Nigeria’s largest bank by profits and net assets Zenith Bank has now outpaced GT Co as the most valuable bank in the country. Zenith Bank’s market capitalization rose past N800 billion on Thursday while GT Co slipped to N749 billion.

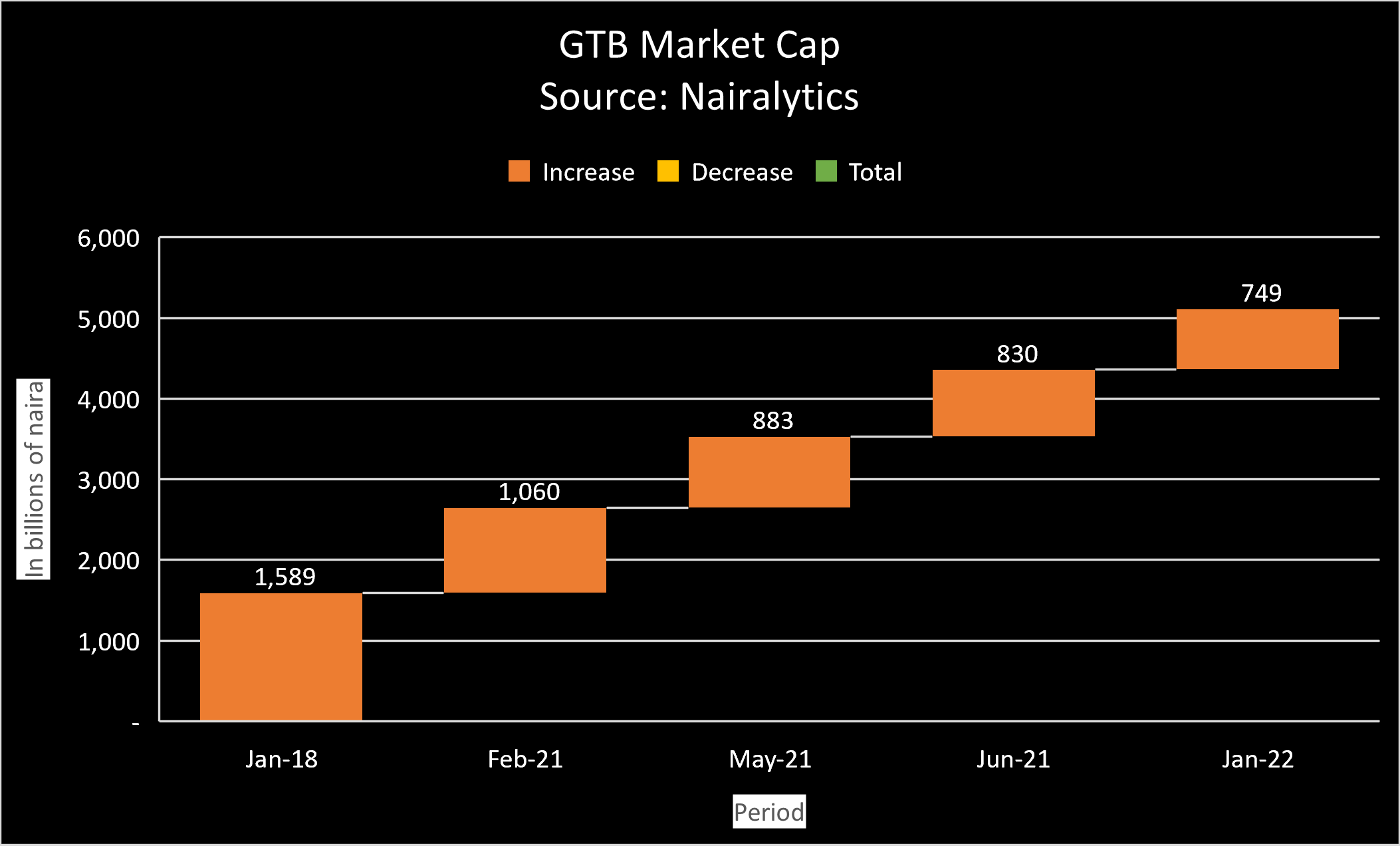

Nigeria’s most efficient bank, Guaranty Trust Holding Company, the owners of GT Bank has suffered an N80 billion loss in market valuation since it transformed into a bank holding company. GT Bank’s shares price was trading at N28 per share in the weeks leading to finally transforming to a holding company.

