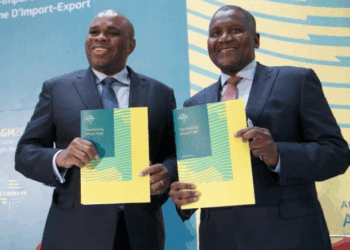

Investment Corp of Dubai (ICD), the state fund which holds stakes in some of the emirate’s top firms, has agreed to buy a $300 million stake in top Nigerian cement producer Dangote Cement, a spokesman for Dangote said on Monday.

Carl Franklin, Dangote’s head of investor relations, did not give further details. Dangote’s current market capitalisation is about $23.7 billion, meaning ICD is taking a stake of about 1.3 percent.

Dangote, owned by Africa’s richest man Aliko Dangote, is Nigeria’s biggest company. It is expanding operations and plans to roll out cement plants across Africa.

The deal is expected to be signed today and may also lead to other significant deals in future. It appears the trade went through at a price of N200 per share with 243million shares exchanging hands. I also feel this must have been a sell down by Aliko Dangote himself as I have not seen anywhere it was mentioned that this was a special placement or that new shares were issued.

Note

A total of 243,540,000 units of DANGOTE CEMENT PLC [DANGCEM] at N200 per share were traded today Monday, September 8, 2014 as an Off- Market trade. The trade was pre agreed between the seller- Dangote Industries Limited and the buyer- Investment Corporation of Dubai. The purchase and sale were executed by Meristem Securities Limited.

Source: Reuters/Nairametrics