Managing multi-currency B2B payments can get complicated really quickly.

Between balancing the multiple currencies involved, different regulations, a long list of tools, and often strict timelines, businesses tend to struggle, and their workflows become fatigued.

Imagine having to pay vendors in USD, EUR, and GBP from your base in Kenya.

You’re using your local bank for some payments, a money transfer app for others, and an Excel sheet to track everything. It’s chaotic, risky, and so exhausting. And you know what that recipe spells? Burnout and operational drag.

In this article, we will walk you through how to optimize multi-currency payments and simplify your workflows.

What are Multi-Currency Payments?

Multi-currency payments simply involve the ability to send, receive, and process funds in different currencies, instead of being limited to a single, often local, currency.

This allows businesses to serve partners across borders with the convenience of paying in their preferred currency and potentially side-stepping the downsides of international transactions—high costs, delays, etc.

Challenges of Traditional Multi-Currency B2B Payment Workflows

Businesses operating internationally often maintain multiple bank accounts in various currencies to manage payments with their global clientele. This setup requires meticulous funding to cover both routine and unexpected expenses. Furthermore, companies with international branches frequently transfer funds to these locations to cover local operational costs such as taxes, salaries, and daily expenditures, all in the respective local currencies.

While such arrangements may initially appear efficient, they quickly evolve into an intricate system of tools, conversions, and processes. This complexity ultimately results in higher costs than the initial savings, particularly as operations expand and the volume and complexity of payments increase.

Here are some of the most common issues businesses face when managing multi-currency B2B payments the traditional way:

1. Multiple tools, fragmented data

Many finance teams often manage payments across multiple platforms. One for FX conversion, another for sending money, and most commonly, Excel sheets for tracking cash flow. The result of this system? Fragmented data that is all over the place, out of sync, and tedious to collate for reports and balancing books.

2. FX risk exposure

When businesses make international transactions, there’s a potential for financial loss due to fluctuation in FX rates. So, when you receive a payment or want to send one, if you wait too long to convert the funds, you may lose money without realizing it.

Cedar Money mitigates this with Rate Alerts, which ensure you get an instant notification when an FX target you set is met.

3. Reconciliation issues

Payments coming in and going out may vary due to exchange rates and fees. These varying amounts can make it difficult to tell what was paid, to whom, and when, leading to inconsistencies in financial accounts and reconciliation issues.

4. Manual processes equal payment delays

Between manually entering data, chasing down approvals, and following up with clients or vendors, teams unnecessarily lose hours they could spend in more productive endeavours. Not only does this cost the business resources and manpower that could be better utilized, but it also slows down payments and creates room for errors.

Why It Matters: The Business Impact of a Messy Workflow

For any business to thrive, it needs structures and systems in place that keep the wheels running smoothly. And when there are kinks in the system, the business pays dearly for it. Here’s how messy payment workflows can affect your business:

1. Missed growth opportunities

Slow payments can delay you from securing good deals or making important business purchases. It can cost you a chance to buy inventory at a good price, or a partner may decide to go for a more reliable supplier.

2. High vendor churn

A lot of trust is required when running a business; you trust your suppliers to deliver the goods they say they will in the condition they say they will. And they trust you to pay for the goods at the time you say you will. So, when your suppliers aren’t getting paid on time (or in the right amount), you lose their trust and they may choose to stop working with you. Without your vendors, there are no products, and without products, there’s no business.

3. Operational drag

Instead of focusing on strategy or creating growth plans for the business, your finance and operations teams spend all their time fixing payment issues. This not only costs your business potential opportunities to scale and/or improve, but it also costs you money. How? Think about it: you’re paying your employees for skills that they’re unable to adequately use for the purpose for which you hired them because their efforts are being wasted on payment issues.

Nothing adds up faster than those costs that you don’t see: bad FX rates, multiple bank charges, late fees, etc.

How to Simplify Multi-Currency Payments (Step-by-Step)

1. Consolidate your platforms

Rather than juggle three to five different platforms, use fewer tools that can do more. For example, how about you use a single payment solution that can handle your FX and payments and also ensure that you stay compliant?

2. Automate what you can

In most ways that count, automation trumps manual processing. So, if you can have it automated, do it. Set up auto-approvals, recurring payments, or alerts to reduce manual work and by extension, the risk of human error.

3. Use APIs for scale

Instead of having to painstakingly enter every transaction manually, use software (via APIs) that connects your systems and automates your B2B payment flows.

4. Track FX in real-time

Don’t miss great exchange rates. Use tools that show you live exchange rates and can notify you of rates that you want to make a transaction at.

5. Set clear roles and permissions

Ensure that your team has clarity on what their roles are, and they know who approves what. This avoids confusion and, by extension, unnecessary delays.

With Cedar Money’s multi-user account access, your team stays coordinated, compliant, and secure.

What a Modern B2B Payment Solution Should Offer

When it comes to managing payments across currencies, the right payment solution can save your team hours of work and help your business avoid costly mistakes.

But not all solutions are built the same.

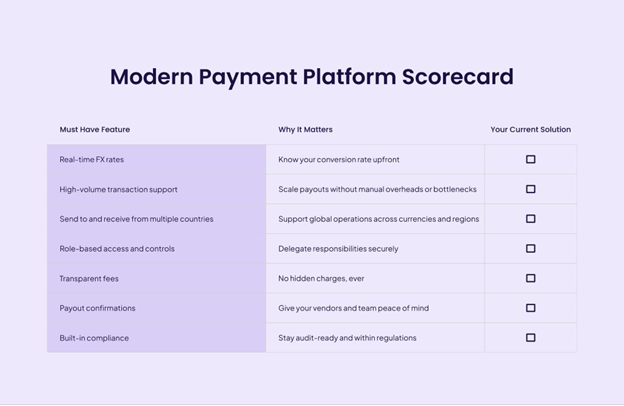

To truly simplify your multi-currency B2B payment workflow, the platform you choose should come with a few non-negotiables, not just nice-to-haves, but actual features that remove friction, increase visibility, and support your business’s growth.

Here’s a checklist you can use to evaluate if your current setup (or any provider you’re considering) is helping you move money efficiently, securely, and at scale:

Pro Tip: Cedar Money checks every one of these boxes—and more. From high-volume payout support of up to $30 million to real-time FX updates and global reach across 190+ countries, our platform was built for the scale and complexity of modern B2B finance.

With Cedar Money, you’re not just sending payments. You’re building a smart, scalable workflow your entire team can rely on.

Your Next Steps: Audit and Improve Your Workflow

Now that you’ve seen what an efficient multi-currency B2B payment process should look like, it’s time to zoom in on your own systems.

Start by asking:

- What tools are we currently using to manage payments?

- How many steps does it take to go from invoice to payout?

- Where are the most frequent delays or errors happening?

- Are we losing money to poor FX rates or hidden fees?

- Do we have full visibility into payments across currencies and regions?

Tip: Map out your current workflow, from when an invoice is received to when the payment is confirmed. This will help you identify bottlenecks, redundancies, or manual processes that could be automated.

You can also book a quick chat with a Cedar Money specialist and see how we can help improve your current setup.

Conclusion: Don’t Let Your Payments Hold You Back

How you manage your payments can either fuel your business’s growth or slow you down.

Clunky processes, scattered tools, and delayed transactions don’t just create headaches for your finance team; they also impact your vendor relationships, cash flow, and your ability to scale.

But it doesn’t have to be that way.

With the right tool, your B2B payments can be fast, flexible, and friction-free—across currencies, countries, and teams.

If you’re ready to simplify how you pay and get paid internationally, Cedar Money is here to help. Get started today!