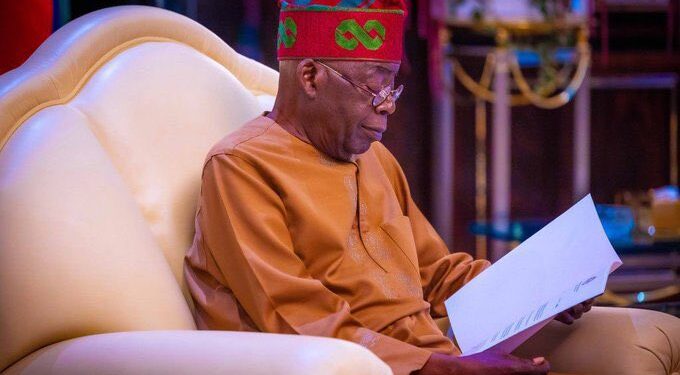

President Bola Tinubu has welcomed Moody’s Investors Service’s recent upgrade of Nigeria’s long-term foreign-currency issuer rating from Caa1 to B3 with a Stable Outlook, describing it as a validation of his administration’s commitment to restoring investor confidence, unlocking economic potential, and securing long-term prosperity.

In a statement issued on Saturday by presidential spokesperson Bayo Onanuga, the President said the credit rating upgrade underscores growing international recognition of Nigeria’s progress in stabilising its macroeconomic environment, improving fiscal transparency, strengthening debt sustainability, and implementing market-driven reforms.

“This upgrade reflects growing international recognition of Nigeria’s progress in stabilising its macroeconomic environment, enhancing fiscal transparency, improving debt sustainability, and implementing market-oriented reforms under President Bola Ahmed Tinubu’s leadership,” the statement read in part.

Moody’s attributed the rating improvement to “a more resilient fiscal position, stronger external accounts, and the government’s demonstrated commitment to macroeconomic and structural reforms.”

These include unifying the foreign exchange market, removing fuel subsidies, increasing non-oil revenue, and restoring credibility to monetary policy through actions taken by the Central Bank of Nigeria (CBN).

According to President Tinubu, the Moody’s upgrade sends a strong signal to global investors and development partners that Nigeria is on a path of responsible governance, reform, and renewed credibility.

“This upgrade signals to global investors and partners that Nigeria is back on a path of responsibility, reform, and renewed credibility. It underscores our unwavering commitment to transparency, discipline, and prosperity for all Nigerians,” he said.

Onanuga further explained that the improved rating is expected to bolster Nigeria’s access to international capital markets, lower borrowing costs, and attract foreign direct investment—key drivers in accelerating economic revitalisation and job creation.

“This positive rating reinforces global confidence in Nigeria’s future and represents a milestone in the administration’s goal of restoring investor trust, unlocking economic potential, and securing long-term prosperity,” Tinubu added.

What you should know

In April, Fitch Ratings revised Nigeria’s economic outlook to Stable from Negative, citing renewed confidence in the Tinubu administration’s reform agenda.

Although Nigeria’s long-term foreign currency rating remains at ‘B’, Fitch noted that the economic policies adopted since mid-2023 are beginning to yield results.

Key reforms—including exchange rate liberalisation, tighter monetary policy, the removal of fuel subsidies, and an end to deficit monetisation—have improved macroeconomic credibility, reduced market distortions, and enhanced the country’s resilience to external shocks.