The Central Bank of Nigeria has lofty goals heading towards 2020

According to the governing body’s National Financial Inclusion Strategy (NFIS) – a document outlining the government’s agenda to enhance financial inclusion in Nigeria – they intend to decrease the number of Nigerians that are excluded from financial services from 46.3% to 20.0% by 2020. Or in other words, the CBN hopes to bring approximately 18 million adults into the financial services space (formal and informal sector) between now and 2020. Research has shown that this kind of increase in access to financial services contributes positively to economic growth, employment and wealth creation and is therefore crucial to reducing poverty in any economy.

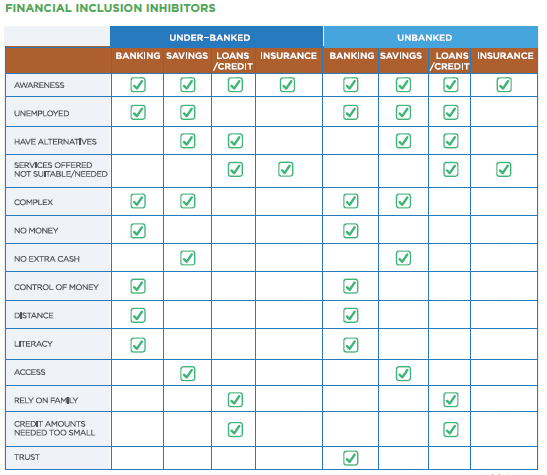

Unfortunately, the NFIS is facing stiff constraints on its crusade. From our research, we were able to identify the major inhibitors to financial inclusion in the Nigerian financial services ecosystem, chief among them being awareness and access – two factors which highlight the difficulty of connecting rural areas to cheap and affordable banking services. To be clear, financial inclusion is not about banks opening new branches in new rural locations, though it is a part of it. Financial inclusion is concerned with making financial services available through whichever means possible to the intended consumers.

State of Market Report 2016, by Lagos Business School

Observers of the Nigerian financial services ecosystem nurse a pulsing hope that the success of m-PESA in Kenya can be replicated in Nigeria. Currently, Nigeria’s mobile phone penetration is currently higher than the number of financially included adults, which has led many experts to believe that digital financial services could piggyback on mobile technology to accelerate the rate of increase of financial inclusion in the country. If Nigeria is to bring about 18 million adults into the formal financial services ecosystem in the next 3 years, mobile potentially holds the key.

However, mobile technology is not a magic bullet. Since Nigeria’s mobile phone penetration has been on the rise, a bevy of FinTech startups have sprung up in the ecosystem and there have been subsequent introduction of licensing guidelines for mobile money, agency banking and super-agency operations. Regardless, digital financial services (DFS) adoption amongst under-banked and unbanked adult Nigerians is yet to grow.

Those who the NFIS document concerns itself with – the unbanked and underbanked – face many constraints ranging from unemployment, underemployment and lack of funds, distance to these services (access), to complexity and proposition. These constraints are realities on ground that have limited even the adoption of mobile financial solutions for the unbanked and underbanked in the country.

Let’s try to unpack some of them

In Nigeria, the benefits of digital financial services are currently difficult to market to the underserved and unserved due to inhibitors. For example, one benefit of digital financial services is convenience, ease or time-savings but this is discounted by the limited access to service points in rural areas. The limited access to finance common amongst under-banked and unbanked individuals and micro-small and medium sized (MSMEs) is also delimited by utility and access costs. Many rural dwellers believe they do not have enough savings to open a bank account while some do not wish to incur potential associated banking fees (which can be summed up under awareness).

A quick visit to any of the major cities in Nigeria will unravel another mystery – cash is still king. Despite the CBN’s cashless economy policy passed in 2012, majority of the citizens are yet make the shift to digital services, not only in rural Nigeria but also in urban regions.

The prevailing behaviour among citizens, even in urban centres, involves going to ATM machines to withdraw cash rather than make payments via their phones, the ATM or other transaction interfaces. Reason being, many service points are yet to adopt digital payments either through lack of trust, or cost of utility. The meat seller in the city market does not have a POS machine to collect your ATM card neither is he/she willing to receive transfers to a mobile wallet (either because he/she has none or he/she is yet to hear about/understand it).

Obviously, these are all constraints that must be addressed to overcome in order to have an inclusive ecosystem. 80% financial inclusion can be celebrated come 2020 but more needs to be done for this to be achieved – institutions, infrastructure, human capital and technology all need to be addressed.

In particular, figuring out how to bring DFS literacy to the last mile of the financial services ecosystem is what will determine the success rate and impact of the national financial inclusion strategy.