Nigeria’s internally generated revenue (IGR) analysis for 2024 has revealed a widening gap between the country’s high-earning and low-earning States.

While Lagos, Rivers, and the FCT continue to dominate subnational revenue generation, several states are still struggling to raise meaningful income internally, depending largely on monthly allocations from the federal government to sustain their budgets.

According to data analyzed by Nairametrics, the 36 states and the FCT generated a combined N3.63 trillion in 2024, up from N2.43 trillion in 2023, representing a growth of 49.69%.

However, the bottom 10 states contributed just 5.23% of this total IGR, highlighting deep-rooted economic and structural challenges at the subnational level.

Bottom 10 States by IGR in 2024

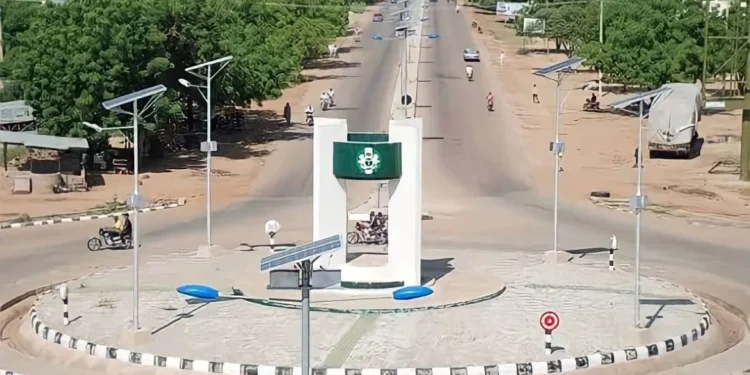

Adamawa’s IGR rose 18.9% to N20.30 billion in 2024 from N17.07 billion in 2023. The total tax collected declined by 0.46% to N12.14 billion, while MDAs revenue increased by 67.43% to N4.88 billion.

The state has introduced digital tax systems and property tax reforms, but the impact has yet to translate into major revenue growth.

I continue to appreciate the role NAIRAMETRICS play in providing timely and incisive data and analysis on the nation’s economy.

For context, do we have the subnationnals IGR figures compared to budget and debts ( foreign and domestic) as at JUNE 2025? kindly oblige us with the latest please