When mobile banking Apps started ushering in just over a decade ago, they were more used as convenient tools to check and monitor account balances. Today, with customers being increasingly accustomed to innovative mobile technologies, expectations are higher than mobile banking Apps will provide a more fully-rounded experience.

Today, the rapid growth and widespread use of information technology is touching every part of human life and as technology begins to settle in, banking has become more seamless and easy. Banks are beginning to strategically decongest their banking halls and encourage the use of mobile apps for transactions.

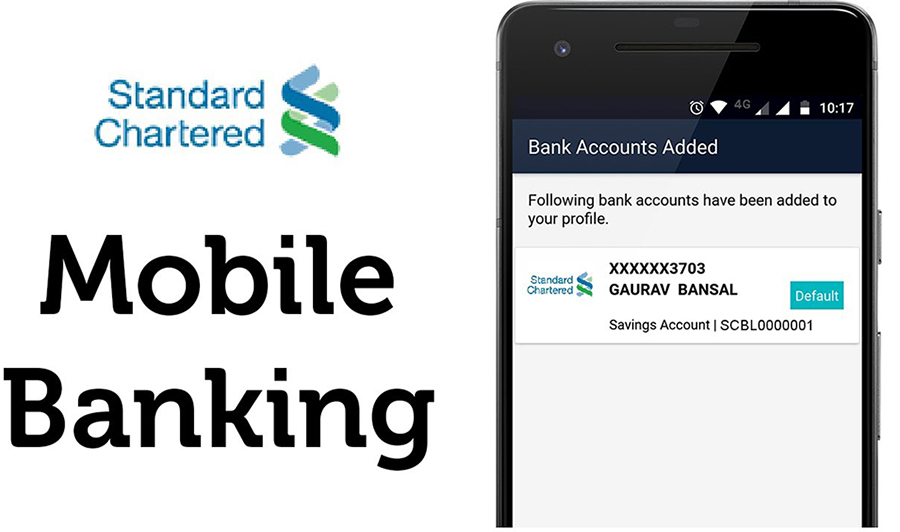

As one of the leading banks in Nigeria, The Standard Chartered bank App is one of the most secure and user-friendly platforms for transactions and is highly equipped with additional cutting-edge capabilities to enhance the customer experience.

The App delivers easier, faster, and more convenient solutions to streamline and make financial transactions very exciting. It is not surprising that Standard Chartered currently has one of the best mobile banking apps in the country and despite its successes in this regard, the bank continues to innovate in efforts to guarantee a future of secure, fast, and convenient banking for all.

The Standard Chartered APP has made things easier for innumerable customers across the country. Irrespective of a user’s location, you can perform the most important financial operations on the go. Everything from checking account statements to paying utility bills and transferring funds can be done online with the mobile banking application.

The App is secure, very simple to use, and allows you to perform transactions and manage your bank account(s) from your mobile device. Some of the banking activities that can be done with the App include:

(READ MORE: Standard Chartered: Easy banking at no cost)

- Viewing the account balance and transaction history.

- Initiating bank transfer from your account to other Standard Chartered accounts and other bank accounts.

- Paying bills and purchase airtime and data bundles for all mobile telecommunication networks in the country.

- Request a credit/Visa Gold Debit card directly from the App and it will be delivered to your mailing address anywhere in Nigeria at a zero cost

- Service requests directly on the app that eliminates almost the need to go to the branch. For example, fixed deposit, choose PIN and active your debit/credit card, request letters, confirm cheques, etc can all be done on the app

With a stunning user interface and attractive appearance, the Standard Chartered mobile banking app ensures swift and quick banking operations. It is extremely easy-to-use, interactive, and intuitive with an attractive UI and simple functionality that makes financial transactions a cakewalk.

Focus on the customer journey

The page layout, content display, and task flow are top-notch, to begin with. Like B. J. Fogg’s Behavioral Model suggests, it is important that a user is motivated to use the app. All the immediate call-to-actions are well placed and help users take the desired actions and detailed information.

No information overload

Serious thought was put behind understanding and thinking of the Customers who are going to use the App with absolutely no overload of information. The Standard Chartered App is clean with a simple interface that focuses on what the user is really trying to do.