- Over 36% of Nigeria’s adult population is unbanked.

- Nigeria contributed 3.4 percent to the world’s unbanked population in 2017 even though its population was 2.6 percent of the world’s population.

- There are just a little over 40 million Nigerians with BVN, a far cry from the estimated population of Nigerian adults.

This is numbing data if you are a Nigerian living the urban life where you juggle transactions between two to three of your bank cards on a daily basis, troubling data if you are with the banks who think their retail sales teams are meeting their customer onboarding targets, and humbling data if you are the CBN who set an 80% target for financial inclusion by the year 2020 and has consistently rolled out different frameworks and policies to achieve this, including licensing three Payment Service Banks (PSBs).

Payment service banks are a new category of small-scale banks established by the CBN in 2018 to facilitate high volumes of low-value transactions, offering payment and remittances under a secured technology-driven environment. The scope of their license is to deepen financial inclusion, and they are forbidden from credit risk and foreign exchange operations.

Since their licensing, however, there has been little impact on the financial inclusion scene, and they are beginning to look like a surplus arrangement to the CBN’s financial inclusion drive, and for good reason too, as the newly authorised PSBs are bound to face stifling operational and profitability problems in their financial inclusion campaign.

PSB operators, who by the way are required to have a minimum paid-up capital of N5 billion, are in competition for basically the same markets with Microfinance banks (who require a capital of ₦200 million, ₦1 billion, and ₦5 billion for a unit, state, or national license, respectively) and mobile money operators whose paid-up capital is N2 billion, not to mention the commercial banks who are not averse to making inroads into whatsoever markets will earn good returns for their shareholders.

Operational efficiency in this market could be an uphill task as the PSBs lack the infrastructure that the MMO and commercial banks already have in place, and can not rely on the government’s non-existent infrastructure in the rural areas where these PSBs are supposed to amass their targets. Challenges with insecurity and poverty are also a major concern in banking in the rural areas, mostly the northern parts of the country where poverty rates are as high as 77% and insecurity has become a booming industry.

That the PSBs are not allowed to take on credit risk is a major disadvantage to them as well as their customers. The PSBs, by virtue of their license, forfeit the profit margins they could potentially make by lending to their customers. On the other hand, there seems to be no incentive for their customers to bank with them when they could be getting much-needed financial assistance from the MFB competitors.

Perhaps on this note, the CBN would do well to borrow a leaf from the Nobel prize-winning Grameen Bank of Bangladesh by mixing financial inclusion with a dose of financial empowerment. Who knows, perhaps this will help address the issues with insecurity in these rural areas. After all, the Grameen Bank’s Nobel peace prize (jointly awarded to its founder) was for their work to “create economic and social development from below.”

In the years since Soludo’s consolidation era of banks, Nigerians have come to expect a landmark achievement from subsequent CBN regimes. There is an unsaid word, an expectation that CBN Governors should distinguish themselves in a particular area of endeavour in banking reforms or economic input that will leave a legacy for which they will be remembered.

Lamido Sanusi’s manner of exit as CBN Governor, and subsequently, Emir of Kano does not in any way undermine his work as CBN governor where he stabilised the sector amidst a global downturn and was the first Governor in Nigeria’s recent history to nationalise banks in a bid to protect depositors.

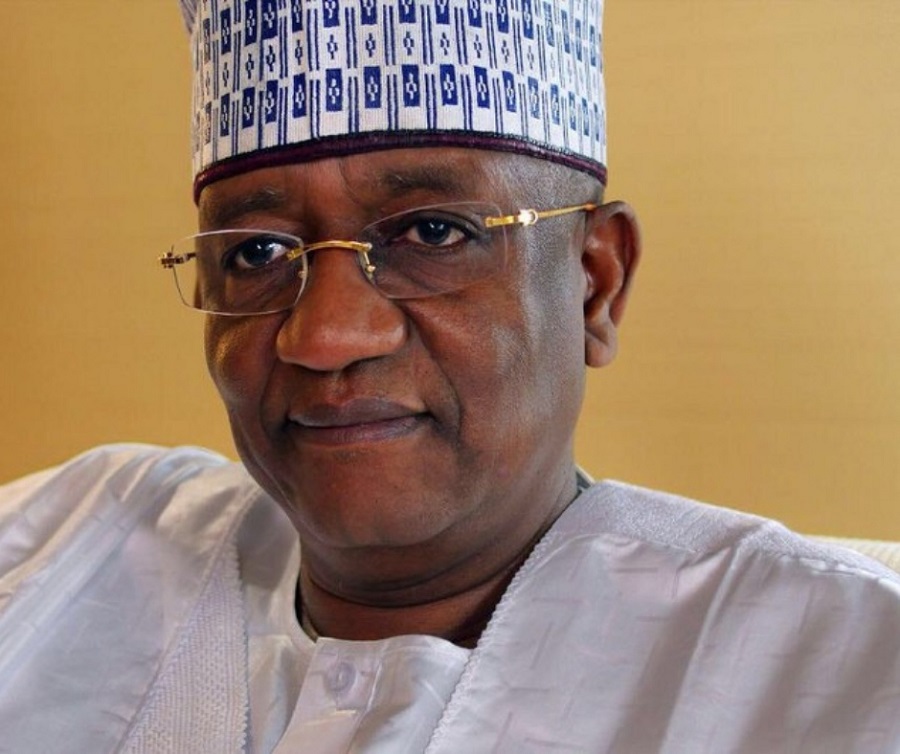

In Godwin Emefiele, we have a man passionate about growth in the real sector of the economy who continuously seeks to achieve this by exchange rate unification and financial inclusion, amongst other policies.

While the exchange rate unification battle may be a protracted one, financial inclusion is achievable and could provide an easy win for the present CBN leadership if the right policies are enforced, stakeholders are provided a level playing field and are rightly incentivised.

With a revised financial inclusion target of 95% by 2024, the PSB strategy to financial inclusion could be Emefiele’s biggest win yet—if rightly implemented.