Mutual funds have been known to be the go-to asset class that investors use to manage asset diversification as well as balance their portfolios, without compromising their risk characteristics, and while maintaining good investment return and performance. However, trends in the Net Asset Value of mutual funds in Nigeria seem to point to the contrary. Analysis of the mutual fund NAV Summary reports released by the Nigeria Security and Exchange Commission is pointing to the fact that mutual fund investors seem to be bailing out of mutual fund investments.

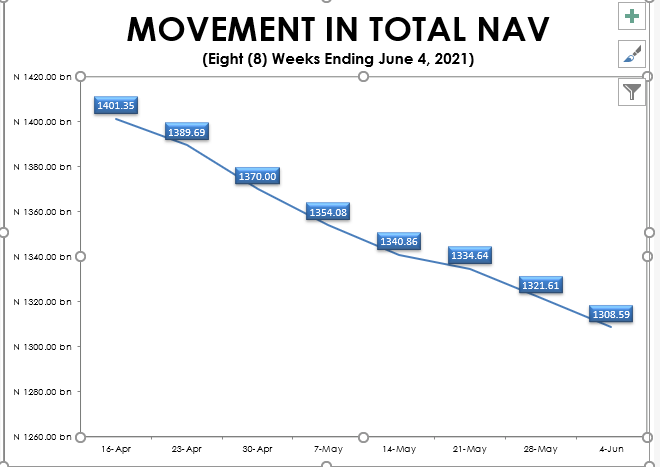

For the last consecutive six months, Nigerian mutual funds have witnessed more withdrawals than subscriptions, a trend that has diminished the total net asset value of mutual funds from the N1.57 trillion it ended 2020 with to the N1.4 trillion it stood at, on June 4, 2021.

On a year-to-date basis, Nigerian mutual funds have attracted an estimated additional investment of N245.5 billion since the beginning of the year 2021, while suffering an estimated withdrawal of N426.9 billion. The industry had not seen such large net outflow since 2013, when Quantitative Financial Analytics began monitoring the industry.

Fund type analysis reveals that much of the withdrawals occurred within the money market category of funds. Within the period under review, money market funds attracted only about N20.1 billion of subscriptions but suffered a whopping N253.75 billion of withdrawals. This never happened before and such a trend does not augur well for the industry. The rest of the category of funds seem to have all been breaking even as their outflows were almost nullified by equal and opposite inflows. However, Eurobond funds attracted N47.6 billion of new investments while shedding only about N12 billion by way of withdrawals.

The question that calls for an answer is: what are the reasons for the bloodletting in Nigerian mutual funds?

The reason may not be unconnected with the ultra-low interest rate that most money market instruments currently attract. With interest rate as low as 2%, there is little or no incentive to invest in money market funds, especially when one can get better returns directly or indirectly from other sources.

Another reason could be the presence of off-the-market investments that are promising huge interest rates to investors. While the authorities have been cracking down on such Ponzi schemes, investors should be very careful as all that glitters is not gold.

The current exchange rate of the dollar and other major currencies to the Naira may also be a contributing factor. The Naira has been losing against such currencies at a rate that makes it even better to use the Dollar as a store of value or for speculative purposes. It is not unlikely that investors are withdrawing from their money market funds and buying dollar with such withdrawals with the hope of selling the same in future.

Yet another reason for the massive withdrawals from mutual funds is the current instability in the country. The incessant killings and unrest in various parts of the country is putting people on edge and as such, investors may be withdrawing their money in readiness for any unforeseen event. It will be recalled that at the end of the Nigerian civil war in 1970, most people from the Eastern and South Eastern parts of the country were made to receive only twenty pounds for whatever amount they had in the bank. It is not unlikely that people would not like to be caught in that same trap, should a repeat of that event take place, so they may be proactively withdrawing their money, after all, a bird in hand is worth two in the bush.

Economic hardship could be contributing to the massive withdrawal, as investors seem to be de-saving to keep body and soul together in the light of the vanishing value of the Naira and the skyrocketing prices of goods and services following recoveries from Covid 19.

Pension fund managers have not been helping matters in the mutual funds industry. Analysis of the reports released by the National Pension Commission of Nigeria, conducted by Quantitative Financial Analytics Ltd indicates that pension fund managers allocated zero Naira to mutual funds since the beginning of 2021, but have withdrawn about N32.6 billion from their N76.3 billion mutual fund investments, bringing the total pension fund managers’ investment in mutual funds to N43 billion as at the end of May 2021.

Lack of data and transparency also plays a part in diminishing the importance of mutual funds in Nigeria. Not much is being said or written on mutual funds by way of analysis and commentary. As a result, current and intending retail investors may not be as enthused as they would have been, had there been timely data and analysis on the basis of which credible investment decisions could be made.

Conclusion

Mutual funds should be encouraged and be made to thrive and survive as the investment category offers retail investors the opportunity to access the capital market indirectly.