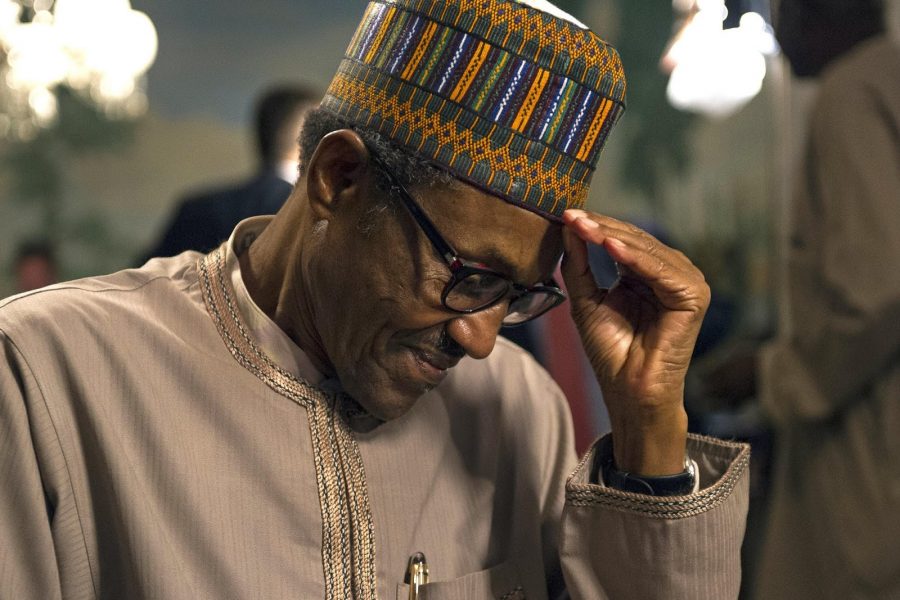

After months of eager anticipation, hopes were not entirely dashed as President Muhammadu Buhari finally approved the immediate implementation of N30,000 new minimum wage to lowest cadre workers.

The development was confirmed by the Chairman of the National Salaries, Income, and Wages Commission, Chief Richard Egbule, who spoke to journalists during a press conference in Abuja. Meanwhile, according to the directive from the Presidency, not all civil servants would get paid at the moment.

The President’s directive: The President gave a directive to the Accountant-General to begin processing payments for only civil servants who currently earn below N30,000 minimum wage.

- The President’s directive entails that the new salary payment will be backdated to April 18, 2018. This will only affect the salaries of government workers under five salary structures.

- This implies that only workers who are within the grade level 1-5 will benefit from the approval, at least for now.

- Basically, the new payment will cut across the Consolidated Public Service Salary Structure, Consolidated Health Salary Structure, the Consolidated Research, and Allied Institutions Salary Structure.

[READ: 2019 Budget: FG may borrow more to close N102.8 billion funding gap]

Nigeria might just be broke: Many people are probably wondering why the Government cannot just implement the salary increment for everyone at the same time. Well, this is probably because the Government is short on cash at the moment.

Recall that President Buhari signed the N8.91 trillion 2019 budget in May. At the time, people’s expectation was that the budget signing would facilitate the implementation of the new minimum wage. But two months later, the implementation lingered until now.

- A breakdown of the 2019 budget shows that 25% will go into debt servicing, which amounts to as much as N2.14 trillion.

- Latest debt stock data reveals that Nigeria’s debt rose to N24.9 trillion, which is about 19% of the country’s Gross Domestic Product.

- Debt stock rose significantly under Buhari (between 2015 and 2019) by N12.3 trillion.

- Specifically, Nigeria’s revenue in 2018 stood at N3.96 trillion. This means to fund the 2019 budget, the country would have to source for over 50%.

To say the least, the 2019 budget does not have the capacity to provide the billions of Naira required to facilitate the new minimum wage implementation. What this means, therefore, is that either provision is made for a supplementary budget or the country incurs more debt.

Even financial expert, Kalu Aja, has pointed out that the government cannot afford to pay the N30,000 without a massive tax hike.

https://twitter.com/FinPlanKaluAja/status/1151149696158580736

https://twitter.com/FinPlanKaluAja/status/1151206219257790464

[READ: President Buhari signs N8.91 trillion 2019 Budget into law]

In the meantime, the Presidency is in limbo over the new wage implementation. This is because the country appears broke in the face of building debt stock and dwindling national income.

Will the Presidency’s approach work? The Presidency’s plan to first implement the minimum wage for low-cadre workers appears to be more of a bottom to up approach. The aim may be to test-run how the economy would react, considering the government’s cash constraints.

There is already mounting tension among several organized labour groups. The latest strategic move by the presidency to start with the bottom-up approach to minimum wage implementation may just heighten tension. This is because:

- Senior-level civil servants may not greet the President’s move with smiles on their faces.

- Recently, the Joint National Public Service Negotiating Council reportedly declared a nationwide mobilisation of civil servants in the country for a possible showdown with the government.

- The council expressed displeasure after the deadlock negotiation on the consequential salaries adjustment for officers on grade level 7 and above with the Technical Committee set up by the President.

- While the NLC has shelved the plan to embark on a nationwide strike, a possible lockdown on the economy is possible if the Buhari’s camp fails to act fast.

On the flip side, some analysts viewed the move by the Presidency to adopt a bottom-to-top approach as a strategic move aimed at avoiding exacerbation of the inflation rate in the economy.

Others have, however, argued that this is not true because they believe the new minimum wage is not expected to trigger inflation in the system. Instead, they believe it will boost the country’s economy and workers’ standard of living.

[READ FURTHER: Evidence that Sanusi is right about Nigeria ‘going bankrupt’]