Nigeria’s economic growth slows for first time since end of recession – NBS

KEY INDICATORS

| Inflation | 12.48% | Declined by 0.86% in April from 13.34% in March 2018 |

| MPR | 14.00% | Left unchanged at 14.00% at the MPC meeting 0n 4 April 2018 |

| External Reserves | $47.79billion | Rose by0.02% as at 18 May from $47.78bn as at 17 May 2018 |

| Brent Crude | $78.46pb | Fell by0.76% from $79.06pb on 18 May 2018 |

Bonds

The Bond market opened the week on a weaker note, with yields rising higher by c.14bps. This was following fears of continued selloff from offshore investors which pushed bid prices significantly lower, despite the relatively scanty volumes traded. We witnessed the most selloff on the 2027s and 2034s, which rose by as much as 7bps (-0.40pt). We expect yields to moderate slightly in the near term, with slight pullback in yields expected at these levels.

| FGN Bonds | |||

| Description | Bid (%) | Offer (%) | Day Change (%) |

| 16.00 29-Jun-19 | 12.22 | 11.36 | 0.71 |

| 15.54 13-Feb-20 | 13.07 | 12.71 | 0.22 |

| 14.50 15-Jul-21 | 13.62 | 13.52 | 0.02 |

| 16.39 27-Jan-22 | 13.59 | 13.42 | 0.09 |

| 14.20 14-Mar-24 | 13.58 | 13.30 | 0.04 |

| 12.50 22-Jan-26 | 13.57 | 13.36 | 0.07 |

| 16.29 17-Mar-27 | 13.55 | 13.50 | 0.07 |

| 12.15 18-Jul-34 | 13.51 | 13.44 | 0.07 |

| 12.40 18-Mar-36 | 13.52 | 13.42 | 0.05 |

| 16.25 18-Apr-37 | 13.46 | 13.41 | 0.04 |

Source: Zedcrest Dealing Desk

Treasury Bills

The T-bills market traded on a slightly bullish note with yields compressing further by c.5bps down to 13.00%. This was as market players cherry-picked on most of the higher yielding bills in the market. We expect yields to maintain a slight downtrend, ahead of the next OMO maturity on Thursday.

| Treasury Bills | |||

| Description | Bid (%) | Offer (%) | Day Change (%) |

| 14-Jun-18 | 12.00 | 11.50 | (0.50) |

| 5-Jul-18 | 13.00 | 11.50 | 0.00 |

| 2-Aug-18 | 12.50 | 11.50 | 0.00 |

| 13-Sep-18 | 12.50 | 12.00 | 0.00 |

| 4-Oct-18 | 12.50 | 12.00 | 0.00 |

| 1-Nov-18 | 13.00 | 12.00 | 0.00 |

| 6-Dec-18 | 12.45 | 12.15 | 0.00 |

| 3-Jan-19 | 12.25 | 12.00 | (0.15) |

| 14-Feb-19 | 12.50 | 11.50 | 0.00 |

| 14-Mar-19 | 12.50 | 11.00 | 0.00 |

| 4-Apr-19 | 12.50 | 11.00 | 0.00 |

Source: Zedcrest Dealing Desk

Money Market

The OBB and OVN rates shot higher by c.10pct to 16.50% and 17.42% respectively. This was due to provisioning by banks for their Wholesale FX bids which put pressure on system liquidity which opened at c.N66bn long. We expect rates to decline slightly tomorrow, as there are no significant funding pressures expected.

| Money Market Rates | ||

| Current (%) | Previous (%) | |

| Open Buy Back (OBB) | 16.50 | 7.83 |

| Overnight (O/N) | 17.42 | 9.00 |

Source: FMDQ, Zedcrest Research

FX Market

The Interbank rate remained stable at its previous rate of N305.85/$, with the CBN’s External reserves recovering slightly by 0.02% to $47.79bn. The NAFEX rate depreciated by 0.10% to N361.47/$. Rates in the Cash market remained stable atN363.00/$, while rates in the Transfer market appreciated by 0.27% to N365.00/$.

| FX Market | ||

| Current (N/$) | Previous ( N/$) | |

| CBN Spot | 305.85 | 305.85 |

| CBN SMIS | 330.00 | 330.00 |

| I&E FX Window | 361.47 | 360.85 |

| Cash Market | 363.00 | 363.00 |

| Transfer Market | 365.00 | 366.00 |

Source: CBN, FMDQ, REXEL BDC

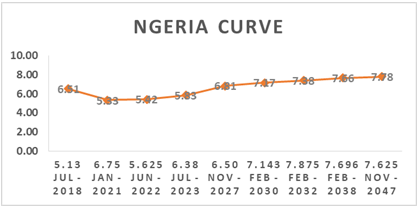

Eurobonds:

The NGERIA Sovereigns traded on a bearish note, with yields rising higher by c.9bps. We witnessed very few trades, mostly on the 2022s, 2030s and 2032s, as investors remained net sellers of bond with very little interests across the SSA space.

The NGERIA corps were mostly quiet, with very little interests observed mostly on the FBNNL 21s and SEPLLN 23s. Other Tickers were relatively quiet with some gains however noted on the Zenith and UBANL 22s.

Disclaimer:

Whilst proper and reasonable care has been taken in the preparation and accuracy of the facts and figures presented in this report, no responsibility or liability is accepted by Zedcrest Capital or its employees for any error, omission or opinion expressed herein. This report is not an investment research or a research recommendation and should not be regarded as such. The information provided herein is by no means intended to provide a sufficient basis on which to make an investment decision.Contact us:Dealing Desk: 01-6311667, Dayo: 07032208237, Seyi: 08023231396,

Nnamdi: +2348133385000

Email: research@zedcrestcapital.com