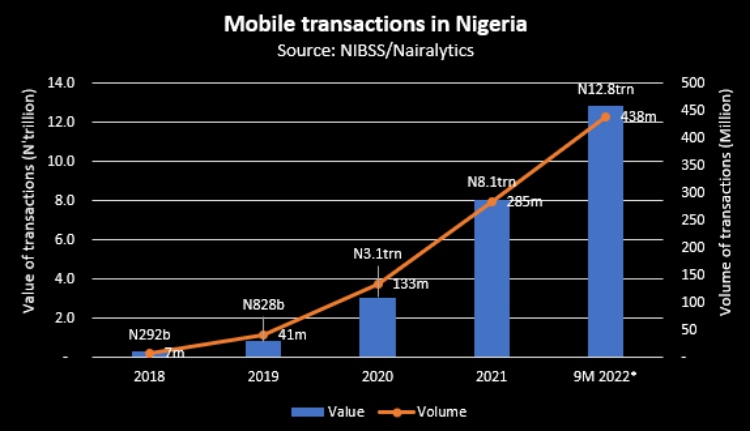

Nigerians carried out N12.8 trillion worth of mobile transactions between January and September 2022, more than double the amount recorded in the same period last year and even much more than what was recorded in 2020.

This is according to data from the Nigeria Inter-Bank Settlement System (NIBSS) for 2018 to 2022. According to the NIBSS, recorded mobile inter-scheme transactions in Nigeria grew by a whopping 153% year-on-year in the first nine months of 2022 from N5.07 trillion recorded in the comparable period of 2021. The total transactions for the current year represent an even higher margin when compared to the same period of 2020 (N1.89 trillion), 2019 (N461.4 billion), and 2018 (N216.4 billion).

Mobile and electronic forms of banking have been on the rise, particularly since the COVID-19 pandemic, which necessitated the use of more cashless forms of payment across the country. A closer look at the data tracked by the NIBSS showed that the volume of mobile transactions rose by over 132% in the review period.

Specifically, a total of 438.28 million transactions were recorded through mobile, higher than the 284.5 million transactions recorded in 2021. Similarly, a sum of N6.05 trillion was spent through POS transactions in the first nine months of the year, a little below the N6.4 trillion recorded in the full-year 2021, with three months left till the end of the year.

Banks and telcos are major gainers

The use of mobile and other digital forms of payment in Nigeria has also resulted in gains for Nigerian commercial banks and telecom services providers. That is because most of these transactions attract some charges for banks even as telcos gain from increased data consumption.

A review of the financials of listed telecommunication providers in the country showed impressive growth in data revenue. MTN Nigeria generated a whopping sum of N549.2 billion from data in the first nine months of the year, a 50% increase from the N366.18 billion earned during the comparable period in 2021.

Similarly, Airtel earned $431 million from their data business between April and September 2022, representing a 22.8% increase from $351 million recorded in the comparable period of last year.

Banks have also raked a fortune from commissions charged on electronic banking transactions. FBN Holdings, in the first nine months of the year, recorded N39.98 billion as e-banking revenue, Access Bank (N49.39 billion), and GTBank raked in N15.18 billion.

More spending expected in Q4 2022

- Interestingly, mobile transactions in the country could rise further in the last three months of the year, especially during the Yuletide characterized by festivities and increased spending.

- During this period, Nigerians in the diaspora would return home to their families, which would increase the number of spending, most of which would be done using digital means of payments as opposed to traditional cash-based transactions.

- Meanwhile, due to the rising inflation rate in the country, the CBN has adopted a hawkish monetary policy by increasing the cost of credit and mopping liquidity from circulation. As of September 2022, the currency in circulation had risen to N3.23 trillion, while the money supply is almost at N50 trillion.

Why this matters

The growing adoption of the mobile form of transactions in the country is in line with the Financial Inclusion strategy of the CBN, which is aimed at drastically reducing the number of unbanked and underbanked citizens by encouraging cash-less forms of banking.

Also, the Central bank launched the digital currency, eNaira in 2021 in a bid to grow digital payment in the country, which according to the apex bank recorded 200,000 users and N4 billion worth of transactions in one year.

The CBN governor noted that the digital currency would increase Nigerians’ engagement in the digital economy, thereby improving financial penetration in the country.

Editing by Emmanuel Abara Benson