Article summary

- The Nigeria-Morocco gas pipeline project will pass through 13 countries and is expected to increase Nigeria’s gas export capacity.

- NNPCL says it is committed to the project even as the Buhari administration plans to exit office in less than 40 days.

- An industry expert calls the viability of the project into question, citing it as a white elephant project.

The Group Chief Executive Officer of the Nigerian National Petroleum Company NNPC) Limited, Mele Kyari recently said that the company is unlocking more opportunities in Nigeria’s gas export capacity through the Nigeria-Morocco Gas Pipeline Project.

The $25 billion Nigeria-Morocco gas pipeline is a 5,600 km gas pipeline that will travel the length of Nigeria, Benin Republic, Togo, Ghana, Cote D’Ivoire, Liberia, Sierra Leone, Guinea, Guinea Bissau, The Gambia, Senegal, Mauritania to Morocco. The pipeline is projected to have thirteen compressor stations.

Kyari also previously announced that there is a clear line of sight in securing funding for the Nigeria-Morocco gas project. However, the Buhari administration has less than 40 days to go after which a new administration will come in. What is the assurance that this project, which has lacked implementation since 2016, will see the light of day? Are there viable alternatives to the project?

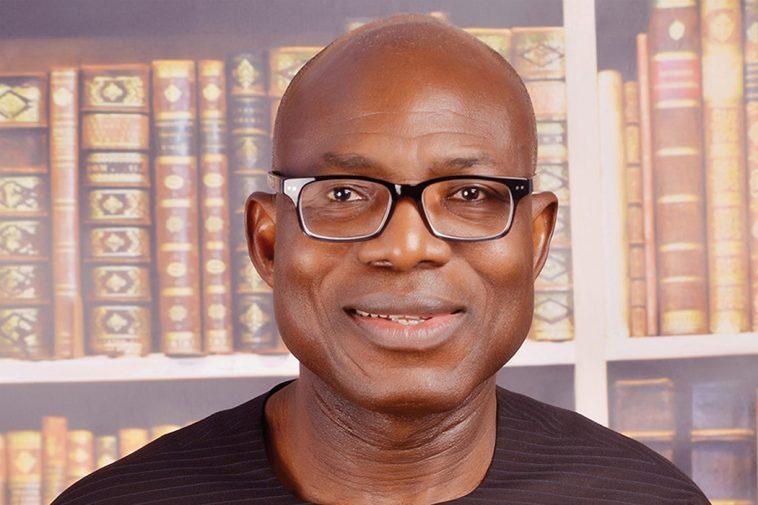

Nairametrics caught up with Dan D. Kunle, an Energy Analyst and former Privatization Advisor at the Bureau of Public Enterprise (BPE) from 2003 to 2007, to explore the viability of the Nigeria-Morocco gas pipeline project as well as discuss other alternatives to the project which will achieve the same objectives – further enhancing Nigeria’s gas export capacity and increasing gas revenues.

NAIRAMETRICS: Recently, Mele Kyari, CEO of NNPC Limited said there’s a clear line of sight in securing funding for the Nigeria-Morocco gas pipeline project. What is the worth of this project in terms of benefits to Nigerians?

Dan D Kunle: This project is political and has no economic value in the present circumstance in which the Nigerian gas industry is today. It will be good for us to see the business and economic studies carried out by any of the world’s leading investment banks and consultants.

Such studies will show us the economic life of the project and all the financial earnings that will accrue to Nigeria and other countries respectively. It will also be good to see all the relevant treaties between Nigeria and all the countries where the pipeline will pass through their water bodies to Morocco.

This project has not gone through proper technical and financial calibrations, evaluations, and environmental considerations. There cannot be a clear line of sight in securing funding for the Nigeria-Morocco gas pipeline as quoted from Mele Kyari because financiers and investors will weigh and compare LNG projects as well as regasification plants for Morocco and other countries plus the vast flexible advantages that LNG vessel carriers will provide in the Atlantic and Pacific basins.

Both countries need to explore investments in LNG plants and regasification facilities in the Morocco waterfronts. The Moroccan government can also invest in the LNG Vessel Carrier business to procure LNG and carry the liquids from Nigeria or any part of the world to their regasification plant in Morocco or any other available market in Europe or the Pacific-Asia markets. The pipeline will limit their access to multiple markets for liquid fuels.

Furthermore, Morocco possesses huge solar resources from the Sahara Desert which can be converted to liquid hydrogen for shipment to nearby Europe. Beyond that, Morocco has phosphate rocks in large deposits which is the most developed in North Africa and Nigeria requires this phosphate for her fertilizer industry but the volume per annum can easily be exchanged for LNG cargoes with carrier vessels as evaluated.

