The Federal Government is planning to raise up to N500 billion through the issuance of green bonds in 2026, as it seeks alternative financing to fund climate-related and environmental projects.

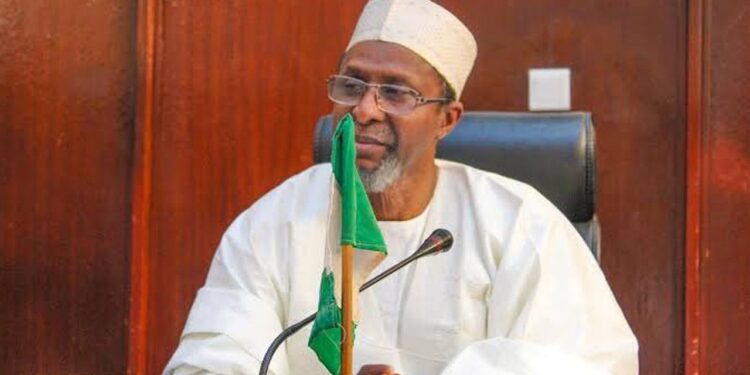

This was disclosed by the Minister of Environment, Balarabe Abbas Lawal, at the Abu Dhabi Sustainability Week on Tuesday, Bloomberg reports.

The proposed issuance reflects Nigeria’s growing use of climate-linked debt instruments to diversify funding sources beyond oil revenues and conventional borrowing.

What FG is saying

The Minister said proceeds from the green bond sale would be channelled into projects aimed at improving air quality, expanding access to clean cooking fuels, and combating deforestation.

According to Lawal, the initiative aligns with Nigeria’s broader climate commitments and environmental sustainability goals, while also tapping into rising global investor appetite for green and sustainable finance instruments.

The planned issuance follows rising global demand for climate-linked assets across emerging markets, as countries including Saudi Arabia and Hungary adopt green financing to fund environmental and infrastructure projects.

For Nigeria, pursuing fiscal reforms, green bonds offer funding for climate and infrastructure projects without heavy reliance on traditional debt or volatile oil revenues, the country’s main source of foreign exchange.

Why this matter

Climate financing has become increasingly important for Nigeria as it grapples with environmental challenges such as air pollution, deforestation, and limited access to clean energy solutions.

Green bonds allow the government to attract environmentally focused investors while funding projects that deliver both economic and environmental benefits.

The strategy also supports Nigeria’s efforts to align public finance with its climate commitments under international frameworks, while broadening its investor base.

What you should know

Nigeria has a track record of successful green bond issuances, with previous offerings recording strong investor demand.

The Federal Government’s N50 billion green bond issued last year was oversubscribed, attracting more than double the amount on offer.

Nigeria’s inaugural sovereign green bond was also fully subscribed, signalling sustained investor confidence in the country’s climate-linked debt instruments.

Green bonds are typically earmarked for projects with measurable environmental benefits, enhancing transparency and accountability in public spending.

Earlier, Nairametrics reported that President Bola Tinubu has approved the implementation and operationalization of Nigeria’s carbon market framework, a landmark policy expected to generate at least $3 billion annually by 2030.

Nigeria had, in November 2025, unveiled an ambitious plan to mobilize up to $3 billion annually in climate finance through its National Carbon Market Framework and Climate Change Fund.