Copper prices gained for a fifth straight trading session to its highest since January on Wednesday, supported by global industrial demand for copper metal

Copper futures on the London Metal Exchange (LME) gained about 0.8% at $5,822 per ton in official trading, after touching its highest level since Jan. 24 at $5,862.50.

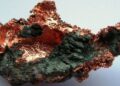

What you should know about copper? Copper is a malleable metal, a good conductor of electricity, used in making electrical wires.

Copper is also used in the construction sector and the mining industries, taking a technical view, copper broke through the 100- and 200-day moving averages, thereby giving metal traders the green light to increase their purchases in copper contracts.

“Copper is being carried higher by an improved fundamental outlook but also by an improved technical picture,” Saxo Bank analyst, Ole Hansen told Reuters

“The next area of resistance for LME copper lies at $6,050,” Hansen added.

READ MORE: Brent crude closes at $41, hitting a three-month high

The bullish momentum building on copper future shows a positive signal that the worse is over since the COVID-19 pandemic onslaught began early in the year.

“Net positioning on LME copper is on the verge of turning long, with the net short position shrinking from over 40,000 contracts in February to just 895 contracts as of early June,” said BMO analyst, Timothy Wood-Dow.

“Any aggressive buying here would have a positive effect on prices.” Timothy Wood-Dow added.