These are a few economic and political justifications as to why NNPC cannot pass this Morocco gas pipeline project through any government in Nigeria. It will be good to remind NNPC of the inconclusive Nigeria-Niger-Algeria Trans Saharan gas pipeline project which has been pushed from Ajaokuta through Abuja, Kaduna to Kano but funding and its economic viability has been called to question to date because there is no clear line of sight in the investment for the gas production and processing that will be fed into the AKK gas pipeline to Kano, Niger and Algeria.

In recent times, Niger Republic has discovered more crude oil and probable gas reserves thus increasing its appetite and demand for the Nigeria Trans Saharan gas pipeline to be extended from Kano, through their country, to the Algeria-Mediterranean gas supply system. I will not be surprised if the Niger Republic can convince the Chinese National Oil Corporation to build their gas pipeline for them since PetroChina is building a crude oil pipeline from Niger to the Benin Republic spanning 1800 km.

NAIRAMETRICS: Are there other alternatives to building the Nigeria-Morocco gas pipeline? What are they?

Dan D. Kunle: Yes, Nigeria and Morocco can jointly develop Brass/Olokola LNG in the next 3 to 4 years, if Morocco has such an ambitious appetite for the gas business. Nigeria had long conceptualized two very viable liquefied natural gas (LNG) projects in the Brass and Olokola Free Trade Zone, both located in Bayelsa and Ondo/Ogun States. But it appears that NNPC Limited has ignored these two viable gas monetization projects for a subsea gas pipeline to Morocco.

Another alternative is for Morocco to invest in LNG vessel carriers to buy and trade in LNG with Nigeria and other countries such as Equatorial Guinea, Senegal, Mozambique, Egypt, etc. As earlier mentioned, Morocco can alternatively invest its money in solar renewable energy and convert the harvest into blue or grey hydrogen for export into Europe or other markets.

Also, in the last 16 years, NNPCL could not establish a gas pipeline to Malabo, Equatorial Guinea. The country EG has been asking for a raw gas pipeline to be delivered to their LNG plant for liquefaction. This way, Nigeria will make money. But to date, NNPCL cannot figure out how to do this. Meanwhile, Morocco is thousands of kilometres away.

A subsea gas pipeline from Nigeria to Morocco is a white elephant project and a waste of our NNPCL staff resources and money and this must stop. If the shareholders will not interrogate the NNPCL Management, then, the National Assembly should do so.

NAIRAMETRICS: What is the best way to maximize Nigeria’s natural gas resources in the short to medium term?

Dan D. Kunle: The Petroleum Industry Act (PIA) must be reviewed, and new gas investment enablers should be introduced into the new act. This will allow investors to have a reconsideration for natural gas investments around and within Nigeria. Such new enabling law will also attract long-term investments in gas exploration, production, processing and distribution within Nigeria as well as exports.

NAIRAMETRICS: Nigeria does not have enough gas processing facilities. How do we then implement the National Gas Expansion Program (NGEP)?

Dan D. Kunle: Once the PIA is amended to accommodate better-enabling investments, they will be made into natural gas production and processing. The Nigerian Domestic Gas expansion project will continue to lag if the enabling law does not encourage mid and long-term investments because investors want a guaranteed return on them.

Gas investment is a medium to long-term investment and very capital intensive. It requires high technological processing facilities and financial investments are far more expensive than crude oil processing. This is why Nigeria has not seen many petrochemical and methanol investments in the last 60 years of our hydrocarbon history.

NAIRAMETRICS: Do we have any business sending gas to Europe? Or do we stick to domestic use and regional markets in Africa?

Dan D. Kunle: If the European gas market is open for Nigeria and the buying price is favourable to us, we must continue to meet our Gas Sales and Purchase Agreement (GSPA) obligations. LNG business is a forward sales transaction, but the recent Russia-Ukraine crisis has brought a lot of market disruptions and dislocations in deliveries and prices, but Nigeria cannot ramp up production and take advantage of the market disruption created in the last year by the crisis.

The big question today is whether in the next 2 to 3 years Nigeria can move from 22 million tons to 40 million tons of gas production to fill part of the market gaps we have seen in Europe and Asia. The global race for LNG production led by the USA, Qatar, Australia, Indonesia, Malaysia, and some African countries will put Nigeria to the test in the next 3 to 5 years of whether we can ever take advantage of our comparative position in gas reserves with the other countries mentioned above. Econ

Economies of scale are very critical in gas production because it is all about the volume that can be made available for both the domestic and export market. Nigeria and the new incoming government must, within the first 100 days, de-bottleneck all the political and economic decisions surrounding energy investments.