Nigerian banks are beginning to review their business model which is still very much the traditional banking system as technology is penetrating deeper into the tasks that workers carry out.

Technology has already compelled some banks to limit their expansion rate, while others are shutting down their brick and mortar structures to accommodate technology. All these are happening because technology is projected to handle 30% of the work currently done at banks.

Part of the 30% of work that will be taken over by technology is collation of tellers. This means that the staffs who work as tellers will be major casualties of the onslaught of technology. Banks are reviewing their work system because in the next two to three years, teller jobs would likely be phased out by the financial institutions.

Speaking on the projected job loss, the President, Chartered Institute of Bankers of Nigeria (CIBN), Uche Olowu, said the downsizing might occur because the banks’ traditional business model is being threatened. According to him, banks are now investing in financial technology rather than invest in expansion or brick and mortar building which will accommodate more jobs.

[READ MORE: CBN now has its eyes on Fintechs’ activities]

Apart from their investments in Fintech, banks are also investing in specialised human capital. This paradigm shift in investment focus of banks is expected to affect departments that can be technologically driven.

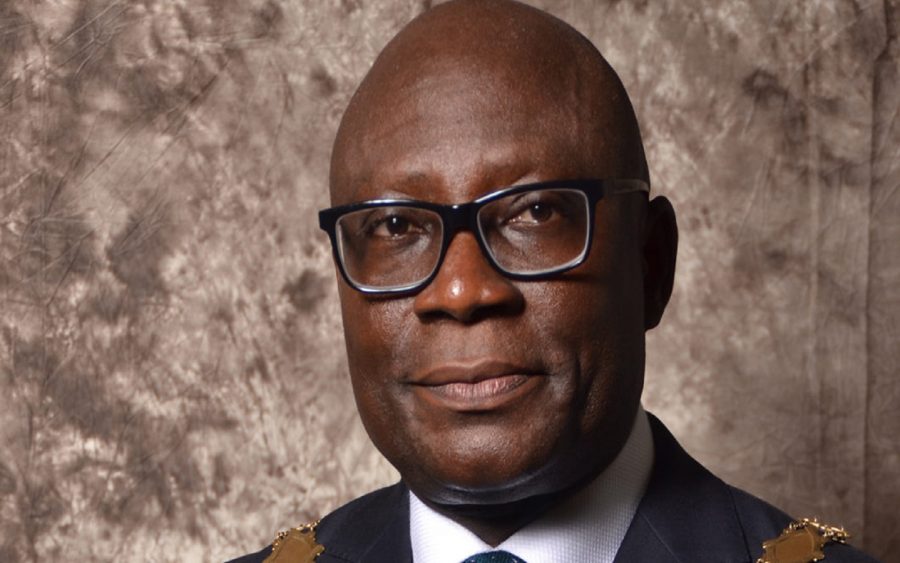

While defending the actions taken by banks, the Managing Director/CEO, Ecobank Nigeria, Patrick Akinwuntan, said the infusion of technology into banking services was done in a bid to remain relevant as banks gradually lose monopoly over financial transactions.

Nairametrics had previously reported that the future of banks was under threat from FinTech startups and telecoms companies which received approval from the Central Bank of Nigeria (CBN) to conduct mobile money service. They were given pproval to enable the apex bank achieve its 80% financial inclusion by 2020. However, the growing popularity of FinTech startups and functionality of network providers as Payment Service Banks has placed some jobs in banks in jeopardy, as customers continue to get more reasons not to visit banks for some financial transactions which can now be done anywhere.

[READ MORE: CBN set to backtrack on its costly new regulation for fintechs]

Some banks didnt improve their technology. While some did, banks that invested in technology are not closing down branches or massively sacking their members of staff. Fintech and (Telecommunications) companies are now disrupting the banking space by providing financial services. Banks that failed in the past to invest in their technologies are now having serious competition. To survive , banks must do more than the traditional banking.