A property auction is a sales event (whether online or offline) where potential buyers place competitive bids on a property. People use auctions for real estate sales for several reasons.

The most common is that it provides an avenue to sell off assets to buyers with ready cash. Buyers prefer auctions because they provide access to a wide range of properties that in most cases are below market value.

Auctions also make it easier to sell properties that may be difficult to sell through other methods.

Across the world, auctions have helped countries in tackling major housing problems. Although the adoption of auctions is relatively low in emerging economies like Africa, it has the potential to curb major housing issues especially the housing deficit in a country like Nigeria.

In this article, we provide context to how auctions can be used as a veritable tool for enhancing home ownership in Nigeria. Before we dive in, let’s look at the global property auction market.

Global landscape with respect to property auction transactions

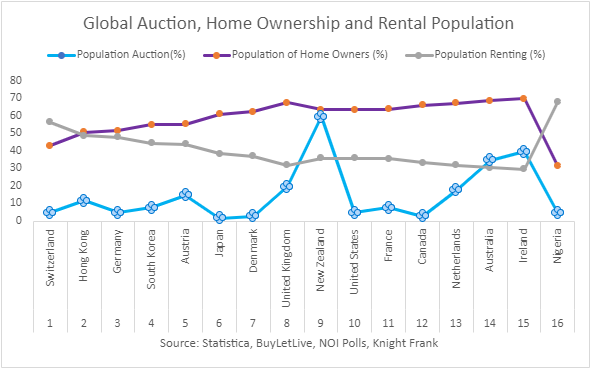

Property auctions have become increasingly popular in many countries around the world. The popularity of auctions, especially for real estate transactions, varies across countries. Generally, auctions are more prevalent in countries like Ireland, Australia, and New Zealand.

In fact, estimates suggest that auction in New Zealand is around 60% of residential sales. on the other hand, countries like the US and Canada, Nigeria and many other African countries primarily lean towards open market methods when it comes to real estate acquisition methods.

Leading regions in Africa

While traditional property sales dominate the African region, the property auction market is gaining traction.

More than any other factor, auction offers a faster and potentially more transparent alternative for property sales. In terms of regional adoption, South Africa leads the continent with established auction houses and a longer history of utilizing auctions in selling various property types.

Including residential, commercial, and industrial properties. South Africa is the most developed economy in Africa and has a well-established real estate market, offering a wide range of investment opportunities.

The property market in South Africa is relatively more developed compared to other countries in Africa due to several factors. Including market maturity, economic stability, infrastructure and higher level of urbanisation.

Over the past half decade, Kenya has witnessed significant growth driven by factors like distressed assets and land disputes. Nairobi hosts prominent auction houses like Lamudi Property Auctions among others.

Ghana’s on the other hand, has also seen phenomenal growth in the past decade. The auction market has seen increasing popularity, particularly for land sales due to its transparency and efficiency.

Accra holds regular auctions by companies like Ghana Auctioneer Company. Compared to other countries mentioned, Nigeria is a still growing auction market.

Nigeria’s over 200 million population and 18 million housing deficit presents a huge opportunity.

The golden opportunity

The growing presence of non-performing mortgage back loans and foreclosures opens opportunities for Africa to enhance housing ownership through partnerships.

The continent’s rapid urbanisation rate has created more demand for properties. These factors for instance have fueled the growth we see in the auction markets in countries like South Africa, and Kenya.

Across the continent, the opportunity for growth in the property auction market is enormous. In South Africa alone, Knight Frank estimates the market size of the auction market at $1.5 billion in 2022.

The average sales price for auctioned properties was estimated at $220,000 according to available data from High Street Auctions. With over 1,000 transactions concluded annually, the growth projections for the African property auction market are generally positive.

Estimates suggest a potential reach of USD 5 billion by 2025. More than ever, Africa can leverage property auctions to solve the burgeoning home ownership problems.

Additionally, auctions can be used in solving much wider problems like land disputes, market illiquidity and gazumping.

Generally, auctions provide faster access to cash for sellers and attractive investment options for buyers. With online platforms and virtual auctions, opportunities for home ownership can be better disseminated, particularly in remote areas.

