The importance of stable electricity in the quest for economic development can never be overstated. Unfortunately, many factors (mainly infrastructural inadequacies) have continually militated against the actualisation of stable electricity in Nigeria. It is in this regard that Cutix Plc has been playing a major role over the past three decades, manufacturing and distributing assorted, quality cables used in the conduct of electricity across the country.

For our company focus this, we shall be focusing on this Nigerian company. Let’s take you through everything you need to know about Cutix Plc’s effort to redefine the cable industry. We shall also be examining the company’s business model, products, target market, ownership structure, investment prospects, and most important the financials.

About the company

Incorporated in 1982, Cutix Plc is an Nnewi-based cable manufacturing company which was established in 1982. The company manufactures and distributes various kinds of cables such as electrical wires, telecommunication wires, to automobile wires. Some typical examples of the company’s wide range of products are insulated copper conductors, PVC insulated, and sheathed flat twin/three-core copper cables. Others are low tension bare aluminium conductors and reinforced aluminium conductor steel wires.

Cutix Plc also manufactures bare stranded copper conductors as well as bare copper conductors which are used for earthing electrical installations and the production of copper cables.

[READ: FOCUS: The drum business has failed Greif Nigeria Plc in 2018]

The company’s incorporation and NSE-listing

Cutix Plc is the brainchild of Dr Ajulu Uzodike who resigned from a well-salaried job at Raychem Corporation in 1981, to establish one of the foremost wire manufacturing companies in Nigeria. In the early days of the company, he used Adtec Limited (a venture capital firm he also founded) to kick-start some of the initial projects.

According to information available on the company’s website, Cutix Plc started operations with a startup capital of about N400,000 which was collectively raised by the founder and eighteen others; consisting of his friends and his family members.

The company was initially incorporated on November 4th, 1982 as a private limited company before it transformed into a publicly-owned company. Its shares were then listed on the Nigerian Stock Exchange’s main board on December 8, 1987. Cutix Plc currently has a market capitalisation of N2,906,181,342.90.

[READ THIS: Focus on Notore Chemical Industries Plc’s commitment to Africa’s food security]

Following Cutix’s listing on the NSE, which made it the first Eastern Nigeria-based company to do so, it was able to raise the necessary capital to facilitate its expansion drives. Consequently, the company built its own factory/several cable production lines, installed and commissioned more machines, and obtained more licenses from the authorities.

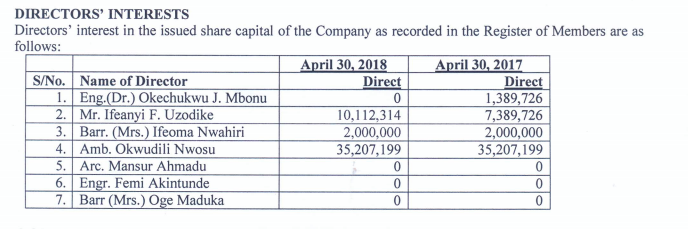

The company’s ownership structure

About 60.38% of the company’s shares are currently held by the investing public. The remaining 39.62% shares are split thus:

- Uzodike Gilbert Obiajulu: 90,172,226 units, holding (10.24%).

- R.C Onyeje And Company (Nig) Ltd: 55,416,000 units holding (6.29%).

- Nsoedo Samuel: 54,333,333 units holding (6.17%).

- Nigerian Reinsurance Corporation: 53,333,333 units holding (6.06%).

- Nzewi Christopher Emengini: 50,571,310 units holding (5.74%).

- AMI Nigeria Limited: 45,093,991 units holding (5.12%).

The company’s founder and other top executives

Dr Gilbert Obiajulu Uzodike is the Founder of Cutix Plc. Born in 1949 in Onitsha, he studied for his primary and secondary school education in Eastern Nigeria before proceeding to the University of Lagos where he obtained a B.Sc. Mech. Engineering in 1974. He then proceeded to Harvard Business School, where he obtained an MBA in 1977.

He has founded and managed several companies asides Cutix Plc, following his successful career as an employee business executive. These companies include cosmetics manufacturing company Ugora Limited, Raychem Adtec Limited, Adswitch Plc etc.

He currently sits on the board of quite a number of establishments, including his position on the Board of Trustees of the Anambra State Security Trust Fund.

Other notable executives/board members of the company are-

- Mrs Uche C. Igbokwe (CEO)

- AMB. Okwudili Nwosu (Chairman)

- Mr. Nnamdi Ike (Non-Executive Director)

- Mr. Mathias Umego (Independent Non-Executive Director)

[READ FURTHER: Focus on this small-cap company and its very ‘salty’ business]

The company’s target market

Cutix Plc targets everyone, particularly real estate developers, governments, electricity companies, private companies, and anyone else who deals in the construction of residential and office buildings. It also targets telecommunications companies like MTN and 9mobile, who make use of telecommunication wires such as those manufactured by the company.

But the company faces competition

Cutix Plc faces competition from various quarters, including those posed by other cable manufacturers in Nigeria such as Coleman Technical Industries Limited which, though not listed on the Nigerian bourse, is still one of the biggest names in the sector. Other competitors are Sinitor & Co Nigeria Limited, Emarvel Electrical Cables, Berliac Engineering Cables Limited, and Vecan Cable Limited, etc.

Note that out of all the cable manufacturing companies in Nigeria, Cutix Plc is the only one whose shares are publicly traded on the Nigerian Stock Exchange.

Focus on the company’s financial performance

The company’s unaudited third quarter 2019 result shows that it earned a total revenue of N4.1 billion as against N5 billion worth of revenue earned during the comparable period in 2018. Unaudited profit for Q3 2019 stood at N300 million as against N440 million in Q3 2018.

Over the past five years (i.e., between 2014 and 2018) Cutix Plc’s revenue has been on a steady rise. The company reported N2,234,959,000 for the year ended April 2014. By the end of FY 2015, revenue had increased to N2,358,412,000. The rise is similar to 2016, with N2,835,863,000. By 2017, total revenue had reached N3,675,712,000 and in

[READ: Is Nestle Nigeria’s recently-launched seasoning brand even necessary?]

Similarly, Cutix Plc performed relatively well in terms of profits. The company recorded a profit after tax of N207,116,000 in 2014. However, profit decreased to N149,209,000 in 2015, only to increase yet again to N190,551,000 in 2016, N257,498,000 in 2017, and N440, 295 in 2018.

In conclusion, Cutix Plc is doing okay, although it can do better. This is a truth that even the management of the company acknowledges. This explains why they are making serious plans for the future by developing “a new power plant, where power cable of all sizes in low voltage varieties of PVC, PE and XLPE will be produced.” It is expected that this move will, among other things, build capacity, while ensuring that they reach newer markets even as they, in turn, make profits.