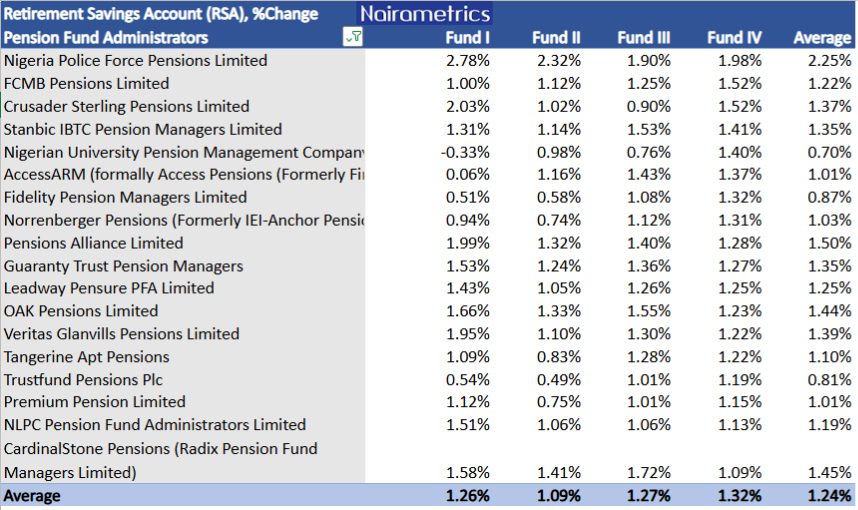

Nigeria’s pension industry recorded another positive month in September 2025, with several Pension Fund Administrators (PFAs) delivering solid returns across all Retirement Savings Account (RSA) Funds.

According to data compiled by the Nairametrics Research Team, the average return across the industry rose to 1.24%, up from 0.40% in August, reflecting steady market recovery and improved portfolio rebalancing by most PFAs.

Leading the performance table were Nigeria Police Force Pensions Limited, Pensions Alliance Limited, and Crusader Sterling Pensions Limited, all of which delivered above-average returns and strengthened investor confidence in their fund management strategies.

By fund category, RSA Fund IV (the conservative fund for retirees) delivered the strongest performance, averaging 1.32%. RSA Fund III (for pre-retirees) followed at 1.27%, RSA Fund I (for younger contributors) at 1.26%, while RSA Fund II (the default fund for most contributors) recorded the lowest return at 1.09%.

All percentage returns were calculated based on changes in fund unit prices as published by each Pension Fund Administrator on their official website for August and September 2025.

And all 18 PFAs recorded positive growth in September.

Top Performing PFAs in September 2025

- Nigeria Police Force Pensions Limited led the industry with an outstanding average return of 2.25%, supported by strong performances across all funds — 2.78% (Fund I), 2.32% (Fund II), 1.90% (Fund III), and 1.98% (Fund IV).

- Pensions Alliance Limited followed with an average return of 1.50%, driven by gains in Fund I (1.99%) and Fund III (1.40%).

- CardinalStone Pensions (formerly Radix Pension Fund Managers) also stood out, posting an average of 1.45%, with strong returns from Fund III (1.72%).

- OAK Pensions Limited averaged 1.44%, supported by Fund I (1.66%) and Fund III (1.55%), while

- Veritas Glanvills Pensions Limited returned 1.39%, thanks to its impressive Fund I (1.95%) performance.

Other PFAs that posted above-average returns include:

- Crusader Sterling Pensions Limited – 1.37%

- Guaranty Trust Pension Managers – 1.35%

- Stanbic IBTC Pension Managers Limited – 1.35%

- Leadway Pensure PFA Limited – 1.25%

- FCMB Pensions Limited – 1.22%

- NLPC Pension Fund Administrators Limited – 1.19%

- Tangerine Apt Pensions – 1.10%

However, Nigerian University Pension Management Company recorded the weakest average return of 0.70%.

RSA fund category breakdown

A closer look at the sub-fund performance reveals varying trends across risk profiles:

RSA Fund I (Younger Contributors)

This fund, designed for contributors with higher risk tolerance, grew by 1.26% in September. Improved equity performance helped lift most PFAs.

Top 3 Performers:

- Nigeria Police Force Pensions Limited – 2.78% (rose to N3.3556 per unit)

- Crusader Sterling Pensions Limited – 2.03% (rose to N2.7879 per unit)

- Pensions Alliance Limited – 1.99% (rose to N2.9314 per unit)

Only one PFA, Nigerian University Pension Management Company, recorded a negative return of –0.33% in this Fund category.

RSA Fund II (Default Fund for Most Contributors)

RSA Fund II posted the lowest average growth of 1.09%, reflecting the cautious positioning of PFAs amid subdued market conditions.

Top 3 Performers:

- Nigeria Police Force Pensions Limited – 2.32% (rose to N4.4903 per unit)

- CardinalStone Pensions – 1.41% (rose to N4.7027 per unit)

- OAK Pensions Limited – 1.33% (rose to N6.4172 per unit)

All PFAs delivered positive results, with Trustfund Pensions Plc posting the weakest return at 0.49% in this Fund category.

RSA Fund III (Pre-Retirees)

RSA Fund III, focused on contributors above 50, performed well with an average return of 1.27%, supported by stable fixed-income yields.

Top 3 Performers:

- Nigeria Police Force Pensions Limited – 1.90% (rose to N2.9317 per unit)

- CardinalStone Pensions – 1.72% (rose to N2.6993 per unit)

- OAK Pensions Limited – 1.55% (rose to N2.3299 per unit)

RSA Fund IV (Retirees)

The most conservative fund outperformed all others with an average of 1.33%, driven by gains in government and money market instruments.

Top 3 Performers:

- Nigeria Police Force Pensions Limited – 1.98% (rose to N3.2425 per unit)

- FCMB Pensions Limited – 1.52% (rose to N6.6799 per unit)

- Crusader Sterling Pensions Limited – 1.52% (rose to N7.4863 per unit)

What you should know

The Nigeria Police Force Pensions Limited maintained its top position for the second consecutive month, outperforming all peers across every RSA fund category.

Its consistent success is linked to a well-diversified strategy that combines tactical equity exposure with long-term government securities, delivering both stability and growth.

Overall, the pension industry showed resilience in September, rebounding from August’s modest returns. The improvement coincided with stable bond yields (around 17-18%) and mild equity recovery (NGX-ASI 1.72% Sept. month-to-date), which together supported portfolio gains across PFAs.