Nairametrics File

Nigerians stocks closed trading December 31st for a second straight day of rally as the All Share Index closed with a gain of 3%. This follows with a gain of 3.2% the day before effectively wiping out the losses incurred in the other trading days of the month. This is now the 7th straight year that the stock market will be closing the last month of the year on a positive note. The last time the All Share Index closed negative for December was in 2008.

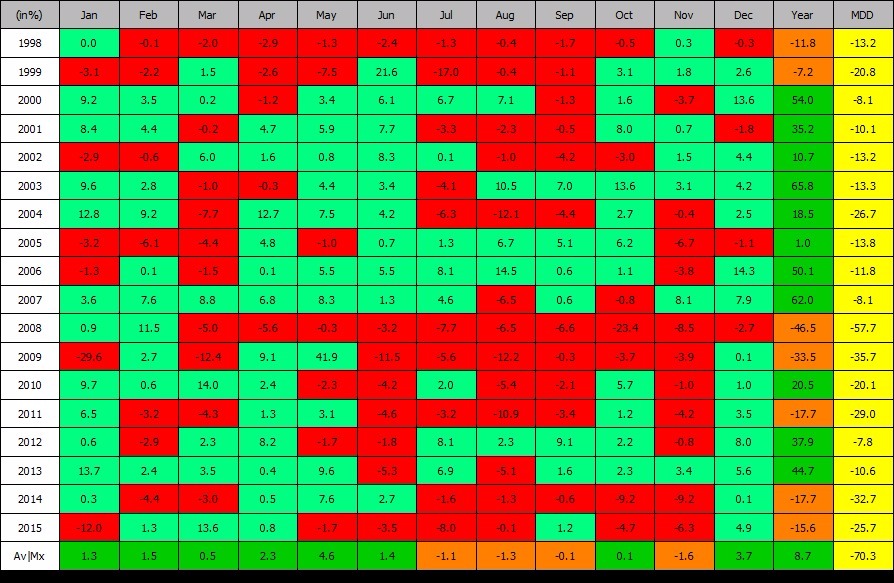

The significance of this is that investors who track performance of stocks on a monthly basis know when to time their entry and exit from the market. They buy stocks during bearish months and exit during bullish months. A look at the chart above shows months like August, September and November are usually the most bearish months of the year. April and until (2015) January used to be the months that recorded the most bulls.

Why does December Close Positively

The Santa rally as many analysts have come to call it is mainly driven by asset and portfolio managers who re-allocate their portfolios and sell-off under performing assets for tax reasons. Analysts are as expecting dividend in their forecast of another December rally. So to boost valuations, Portfolio Managers and those who index the market purchase shares from Blue Chip stocks in December. Remarkably a total of 33 stocks post gains for both days (30th & 31st) respectively. Only 8 and 6 stocks lost on the 30th and 31st respectively.

The All Share Index closed the month at 28,642.25 with a gain of 4.58%. Market Capitalization for the end of the year was 9,850,605,500.53 down 17.36% year to date.