The Governor of the Central Bank of Nigeria, Yemi Cardoso, has called for strategic cohesion among African states amid the African Export-Import Bank’s (Afreximbank) over $40 billion capital asset expansion as of 2024.

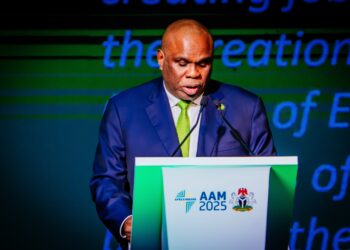

Cardoso made the call on Wednesday while delivering his remarks at the Afreximbank 2025 Annual Meetings, themed “BUILDING THE FUTURE ON DECADES OF RESILIENCE.”

The ongoing meeting attracted representatives, including heads of state, ministers, leaders of trade institutions, policymakers, private sector representatives, and stakeholders.

Strategic Cohesion

Cardoso congratulated the Bank on its 32nd anniversary and commended Professor Benedict Oramah, President and Chairman of the Board of Directors of Afreximbank, along with the entire team, for their unwavering commitment to transforming the continent’s economic landscape.

- He stressed that the bank has emerged as more than an average financial institution; it has become a trusted partner, a convener of ambition, and a catalyst for change, shaping strategy, enabling execution, and elevating African agency across the globe.

- He highlighted that the bank’s $40 billion capital assets in 2024 reflect its prudent financial stewardship, among other factors.

“From an initial capital base of $750 million—a relatively small amount by international standards—the bank has expanded its capital assets to over $40 billion as of the end of last year.

“This remarkable trajectory reflects both prudent financial stewardship and the continent’s growing confidence in its capabilities.

“It is also a testament to the expanding coalition of stakeholders, spanning 51 African countries and a mix of public and private investors who have placed their trust in Afreximbank,” he said.

- He added that while stakeholders celebrate the bank’s accomplishments, it is imperative to recognize the persistent and emerging challenges facing the African continent, such as rising trade protectionism, global economic fragmentation, and shifting geopolitical dynamics.

- According to him, these challenges not only undermine Africa’s developmental prospects but also threaten the coherence of the international ecosystem, making Afreximbank’s role even more crucial in addressing these issues.

- Looking to the future, Cardoso advised stakeholders to come up with deliberate choices, building strong foundations, and adopting a mindset oriented towards long-term impact.

“First, it takes strategic foresight—the ability to look beyond the noise of the present and invest in solutions for the next decade, not just the next quarter. Resilient institutions are always thinking ahead. Second, it requires crisis preparedness,” he added.

- He maintained that resilience demands sound decision-making processes, strong data, functional infrastructure, and the ability to learn and grow.

- To secure the future envisioned for the bank and Africa, Cardoso said stakeholders “must foster greater strategic cohesion among African member states.”

- This, according to him, includes accelerating the implementation of the African Continental Free Trade Area (AfCFTA), deepening regional integration, and building robust engagement with the African diaspora.

- For the Central Bank of Nigeria, he said the apex bank has focused on rebuilding trust with markets, citizens, and partners, recognizing institutional credibility as the anchor of effective monetary and financial policy.

What You Should Know

Nigeria is one of Afreximbank’s major shareholders.

- The country was among the largest beneficiaries of the bank, accounting for about 60% of its US$30 billion funding of the energy sector in Africa as of 2024.

- Afreximbank has contributed significantly to Nigeria’s energy and industrial transformation, investing heavily in projects such as the Dangote Refinery and the Port Harcourt Refinery.

- These investments are part of a broader strategy to make the Gulf of Guinea a major refining hub, reducing Africa’s dependence on petroleum imports.

The bank also supports the establishment of an Africa Energy Bank in Abuja to strengthen the continent’s energy security.

Furthermore, Afreximbank has supported Nigeria’s fertilizer production, enabling the country to become the continent’s leading producer with an annual output of 7.5 million metric tonnes.

The bank is also involved in supporting Nigeria’s creative industry through credit facilities, capacity building, and market access initiatives aimed at expanding the country’s cultural exports.