The Securities and Exchange Commission (SEC) has confirmed that it approved the sale of shares in First HoldCo by Oba Otudeko, chairman of Honeywell Group, and Tunde Hassan-Odukale, group managing director of Leadway Assurance, to RC Investment Management Limited.

The SEC granted a “no objection” to the transaction after due consideration and in full compliance with applicable requirements.

This was confirmed in a statementon Thursday by Efe Ebelo, the SEC’s head of external relations.

Background of the Transaction

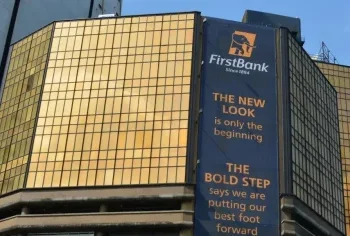

The block trade, executed off-market on the Nigerian Exchange (NGX) on July 16, 2025, involved 10.43 billion shares at N31 per share, totaling N323.4 billion.

This transaction represents approximately 25% of the total outstanding shares of FirstHoldCo Plc and marks the exit of Oba Otudeko, a long-time stakeholder and former key figure within FirstHoldCo and its predecessor entities.

SEC’s Position

The SEC clarified that its correspondence with the operators was not a query, but part of an automated compliance mechanism aimed at enhancing transparency and ensuring the proper closure of large market transactions.

“The Commission granted a ‘no objection’ to the transaction after due consideration and in full compliance with applicable requirements,” the SEC said.

The commission reaffirmed its commitment to maintaining a fair, orderly, and efficient market, safeguarding investors, and supporting capital formation in Nigeria.

FirstHoldCo had in a statement signed by Company Secretary Adewale Arogundade, distanced both its Chairman and the federal government from the high-profile deal.

“The Chairman of FirstHoldCo, Femi Otedola, did not purchase any of the shares in question, nor did the Federal Government of Nigeria or any of its agencies acquire the shares in trust,” the statement read.

According to the company, the sellers were Barbican Capital Limited & affiliates linked to longstanding shareholder Oba Otudeko, and Leadway Group & affiliates.

The buyer was confirmed as RC Investment Management Ltd; a Special Purpose Vehicle associated with Renaissance Capital.

What You Should Know

- The acquisition, one of the largest off-market trades in NGX history, has sparked speculation about possible boardroom changes, new capital-raising initiatives, or shifts in operational strategy.

- As the new stakeholders take control, the future direction of FirstHoldCo Plc will be closely watched by investors and industry analysts.