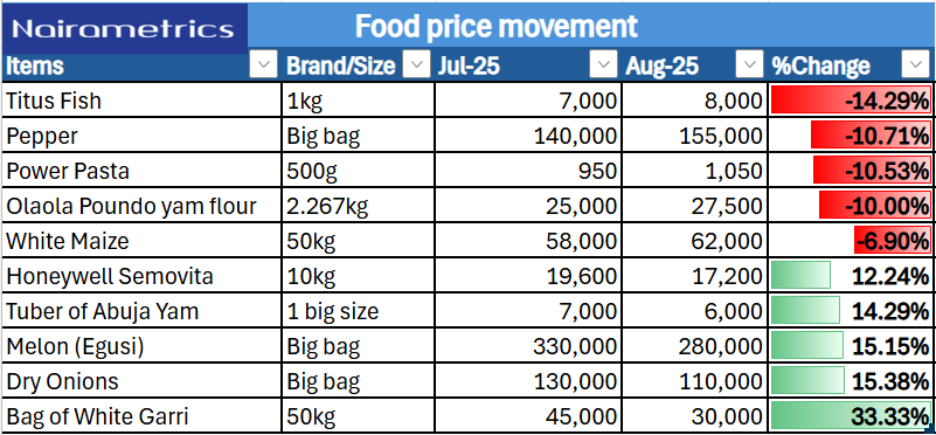

The food market in Lagos showed a mixed bag of price changes between July and August 2025, with some staple items such as a kilo of Titus (Mackerel) and big bag of pepper recording notable price hike of 14.29% and 10.71%, respectively, while others including a 50kg of white garri, dry onions, melon experienced significant drops.

The latest Nairametrics Food Price Survey, covering Mushin, Mile 12, Oyingbo, and Daleko markets, reveals that price decreases dominated the period, and this is attributable to seasonal harvests and improved supply.

The August 2025 price movements reflect complex interplays of supply, demand, seasonality, inflation, and market sentiments that affect everyday Nigerians.

Items That Recorded Price Increases

In August 2025 survey, 14 out of 70 food items saw price jumps, with fish, pasta, yam flour, and pepper topping the list.

- Fish (Titus Mackerel) rose by 14.29%, moving from N7,000 to N8,000 per kilogram — traders attributed this development to higher import costs and leaner supply from cold rooms.

- A 50kg bag of oloyin beans went up 11.11% to sell for an average price of N100,000 from N90,000 in July 2025, while the same size for brown beans climbed from N78,000 to N80,000, reflecting a marginal 4% increase.

- A big bag of pepper surged 10.71% to N155,000, while a medium bag saw a rise of 6.67% to N80,000. This is due to seasonal scarcity as the rains affect harvest and transportation.

- Power Pasta (500g) climbed 10.53% to N1,050, while white maize (50kg) rose 6.90% to N62,000 from N58,000.

- Olaola Poundo Yam Flour (2.267kg) went up 10% from N25,000 to N27,500.

Other commodities that experienced marginal increase include Bush mango seed/Ogbono (3.64%), Lipton Yellow Label Tea (52g) (3.3%), big basket of tomatoes (2.86%).

These increases, traders explained, were driven by transportation cost spikes, reduced harvest inflow, and currency weakness affecting imported items.

Items That Recorded Price Declines

While some items became more expensive, a huge number of major food products dropped in price, bringing a measure of relief to households.

- 50kg of white garri saw the steepest fall, plunging 33.33% from N45,000 to N30,000 as harvest season boosts supply.

- A big bag of dry onions fell 15.38% to N110,000, with sellers blaming surplus inflows from northern farms.

- A big bag of Melon (egusi) dipped 15.15% to N280,000, while the price of a big size of Abuja Tuber of yam also dropped 14.29%, selling for N6,000 as new harvest enters the market.

- Pack of Honeywell Semo across various sizes dropped between 11.11% and 12.24%, while Ayoola Poundo Yam Flour (4.5kg) dropped 10.81%.

- A 50kg bag of yellow garri slid 10.53% to N34,000 from N38,000.

- A 400g of peak tin milk fell 10.32%, and big basket of potatoes became cheaper by 10%.