Africa’s real estate market is largely informal and unregulated. Property auctions can help formalize the property market in Nigeria by providing a transparent platform for buying and selling properties.

This, in turn, will help the overall development of the real estate sector.

Additionally, market activity in the sector can also be increased through auctions. By bringing together buyers and sellers in a competitive environment, the volume of transactions happening in the sector will be significantly increased, potentially driving market growth.

This in part will help also solve the liquidity issues in the market. Auctions provide a platform for the exchange of properties, allowing individuals and businesses to efficiently trade real estate assets, which can contribute to a more dynamic and liquid property market.

In Nigeria’s fight for affordable housing, property auctions emerge as a potential weapon. Firstly, by fostering transparency and competition.

Open bidding levels the playing field, potentially leading to fairer prices and attracting more buyers, driving down costs, especially for first-time buyers and those with limited budgets. Secondly, auctions offer improved access to finance.

Faster sales and upfront deposits benefit sellers needing quick cash, while specialized financing options from partnering lenders could open doors for buyers struggling with traditional mortgage approvals.

However, success hinges on several factors. Market conditions, fair regulations, and public trust are crucial. While not a magic bullet, if implemented effectively and ethically, property auctions could offer an alternative path to ownership and play a role in tackling Nigeria’s housing affordability challenge.

The challenges hindering the adoption of property auctions in Africa.

Despite its potential, adopting property auctions in Africa, particularly Nigeria faces several hurdles:

- Lack of awareness and trust: Many Africans are unfamiliar with auctions, leading to apprehension and skepticism. Building trust through education and transparency is crucial.

- Limited legal framework: Clear and robust regulations governing auctions are often absent, creating uncertainty and potential for manipulation. Establishing fair and enforceable guidelines is essential.

- Financial constraints: Upfront deposits and shorter payment timelines in auctions can exclude buyers with limited access to finance. Developing alternative financing options is key.

- Cultural preferences: Traditional negotiation-based property sales might be more culturally ingrained, making the competitive and open nature of auctions less appealing to some. Cultural sensitivity and adaptation are needed.

- Logistical challenges: Efficient infrastructure for marketing, conducting, and managing auctions, including online platforms and trained professionals, is often lacking. Investment in infrastructure and expertise is crucial.

- Corruption and lack of transparency: Concerns about existing corruption and potential manipulation within traditional sales methods can be transferred to auctions, hindering adoption. Combating these issues and ensuring transparency is vital.

The way forward

Pushing for a more efficient auction market in Nigeria would require a multi-level involvement of the government, private sector, investors, service providers and the people. Everyone has a role to play, starting with the government.

The Government, should act as regulators and stick with it

In every society, governments play a major role in providing housing for the people. There is a wider debate as to the role of the government in housing delivery.

Whether the government should act as housing initiators, enablers, providers or regulators are all subject to argument, but one fact remains constant-there is a role to be played.

To make auctions work, trust needs to be built. To build trust, both sides of the transaction need to be assured that the structures and necessary frameworks are put in place to protect their interest.

These, of course, must come from a superior party who is acting as a regulator. In our opinion, this should be the sole role of the government-to act as regulators for all auction activities.

Private sector – should be allowed free participators in solving what seem to be a social problem

Auction houses, which are mainly private sector institutions, establish the platform for auction transactions to take place. Their role is to ensure transparency and provide expertise in conducting auctions. In addition, the private sector players like financial institutions also act as financiers.

They partner with auctions to offer specialized financing options, expanding access to buyers. Real estate players on the other hand, educate the public about auctions, build trust, and guide potential buyers and sellers.

The auctions market in Nigeria is huge, and if properly deployed, can help the government in fixing the wider problem of home ownership.

Auctions create a more transparent and competitive market, potentially leading to fairer prices for both buyers and sellers. This means that sellers do not wean so much power on the market.

With auctions, the problems of opaque pricing and market manipulation in traditional property sales will be eradicated.

Overcoming these challenges requires a multi-pronged approach involving government regulations, industry development, public education, and cultural sensitivity.

If addressed effectively, property auctions can hold promise for increased transparency, competition, and access to finance, ultimately contributing to improved property ownership and housing affordability in Nigeria.

We love to hear your thoughts. Send us an email to research@buyletlive.com and we will be in touch.