The Securities and Exchange Commission (SEC) has reiterated its commitment to leveraging blockchain intelligence to combat the growing wave of cryptocurrency-related fraud, in a decisive move to strengthen oversight of Nigeria’s digital asset ecosystem.

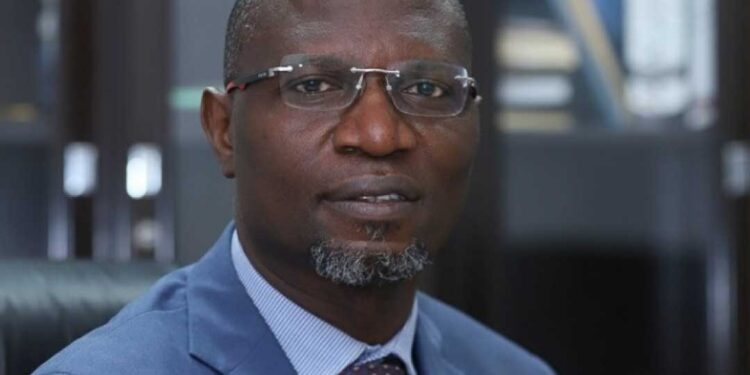

Speaking at a joint webinar hosted by SEC Nigeria and global blockchain analytics firm Chainalysis on Monday, SEC Director-General Dr. Emomotimi Agama emphasized the need for full transparency in crypto transactions as a cornerstone of regulatory enforcement.

The webinar, themed “Combating Scams with Blockchain Intelligence,” brought together regulators, analysts, and industry stakeholders to address the evolving threats in the digital finance space.

“When you imagine the future of cryptocurrency transactions, you imagine that if the fraudulent practices are already climbing the way they are now, what will the future hold if we all sit doing nothing?” Agama asked.

“If we all sit not being coordinated, not collaborating, and finding differences that we should not find, we risk enabling a dangerous future.”

SEC’s Vision: Data-Driven Oversight and Transactional Clarity

Agama outlined the SEC’s strategy to deepen its technical capabilities, focusing on blockchain’s immutable nature to trace illicit activity. He stressed the importance of identifying wallet clusters, analyzing fund flows, and permanently recording transactions across major blockchains such as Bitcoin and Ethereum.

“At the SEC, we need to do deep dives into data intelligence,” he said.

“We must speak about the technical foundations that drive us to transaction transparency—where every Bitcoin, Ethereum transaction is permanently recorded, and wallets belonging to the same entity are identified through flow analysis and trading funds from sources of information.”

Agama warned that the crypto ecosystem is increasingly being exploited by sophisticated fraud schemes, including fake decentralized finance (DeFi) protocols, NFT scams, and mirror exchange platforms that mimic legitimate sites to siphon user deposits.

“There are liquidity mining schemes with fake DeFi protocols promising organic yields, and fake NFT collectible projects targeting artistic communities,” he explained.

“We’re also seeing social media-driven campaigns on Twitter, Telegram, WhatsApp, and romance scams 2.0—where dating apps are used to build trust before crypto investment requests.”

Chainalysis Report: $178 Billion in Illicit Crypto Transactions

The urgency of the SEC’s stance is underscored by findings from the Chainalysis 2025 Crypto Crime Report, released earlier this year. According to the report, illicit crypto addresses received $178 billion over the past five years. The peak year was 2022, with $54.3 billion, followed by 2023 ($46.1 billion) and 2024 ($40.9 billion).

Stablecoins accounted for 63% of illicit transaction volumes, marking a shift away from Bitcoin in certain criminal activities. However, ransomware and darknet market transactions remain largely Bitcoin-dominated.

The report also revealed a 21% year-over-year increase in stolen funds in 2024, totaling $2.2 billion. While DeFi platforms were the primary targets, centralized exchanges saw a surge in attacks during the second and third quarters. Notably, private key compromises accounted for 43.8% of stolen crypto, with North Korean hackers responsible for $1.34 billion, or 61% of the total stolen funds last year.

ISA 2025: A New Era for Digital Asset Regulation

Agama hailed the recent enactment of the Investment and Securities Act (ISA) 2025, which came into effect in April, as a transformative milestone for Nigeria’s crypto regulatory landscape. The law provides long-awaited clarity for digital asset operations, which have long existed in a regulatory vacuum.

“Clearly, we believe the emergence of the ISA 2025 is a groundbreaker,” Agama said.

“It ensures that as a nation, we provide clarity, and as a nation, we are able to cooperate with each other in dealing with the current situation. It is also important that we do not stifle innovation.”

A Call for Collective Action

Agama concluded with a call for unified action among regulators, industry players, and technology providers to proactively address crypto fraud. He emphasized that blockchain’s inherent traceability must be harnessed to protect investors and preserve market integrity.

“With all the various tools at our disposal, it becomes clear that we must all brace up to the challenges of the future,” he said.

“What we need to do collectively is to make sure we stop this right at the beginning.”

As Nigeria positions itself as a regional leader in digital finance, the SEC’s push for transparency and intelligence-led regulation signals a proactive shift toward safeguarding the future of crypto investments.