Other noticeable declines include: 5kg of Honeywell wheat (10%), 380g of ThreeCrown refil milk (9.39%), 50kg of yellow maize (9.20%), and a carton of frozen turkey (8.54%).

Traders said these drops were mainly seasonal, as August is a period when certain farm produce floods the market, pushing prices down.

Food items that remains consistent in the review period include: carton of golden penny noodles, beverages such as milo, bournvita, ovaltine, frozen kote fish and chicken, and milk

Market Reactions: Traders and Buyers Speak

- At Mile 12 market, pepper seller Mr. Kazeem lamented the sharp rise in pepper prices:

“The rain is too much this year. Many farmers can’t even harvest well, and transportation from the north is costlier. That’s why pepper is now gold.”

- In contrast, a garri trader at Oyingbo market, Mr. Obinna, was in high spirits:

“Garri is plenty now because farmers have started bringing in fresh cassava. People are buying more, and sales are moving.”

- For buyers, the mixed price movement means making tough choices. Mrs. Aisha, a mother of four and consumer at Daleko, shared:

“I just focus on what is cheaper for now. This month, I bought more garri and potatoes instead of beans and pasta.”

- At Mile 12 market, the rise in Titus fish prices stirred complaints from both buyers and sellers.

“Before, I could buy 3 pieces of Titus with N7,000, now it’s only 2 small pieces. Customers are complaining every day, but what can we do? The cold room price has gone up,” said Mrs. Amaka, a fish trader.

- A customer, Mr. Sodiq, sighed:

“Titus is now like meat for the rich. I had to reduce how often we eat it at home.” - For Oloyin and brown beans, traders blame the rains for slowing supply.

“Beans from the north are not coming fast. Transport is expensive, and the roads are bad because of the rain,” explained Alhaji Musa, a beans wholesaler.

- Mrs. Bisi, a buyer, added:

“Beans is our regular food at home, but now I just buy smaller quantity and mix it with garri or rice to stretch it.” - Pepper sellers had a similar story of hardship.

“The pepper farms are flooded in some areas. Plus, drivers charge more now because of fuel price. That’s why a small quantity is so costly,” said Madam Kehinde, a Mile 12 trader.

- On the Power Pasta price hike, one grocery store owner (anonymous) in Mushin explained:

“Most of these pastas are produced locally but wheat is imported. The exchange rate is affecting it, so even pasta is not spared.”

- Mrs. Funmi, a mother of three, lamented:

“Pasta used to be my go-to when rice was expensive, now both are expensive. I just buy noodles more often.” - Meanwhile, the drop in onion prices brought some cheer.

“We thank God for onions this month. It’s plenty in the market because the north brought in large harvest. Customers are buying more,” said Yakubu, an onion seller at Oyingbo.

- Melon (egusi) also became cheaper, to the delight of soup lovers.

“Egusi was too costly before, so I stopped cooking it. Now that it’s cheaper, I’ll buy a big measure this week,” said Mrs. Chinyere, a customer at Daleko.

- For semo, both traders and buyers welcomed the drop.

“The company reduced their price because demand dropped when it became too expensive. People were switching to garri,” explained Mr. Olu, a wholesaler at Mushin.

- And in the garri stalls, the mood was even lighter.

- “Garri is now affordable again. With N200, you can soak a good portion. It’s moving fast,” beamed Mr. Obinna, a seller at Oyingbo.

- A customer, Mrs. Aisha, nodded in agreement:

“Garri is now my best friend. With sugar or groundnut, my children are okay.”

Food inflation outlook

Given the current trajectory, food inflation is expected to remain high in the coming months, with some commodities continuing to rise in price despite seasonal harvests.

The National Bureau of Statistics could report a marginal slowdown in month-on-month food inflation for August due to the decline in key staples like garri, yam, and onions, but year-on-year inflation is likely to stay high as overall prices remain well above last year’s levels, and especially as the festive season approaches.

About the Nairametrics Food Price Survey

The Nairametrics Food Price Watch is a monthly market survey tracking the prices of major food items across Nigeria.

This report specifically covers four key markets in Lagos State: Mushin Market, Daleko Market, Oyingbo Market, and Mile 12 Market.

The survey provides up-to-date insights into food price trends, helping businesses, policymakers, and consumers make informed decisions.