Nigerian investors are showing an overwhelming preference for U.S. stocks, according to Richmond Bassey, Chief Executive Officer of Bamboo, a leading digital investment platform.

He said that as local interests for investment continue to grow, the American stock market remains the top choice among users on the platform.

“U.S. stock is still the biggest interest for us today, followed by Nigerian stocks,” Bassey revealed in an exclusive conversation with Nairametrics.

“Nigerian stocks are very much a strong area for interest as well, which is growing. But we see U.S. stocks leading.”

Bassey said that though the traditional way of investing has been very painful to many people, the fintechs have made things simple with a seamless onboarding process.

“Digital natives, millennials, even Gen Xs and boomers, find opening an account easy,” Bassey said. “The experience is what’s typically been painful in traditional investing, and fintechs are solving that.”

Expanding Offerings and Local Impact

In addition to its robust U.S. stock portfolio, the platform has launched access to the Nigerian Stock Exchange (NGX), along with treasury bills and Naira savings. These new offerings are designed to cater to users seeking local investment opportunities while maintaining access to global markets.

“Since we launched NGX on the platform, it’s something our users really love,” Bassey explained. “We’ve also made treasury bills and Naira savings accessible, which is exciting because users can now invest seamlessly in both U.S. and Nigerian assets.”

Regulatory Clarity and Strategic Growth

Commenting on regulation, Bassey noted a clear and collaborative relationship with the Securities and Exchange Commission (SEC).

“We’re regulated directly by the SEC, and they have pretty clear guidelines for operators. It’s straightforward and effective,” he affirmed.

Although the fintech platform is not regulated by the Central Bank of Nigeria (CBN), the company has built trust through compliance and strong stakeholder engagement.

Looking ahead, Bassey envisions fintechs playing a transformative role in enhancing financial literacy across Nigerian households.

“We invest heavily in educating people about their money, how to manage it, invest it, and make informed decisions,” he said. “This literacy drives investment activity and protects users from falling for scams.”

Building a Financial Future for Youth

Bassey believes the future of Nigeria’s youth is closely tied to smarter financial choices. With mobile-first solutions and tech-driven platforms, young investors are more empowered than ever.

“The future is bright for our nation and for the youth,” he declared. “With the right tools and education, we can help millions improve their personal finance and achieve lasting financial health.”

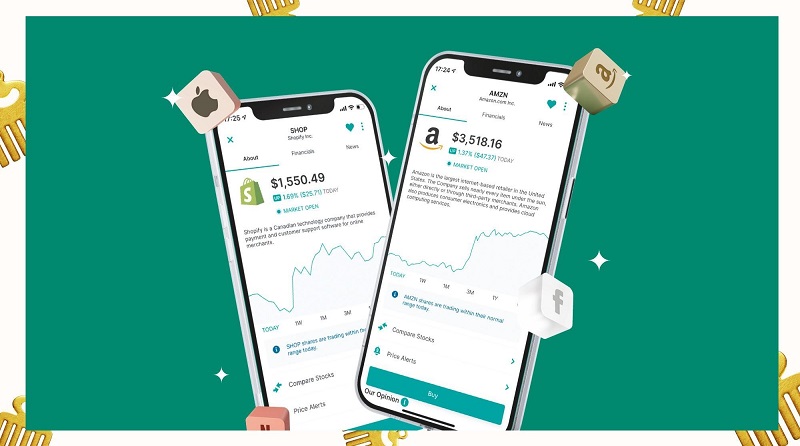

Bamboo, known for simplifying access to global and local financial markets, has witnessed steady user growth, especially among Nigerian youth. With a streamlined onboarding process and intuitive app experience, the platform has become a gateway to both international and domestic investment opportunities.

What You Should Know

Last month, the fintech launched Misan by Bamboo, its comprehensive remittance application and virtual USD card services across 15 key African markets.

- This strategic expansion positions Misan by Bamboo as a major player in facilitating seamless money transfers and global digital transactions across the continent.

- The move addresses the rapidly growing demand for efficient and transparent financial solutions in Africa. By enabling direct transfers to a vast network of countries and introducing versatile Virtual USD Cards, Misan by Bamboo is empowering individuals and businesses to navigate the complexities of international payments with newfound ease.