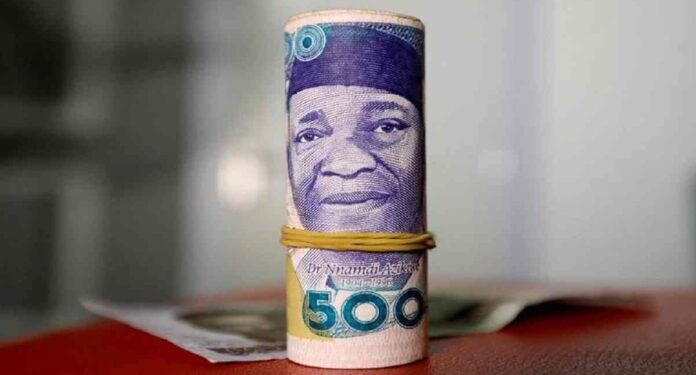

The Nigerian currency traded below the N1.550/$ range at the black market at the first trading session in September, while the dollar index started the new month on a negative note.

The naira ended August on a bullish trend in the Nigerian Foreign Exchange Market, closing at 1,531.57/$.

Nigeria’s inflow of foreign currency increased due to higher remittances and foreign portfolio investments (FPI). Nigeria’s external reserves grew by $1.72 billion to $41.3 billion, giving the CBN some capacity to defend the local currency.

Yemi Cardoso, the CBN Governor, stated that the Nigerian diaspora’s remittances increased by a 200% rise to $600 million in the last two months, which strengthened the liquidity mechanism in Nigeria’s foreign exchange market

Foreign investment inflows rose from $1.5 billion in June to $1.7 billion in July, indicating renewed interest from foreign investors under carry trade conditions and some global macroeconomic stability.

Mr. Yemi Cardoso mentioned that due to improved exchange rates and remittance services, Nigerians living abroad no longer need alternative channels to send money home. He argued that increasing diaspora flows could help Nigeria decrease reliance on oil revenue and diversify its foreign exchange sources.

This aligns with PwC’s forecast in its Economic Outlook, which anticipated that “the Nigerian currency was expected to remain broadly stable through 2025, supported by ongoing Nigerian Apex Bank reforms and improved portfolio inflows.”

The analysts observed that the uptick in the black market reflected reduced speculative pressure and a regain of confidence among traders. With support from the Central Bank of Nigeria’s interventions and modest foreign exchange inflows, experts predict that the naira will mostly stay stable in the official market next week, “though rising demand and a stronger US dollar could limit further gains.”

U.S dollar marginally lower amid the Labor Day holiday

The American currency declined marginally on Monday as investors anticipated a range of US labor market data this week that could influence the size of the Federal Reserve’s expected rate cut later this month.

The US Dollar Index, which gauges the US dollar’s strength against six major currencies, was steady after losing four straight sessions. On Monday, it was trading between 97.70 US markets will be closed on Monday

Inflation figures released by the US on Friday, along with a court ruling declaring that most of Donald Trump’s tariffs are unlawful, were also being analyzed by traders.

President Trump’s efforts to dismiss Governor Lisa Cook and his ongoing conflict with the Fed were additional factors. Investors’ focus this week will be the US nonfarm payrolls report, preceded by data on private payrolls and job openings.

Any weaker-than-expected US labor data this week could boost expectations for a rate cut, with the market pricing in about an 88 percent chance that the Fed will ease rates and provide clues as to whether the cut will be the usual 25 basis points or a larger 50 basis points.

The greenback is facing difficulties amidst growing speculation that the US Federal Reserve (Fed) will lower interest rates at its September meeting.

Mary Daly, the president of the San Francisco Fed, stated on Sunday that officials will soon be prepared to lower interest rates and that the inflation brought on by tariffs would likely last temporarily.

The US Court of Appeals for the Federal Circuit maintained a decision that declared the broad tariffs unilaterally imposed on most countries to be unlawful. However, US Trade Representative Jamieson Greer said in a Fox News interview on Sunday that US President Donald Trump’s administration

Powell is expected to remain in office until 2026, so his position seems secure. But there is now a much clearer discussion regarding the Federal Reserve’s independence.

There have been growing concerns about a more politicized Fed since Trump’s recent actions. Disputes with Powell and the dismissal of the BLS commissioner over allegedly “manipulated” employment data are telling indicators.

Trump is also appointing loyalists to positions by choosing Waller over Powell and nominating Stephen Miran. A Fed that is more inclined to accept rate cuts that suit Trump’s inclinations carries the risk. Tariffs are still expensive, despite their political appeal.

There isn’t much of an effect on consumers right now, but household spending will tighten, the economic slowdown will worsen, and grocery and personal goods prices will increase.

Some Trump aides even appear to be in favor of a weaker dollar to boost American exports, but tariffs alone won’t be enough to boost US manufacturing. The Fed achieved an important milestone.