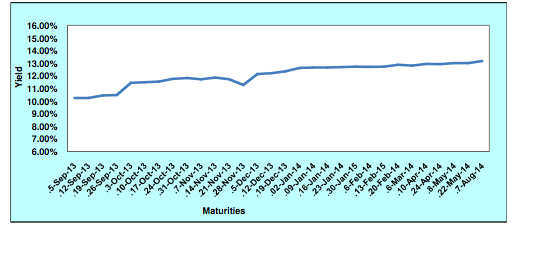

Treasury Bills Yield are higher

As you can see TB’s have even better yields than Fixed deposits. The lowest Yield is between 10% and 11% per annum and that is for as little as N100k and above. You would have to invest a minimum of N5million in Fixed deposits to even get close to 7% per annum.

Deposit Rates are just too low

The highest fixed deposit rates the market can offer is not even up to 9%. You would have to deposit for 90 days and above to attract up to N8%pa.

Even Banks Get Higher Rates From Banks

Even the banks lend to themselves at rates above 10% In fact the lowest which is Call is about 10.5% compared to 3.8% for deposits.

It’s not hard to see which is better for you money. I will always pick Treasury bills over Fixed deposits for short term investments. For me to switch to Fixed deposits, rates had better be at least 200 basis (2%) higher than Treasury Bills.

Well, I want to believe that it all depends on the individual with the funds.,One has a higher return but not easy to access when a need arises and interest is upfront, the other lower return, but can be accessed when the need arises, interest is usually backend.

You can discount the TB with your bank na

That is true, but remember that discounting it is like according you a credit facility, and all facilities must go through a process! Bearing in mind, time value of money!

is there any investment type that has more returns than treasure bill?

is there any investment type that has more returns than treasure bill

which type of investment will be suitable for a beginer who want to make it…

Problem is Treasury bills are harder to liquidate. This means a lot when you need the cash urgently

Good advice, but what are the risks involve and the appropriate fee charging on fixed income and Treasury bill investment by the financial firms.