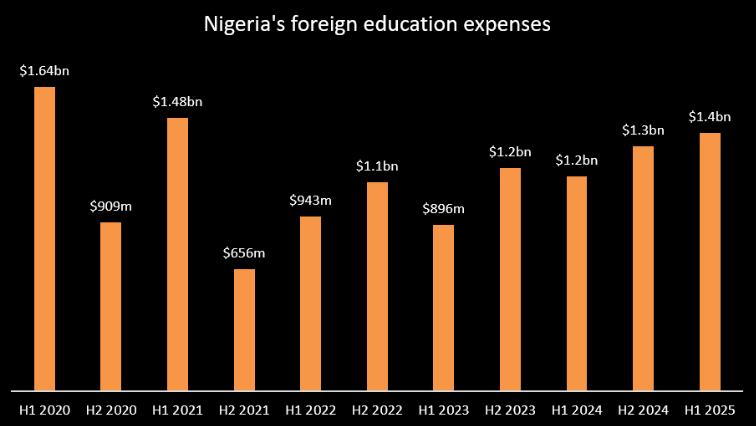

Nigerians spent a total of $1.39 billion (N2.16 trillion) on foreign education in the first half of 2025, marking a significant increase from the corresponding period in 2024.

This figure represents a 20% rise in dollar terms and a 38% increase in naira, based on an average exchange rate of N1,553.6/$ during the period.

The data, sourced from the Central Bank of Nigeria’s (CBN) Balance of Payments report, reflects the growing trend of educational migration amid persistent challenges within Nigeria’s domestic education system.

Notably, the CBN report shows zero income under “Education” in the services trade balance, indicating that while Nigeria expends significant resources to educate its citizens abroad, it attracts virtually no foreign students to its own institutions.

Education Exodus Intensifies Amid Domestic Challenges

This $1.39 billion outflow marks the highest H1 foreign education expenditure since 2021, and comes even as the naira has undergone sharp depreciation following the CBN’s foreign exchange liberalisation reforms of mid-2023.

Despite greater exchange rate stability in 2025 compared to the volatility of 2024, Nigerians continued to pursue education abroad in large numbers.

Multiple structural issues underpin this trend. These include a perceived decline in the quality of education in Nigerian universities, frequent strikes by academic staff unions, infrastructure decay, and overcrowded classrooms.

In addition, international education is increasingly seen not just as an academic pursuit but as a migration pathway, especially for middle and upper-class families seeking better long-term opportunities for their children.

Foreign Education Spending Outpaces Government Budget

Between 2020 and the first half of 2025, Nigerians spent an estimated $11.1 billion (N9.9 trillion) on foreign education, according to data compiled from the Central Bank of Nigeria.

This amount represents approximately 2.6% of Nigeria’s annual nominal GDP over the same period and, in many cases, exceeds the combined education budgets of federal and state governments.

For context, the Federal Government allocated N2.52 trillion to the education sector in the 2025 national budget, representing about 5% of total government expenditure.

This falls below the United Nations Educational, Scientific and Cultural Organization (UNESCO) recommended benchmark of 15–20% of public spending on education.

In comparison, Nigerian households spent N2.16 trillion on foreign education in just the first six months of 2025. This is nearly equivalent to the government’s full-year budgetary provision for the sector.

Despite the scale of education-related capital outflows, the Nigerian education sector has attracted minimal foreign investment.

Data from the National Bureau of Statistics (NBS) shows that capital importation into the education sector amounted to just $150,000 over the past decade, highlighting weak investor interest.

Domestic credit to the education sector has also declined. Central Bank of Nigeria figures show that as of September 2025, total lending by Nigerian banks to the education industry stood at N69.7 billion, a 22% decrease year-to-date. This contraction in credit suggests a reduction in financial sector exposure to education-related projects.

Although foreign education spending remains elevated, recent policy changes in key destination countries may curb demand in the short to medium term. Tighter immigration and student visa restrictions have been introduced in the United States, United Kingdom, Canada, and parts of Europe, potentially limiting access for Nigerian students.

Nairametrics has reported a rise in visa application rejections, particularly from U.S. consular offices, which may impact enrolment numbers.

Additionally, rising tuition fees, cost-of-living pressures abroad, and local currency constraints may further moderate outbound education spending in subsequent reporting periods.