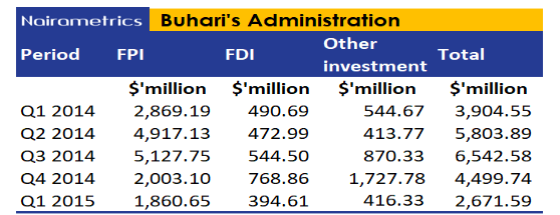

Capital importation into Nigeria witnessed a sharp decline during the eight-year administration of former President Muhammadu Buhari, despite intermittent surges in foreign portfolio investments (FPI).

Data from the National Bureau of Statistics (NBS) shows that total capital inflow plunged from highs recorded from pre-2015 levels to multi-year lows by the end of Buhari’s tenure in mid-2023.

The total value of capital imported into Nigeria dropped from $6.54 billion in Q3 2014, the peak before Buhari’s inauguration, to as low as $1.03 billion by Q2 2023, his final full quarter in office.

However, following Buhari’s swearing-in, inflows trend downward. Total capital importation dropped to $2.66 billion in Q2 2015 and continued to slide to $710.97 million by Q1 2016. This marked a 73.3% and 89.13% decline from Q2 2015 and Q3 2014 levels, respectively.

The sharp drop was largely attributed to heightened investor uncertainty, rigid foreign exchange policies, and declining oil revenues.

The data suggests that while portfolio investors responded positively to select reforms, the absence of deep structural adjustments and continued FX market inefficiencies undermined long-term capital formation for direct investment.

Investor confidence in Nigeria began to wane during the heated election period spanning Q4 2014 and Q1 2015, as political instability and uncertainty surrounding the transition to a new administration created significant concerns within the investment community.

Early declines set the tone

Buhari took office in May 2015 amid declining oil prices and increasing economic uncertainty. In Q2 2015, total capital importation stood at $2.66 billion, barely unchanged from $2.67 billion in Q1 2015. However, it plummeted to $710.97 million by Q1 2016, marking the lowest quarterly figure Nigeria had recorded at that time in over a decade.

Foreign Portfolio Investment (FPI), historically the largest source of capital inflow, saw a steep drop from $5.17 billion in Q3 2014 to just $271 million in Q1 2016. The naira’s instability, capital controls, and delays in FX repatriation eroded investor confidence, driving FPI away from Nigerian assets.

Brief resurgence driven by FX window reforms

Capital inflows began to recover by late 2016, buoyed by the Central Bank of Nigeria’s introduction of the Investors’ and Exporters’ FX window in 2017. This policy helped ease FX illiquidity and bolstered foreign investors’ confidence.

As a result, capital importation rose steadily through Q2 2017 at $1.79 billion and peaked at $8.49 billion in Q1 2019, the highest quarterly figure under Buhari.

This resurgence was largely driven by FPI, which peaked at $7.15 billion in Q1 2019 from $2.76 billion in Q3 2017, showing how sensitive inflows were to FX market reforms and yield opportunities.

However, this recovery was short-lived. Inflows dipped significantly after the post-2019 elections, with capital importation declining to $3.80 billion by Q4 2019. The COVID-19 pandemic further strained the inflow trajectory, as capital importation fell to $1.29 billion in Q2 2020 and eventually slumped to just $875.62 million in Q2 2021.

Foreign direct investments (FDI) remained flat throughout

Foreign direct investment (FDI) under Buhari’s eight-year tenure fell sharply and remained muted. FDI never crossed the $500 million mark in any quarter during his administration. For most of the period, quarterly FDI ranged between $100 million and $300 million, reflecting structural challenges, insecurity, regulatory inconsistencies, and limited macroeconomic reforms.

Nigeria’s FDI performance has remained subdued since 2011, long before his administration began, but it deteriorated further during his time in office.

For example, FDI stood at $211.14 million in Q2 2015 and closed at just $86.03 million in Q2 2023, indicating persistent investor apathy towards long-term investment in the Nigerian economy.

