Commercial paper (CP) is a short-term, unsecured debt instrument issued by private companies to raise working capital.

Because it is not backed by collateral, investors rely heavily on the issuer’s financial strength and credit rating.

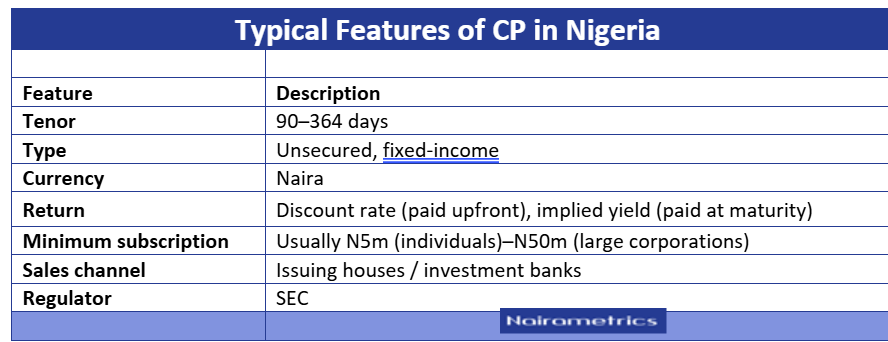

In Nigeria, CPs typically have tenors between 90 and 364 days and are categorized as money market instruments due to their short maturity.

They are usually issued at a discount, but investors seeking higher returns often choose CPs with an implied yield with returns paid at maturity. Companies with weaker credit ratings typically offer higher discount rates and implied yields to attract investors.

CPs remain popular among investors because they generally offer higher returns than bank fixed deposits while maintaining relatively low risk for high-grade issuers.

Companies use CPs to finance inventory purchases, short-term operational needs, bridge financing, and cash-flow management under the FMDQ Commercial Paper Programme, which can range from N10 billion to over N200 billion.

Who issues commercial paper in Nigeria?

Mostly large, well-rated companies with strong balance sheets, including

- Manufacturing & FMCG companies

- Industrial firms

- Telecommunications

- Agriculture & agro-processing companies

- Oil & gas servicing firms

- Financial institutions (non-bank)

Typical issuers include Dangote Cement, MTN Nigeria, Flour Mills of Nigeria, Nigerian Breweries, BUA companies, Lafarge Africa, Seplat, Dangote Sugar, Daraju Industries and others.

Who buys commercial paper?

Commercial paper is mainly purchased by

- Pension Fund Administrators (PFAs)

- Asset managers

- Insurance companies

- Banks and microfinance institutions

- High-net-worth individuals (HNIs)

- Corporate treasurers

Why investors buy CP

- Higher yields than savings and fixed deposits

- Lower risk than corporate bonds

- Short duration reduces inflation and interest-rate risk

- Good for portfolio liquidity

- Often backed by high-credit-quality issuers

Where to find commercial paper data in Nigeria

Most reliable sources are

- FMDQ Securities Exchange – Check the homepage lists ‘new CP quotations’, FMDQ CP Quotation Page or searchable by keywords such as issuer, tenor, amount, and credit rating

- Issuing Houses & Investment Banks – Examples such as Chapel Hill Denham, Stanbic IBTC Capital, Coronation Merchant Bank, CardinalStone, Afrinvest West Africa, Meristem, Cordros, CFG Africa etc

- Press releases – Companies often publish CP issuance news on the NGX or and other financial websites like Nairametrics.

Key risks to evaluate

- Credit risk: Since CP is unsecured, if a company fails, investors may lose money. This risk is mitigated when the issuer has a good credit rating, strong cashflow and high corporate governance.

- Liquidity risk: Some CPs may not be easily tradable before maturity in the secondary market.

- Market risk: If interest rates rise sharply, CPs become less attractive and prices fall (secondary market).

- Regulatory risk: While reforms are favorable, improper implementation or further policy shifts could disrupt business models.

How insurers are usually evaluated

Insurance stocks are typically assessed through the following ratios and other comparable:

- Credit rating – provided by rating agencies like Agusto & Co, GCR, and DataPro.

- Liquidity coverage – current ratio, quick ratio, cash ratio

- Leverage ratios - debt-to-equity, total liabilities-to-assets, interest coverage ratio

- Cash flow adequacy - operating cash flow, net cash position

- Treasury bills rate – commercial paper rates are usually more than treasury bill rates

How to invest in commercial papers

- Ensure you have CSCS (Central Securities Clearing System) / CHN (CSCS Holding Number) already; otherwise, one needs to open an account with a broker or an asset management firm

- Check with a broker/asset management firm or FMDQ to find out available papers and select one to invest in

- Select the tenor of interest and the rate, either implied yield or discount

- Review the credit ratings of the issuing company

- Review financial ratios and cash positions.

Some commercial papers in November

Daraju Industries closing 27th November 2025

- 270 days at 18.55% discount rate and 21.50% implied yield

- 364 days at 18.38% discount rate and 22.50% implied yield

Dangote Cement PLC closed 19th November 2025

- 181 days at 16.1026% discount rate and 17.5000% implied yield

- 265 days at 18.6968% discount rate and 19.0000% implied yield

Miskay Boutique International Limited closed 21st November 2025

- 180 days at 19.85% discount rate and 22.00% implied yield

- 270 days at 20.74% discount rate and 24.50% implied yield

- 360 days at 21.01% discount rate and 26.50% implied yield

Nairametrics’ take

Commercial paper is a suitable option for investors seeking stable, predictable short-term returns, minimal price volatility, and a higher yield compared to regular bank deposits, especially when trying to hedge against uncertain market conditions.

However, it may not be the best fit if you require liquidity before maturity, have a low tolerance for issuer credit risk, or prefer to invest in long-term assets.