Since then, its share price has taken a nosedive ending the year with a 20% drop compared to the banking sector all share index which gained 10% during the year. The slide appears to have continued this year with the share price falling to N25.45 on Wednesday. In fact, the bank shares fell to a year low of N23.9 in December before rallying to N26 in December.

Read: Why Innoson can’t takeover GT Bank

Zenith blows past GTB

The drop in GT Co’s valuation means it has now been overtaken by Zenith Bank in terms of the market valuation after GTB’s share price fell to N25.45 and Zenith rose to N25.5. Zenith Bank has more shares on issue making it more valuable than GT at a similar price.

Zenith Bank first overtook GT Bank in terms of market valuation on November 19, 2021, when GTCo’s market cap fell to N747.5 billion compared to Zenith’s N753.5 billion. Since then, Zenith has risen past N800 billion while GT CO’s slide continues.

At its peak on January 19, 2018, GTB was trading at N54 per share or a market capitalization of N1.5 trillion. In the same period, Zenith Bank was trading at N33 per share valued at just over N1 trillion. During the Covid-19 bull ride of late 2020, GT Co shares recorded a resurgence after its share price rose to as high as N36 taking it to over N1 trillion.

Read: Playing the waiting game with GTCO

The bank has now lost over N250 billion in market value since November 2020. Data also reveal its price to book ratio is now firmly below 1 for the first time in years

The promise of a great future?

During a media briefing in 2020 when the then GT Bank MD/CEO Segun Agbaje was discussing the benefits of transiting to a Holdco, he assured investors of a rewarding future.

“I am delighted over the approval by shareholders for the holding company and I assure the investors of a more rewarding future. The bank will not embark on any share reconstruction, as the same number of shares they have with the bank will be maintained. Under the new structure, existing shareholders of GTBank would be migrated to Guaranty Trust Holdings via a share-for-share exchange between the shareholders of GTBank and GTHoldings.”

While explaining the benefits of the HoldCo structure, Agbaje explained that the overall strategy was to create an operating model that would profitably grow the bank’s presence in the market for commercial banking and non-banking financial services, in order to achieve the aspiration to be the dominant financial services group.

Read: Buy what? GTBank vs Zenith Bank

Unfortunately, none of these promises is yet to materialize as the bank navigates through the difficult waters of operating a holding company. During its 9 months interim results, the bank reported a 9% dip in pre-tax profits going from N167.3 billion to N151.9 billion. The major reason for this is a decline in its net interest income and a rise in operating expenses.

GT Co still more expensive?

- Despite the drop in GT Co’s market valuation, it still trades at a slightly higher price-earnings ratio than Zenith Bank at 3.85x compared to 3.46x respectively.

- In terms of dividend yield, GT Co has an indicative return of 11.79% compared to Zenith’s 11.76%.

- Both stocks remain relatively cheap in terms of their valuation.

- In fact, Zenith still trades at a price to book ratio of 0.67x compared to GT Co’s 0.9x.

Should shareholders be worried?

- Die-hard shareholders of the bank worried about the slide in its market valuation will hope that this is a temporary blip as the bank has always bounced back from such situations.

- GT Co is still a solidly run bank with profits only surpassed by the likes of Zenith Bank its main rival.

- It might be struggling at the moment with its HoldCo structure but we can not rule them out from seizing bank its position as the most valuable bank in Nigeria.

Update: This article was updated to reflect new information. It was also updated to correct the fact that GTB’s share price hit N54 in 2018 and not 2019.