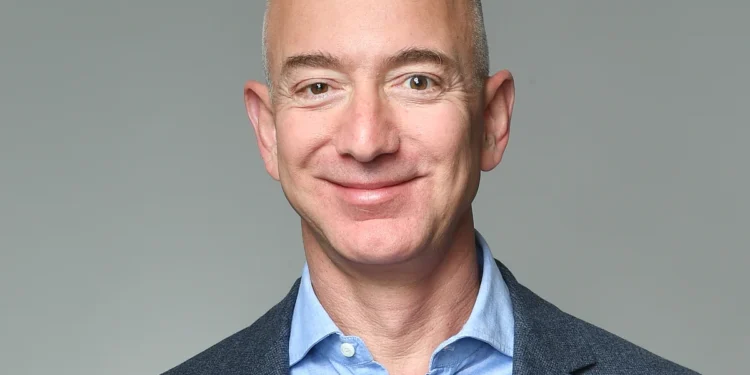

Jeff Bezos believes artificial intelligence will reshape the global economy, even if today’s rush of capital into the field looks unsustainable.

“The benefits to society from AI are going to be gigantic,” the Amazon founder and chairman said Friday at Italian Tech Week.

At the same time, he cautioned that the surge of investment flooding into AI resembles an “industrial bubble” that will inevitably destroy wealth along the way.

What he said

“When people get very excited, as they are today, about artificial intelligence, every experiment gets funded, every company gets funded, the good ideas and the bad ideas,” Bezos told the audience. “Investors have a hard time in the middle of this excitement distinguishing between the two.”

The scale of today’s AI boom has drawn comparisons to earlier episodes of exuberance. Bezos invoked both the biotechnology bubble of the 1990s and the dot-com mania that followed.

In both cases, investors lost vast sums, but the world also gained transformative advances. “In the biotech bubble, a lot of companies went out of business and investors lost money,” Bezos said. “But we did get a couple of lifesaving drugs.” The internet bubble, he added, left behind the infrastructure for the modern digital economy.

A similar dynamic is now playing out in artificial intelligence. Capital is flooding not just to software companies promising AI applications, but also to the infrastructure that underpins them: chipmakers, cloud platforms, and data centre operators. Some of these ventures are raising billions before demonstrating a working product.

The valuations have been striking. Bloomberg News reported Friday that BlackRock’s Global Infrastructure Partners is nearing a deal to acquire Aligned Data Centers for about $40 billion, showing the appetite for assets tied to AI computing power.

Meanwhile, OpenAI creator of ChatGPT, recently became the most valuable privately held company in the world after a secondary share sale that valued it at $500 billion.

What you should know

Bezos emphasised the importance of taking a long view. He predicted that AI will transform nearly every industry, boosting efficiency, productivity, and innovation worldwide. “AI is going to change every industry and improve the productivity of every company in the world,” he said. “When the dust settles and you see who the winners are, society benefits from those inventions.”

Amazon itself has been investing heavily in artificial intelligence, particularly through its cloud computing arm, Amazon Web Services, which provides the computing infrastructure many AI startups rely on. The company has also deployed AI in its logistics network, e-commerce operations, and Alexa voice assistant.

For Bezos, those investments illustrate a broader lesson: bubbles may be painful for investors, but they also accelerate the arrival of world-changing technologies. “That’s what’s going to happen here, too,” he said.