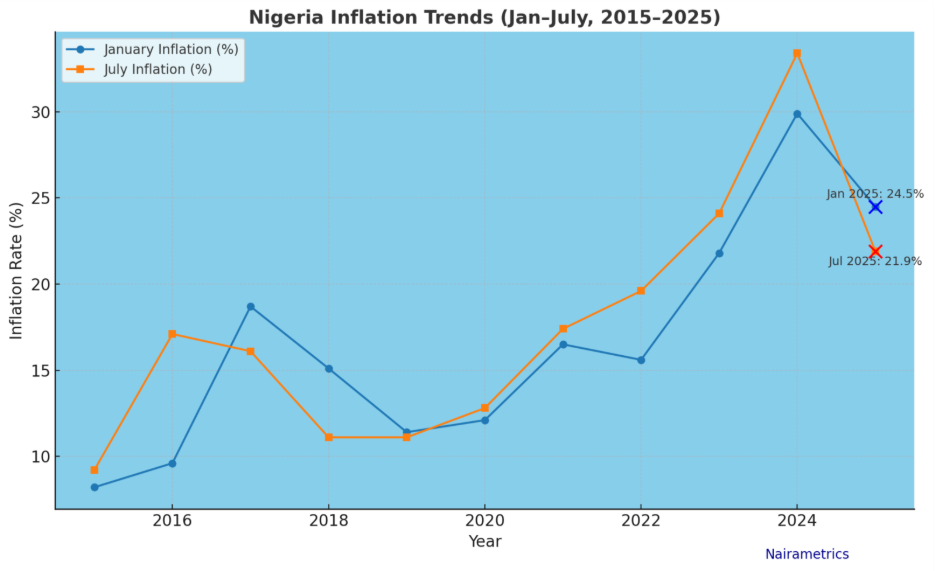

- Nigeria records rare disinflation in 2025, with inflation falling from 24.5% in January to 21.9% in July, a 10.7% drop, the sharpest mid-year slowdown in over a decade.

- Nairametrics Research analysis of 10 years of data shows that, unlike 2020–2024 when inflation accelerated, 2025 stands out alongside 2017 and 2018 as one of the few disinflationary years.

- Controversy trails the January CPI rebasing, with critics arguing official figures understate real household pressures as food inflation stays above 30% and living costs remain high.

Nigeria’s inflation story in 2025 is taking an unusual turn because, for the first time in nearly a decade, the country is witnessing a meaningful and sustained slowdown in consumer prices.

This is according to 10 years inflation data as analyzed by Nairametrics Research for the period January to July.

The data shows headline inflation has dropped from 24.5% in January 2025 to 21.9% in July 2025, a decline of 2.6 percentage points in just seven months.

In relative terms, that is a 10.7% reduction compared to the January level, a pace of disinflation rarely seen in Nigeria’s modern economic history.

What the data is showing

For much of the last decade, inflation has moved upward through the first half of the year, reflecting seasonal food demand, fuel pricing adjustments, and currency weakness.

From 2020 to 2024, January-to-July figures tell a familiar story of acceleration:

- 2020: Inflation rose from 12.1% to 12.8%.

- 2021: It climbed from 16.5% to 17.4%.

- 2022: A surge from 15.6% to 19.6%.

- 2023: From 21.8% to 24.1%.

- 2024: A sharp escalation from 29.9% to 33.4%.

Against this backdrop, 2025’s reversal stands out. Instead of climbing, inflation has steadily declined month after month (with the exception of a brief uptick in March), ending July below 22%, the first time in 16 months that headline inflation has fallen that low.

The turning point came in January 2025, when the National Bureau of Statistics (NBS) announced a rebasing of the Consumer Price Index (CPI).

The technical adjustment, which involved changes to the CPI basket and weights, sharply reset inflation to 24.5%, down from December 2024’s record 34.8%.

Historical comparison: the last 10 years

Looking back, the scale of Nigeria’s mid-year disinflation in 2025 is striking.

- In 2015, inflation rose from 8.2% in January to 9.2% in July.

- 2016 saw one of the steepest jumps in history, rising from 9.6% to 17.1% due to a collapsing naira and fuel subsidy removal.

- 2017 brought some relief, with inflation easing from 18.7% to 16.1% (–2.6pp).

- 2018 was the high point of disinflation, as inflation fell from 15.1% to 11.1% (–4pp).

- From 2019 to 2024, the trend reverted to acceleration almost every year, with inflation climbing relentlessly to a peak of 34.8% in December 2024.

By these standards, 2025’s disinflation is unusual. The only comparable periods were 2017 and 2018, but today’s slowdown is more significant in context: it is happening after an inflationary peak, not after a recession.

Critics Question NBS data vs Reality

While the NBS defended the move as a necessary update to reflect changing consumption patterns, the decision was controversial.

Critics argued that the methodology lacked transparency and that the sudden drop in headline inflation distorted the true cost-of-living crisis.

Opposition figures and independent analysts noted that many Nigerians still faced soaring food, rent, and transport costs, realities that the new CPI seemed to understate.

While disinflation dominates the official narrative, many households still face a daily reality of stubbornly high prices.

What’s driving the decline?

Nigeria’s inflation deceleration in 2025 is being shaped by four key factors:

- The CBN has kept rates above 26%, slowing demand and speculative forex activity.

- Since May, the currency has traded between N1,520–N1,540/$, supported by higher FX inflows from oil, remittances, and reforms.

- Better harvests and relative calm in food-producing regions have eased pressure, though food inflation is still high.

- Comparisons to 2024, when inflation spiked after subsidy removal and FX unification, exaggerate the slowdown.

At 21.9%, inflation remains punishing. Food inflation is above 30%, transport costs are sticky, and real wages lag, meaning the difference between 24.5% and 21.9% hardly eases daily strain.

Prices are still climbing, just more slowly, according to official remarks. The real test will, however, come in Q4, when festive demand, year-end government spending, and shifts in oil prices or FX flows could reverse some gains.

Still, analysts expect inflation to settle around 19–20% by December if reforms hold, marking one of the fastest mid-year slowdowns in Nigeria’s history.

What you should know

Nigeria’s headline inflation rate slowed slightly to 21.88% in July 2025, marking a modest retreat from the previous month’s figure of 22.22%.

- This is according to the latest data released by the National Bureau of Statistics (NBS).

- The data shows that, on a year-on-year basis, the headline inflation rate was 11.52% lower than the rate recorded in July 2024, which was at 33.40%.

- On a month-on-month basis, the headline inflation rate in July 2025 was 1.99%, which was 0.31% higher than the rate recorded in June 2025, which was 1.68%.

- The percentage change in the average CPI for the twelve months ending July 2025 over the average for the previous twelve-month period was 25.65%, showing a 5.11% decrease compared to 30.76% recorded in July 2024.