Many foreign and local companies cited rising costs and poor business environment as key deterrents of FDI.

- Several multinational companies—including Shoprite, Etisalat, HSBC & UBS, Truworths, Kimberly-Clark, Unilever— significantly scaled back or exited their Nigerian operations, citing challenges with capital repatriation due to persistent forex shortages, unreliable power supply, excessive bureaucracy, and severe congestion at the ports.

- According to the Manufacturers Association of Nigeria (MAN), hundreds of businesses shut down between 2018 and 2021, largely due to high diesel prices, currency volatility, and FX access issues. Diesel prices rose within the period, and MAN stated that its members spent around N144.5 billion on sourcing energy outside the grid in 2022, as reported by Nairametrics.

- Reports by the U.S. State Department and the World Bank have consistently flagged Nigeria’s difficult business environment, listing inadequate electricity access (Nigeria ranked 171st out of 190 countries in the 2020 World Bank Doing Business report), long port delays, systemic corruption, widespread insecurity, and forex scarcity as major deterrents to investment.

These systemic issues not only stalled FDI but also pushed existing investors to reduce, delay, or quit operations.

Second term – A struggle to regain momentum

Buhari’s second term, which began in May 2019, failed to recapture the momentum of 2018–2019. From Q2 2020 to Q2 2023, quarterly capital importation remained mostly below $2 billion.

The year 2020 was particularly challenging, with foreign portfolio inflows hitting a decade-low of just $35.15 million in Q4 2020 — a collapse blamed on pandemic-related disruptions and tightening dollar liquidity.

By the time Buhari handed over in May 2023, capital importation had declined to $1.03 billion in Q2 2023, an 84% drop from the peak of $6.54 billion in Q3 2014. FPI, once a key driver of inflows, dropped from $4.29 billion in Q2 2019 to $106.85 million in Q2 2023.

The Buhari administration was characterized by volatility in capital inflows, with periodic recoveries often reversed by macroeconomic instability, policy uncertainty, and FX constraints. Although temporary gains were recorded, particularly in FPI, they were largely speculative and not sustained.

Despite having opportunities to deepen reforms, Buhari’s administration was often criticized for opaque FX management, slow structural adjustments, and a perceived lack of investor-friendly policies.

For Nigeria to attract stable capital inflows, especially in the form of FDI, the new administration will need to address the underlying structural issues, ranging from insecurity and legal uncertainties to FX market reforms and transparent economic governance.

Nigeria’s capital importation dropped if you are using a pro western measure aimed at the capital markets.

But if you are using a pro eastern measure, used by the Chinese, overall funds and investments grew significantly.

History will show the Buhari era as the time when Nigeria shifted from West to east.

China already reports this, but maybe in 2030, when the Western media approves it, Nairametrics will report it too…

TOP 5 YEARS OF CAPITAL IMPORTATION 1999- 2024 (UPDATED)

– Year 2019 – $ 24 bn

– Year 2013 – $ 21 bn

– Year 2014 – $ 20 bn

– Year 2018 -$ 16.6 bn

– Year 2017- $ 12.2 bn

In this same season, local companies hit the highest heights

– Emeka Okwuosas Oil serve got awarfrf the largest contract ever awarded a local company- the multi billion Akk pipeline

– Tony Elumelus oil deal in 2021 became the largest oil deal ever done by a local company

– Local presemce in oil and gas climbed from 3% in 2010 to over 33% in 2021, the highest on record at the time.

– Aliko Dangote built the largest industrial complex in history

– In Kaduna, Olam made the largest single investment ever made in Agric.

– Innoson expanded to its highest.

– Nigerian banks crossed global 1,000

– Nigeria produced 5 new multi billion dollar fintechs

– Air Peace.becane the biggest private local airline ever

– The list goes on….

That was the kind of person Buhari was– driving local growth.

– In his era, the ncdmb building in Bayelsa became the first skyscraper to be constructed by locals from start to finish.