The Tertiary Education Trust Fund (TETFund) has warned that institutions that fail to meet enrolment targets, maintain academic performance, or appropriately retire allocated funds risk losing access to future funding.

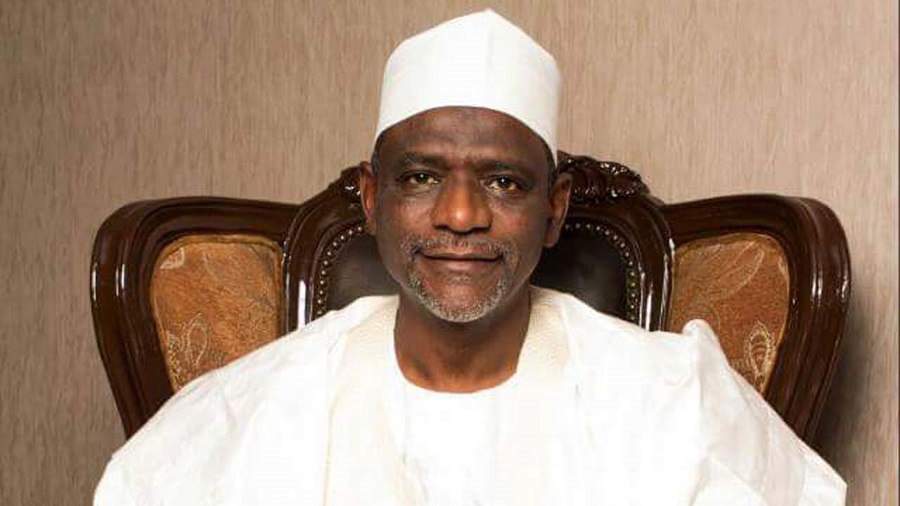

The warning was issued by the Executive Secretary of TETFund, Sonny Echono, during a one-day strategic engagement held on Monday in Abuja with Heads of Institutions, Bursars, and Heads of Procurement from beneficiary institutions.

Echono raised concern over the low number of students in some institutions, citing a case in the Southeast where a polytechnic with only 30 students has been operating for four years while still receiving public funding.

“This development is embarrassing, particularly for a region known for its strong educational culture. This kind of inefficiency undermines our mission and brings unnecessary scrutiny from the presidency and the public,” he said.

Accountability now tied to funding access

The TETFund boss criticised institutions for failing to access and properly utilise allocated funds. He stressed that any institution unable to retire or apply its funding appropriately would have its funds reallocated.

He also warned institutions that blame incomplete or abandoned projects on previous administrations.

“When you inherit an office, you inherit both assets and liabilities. We urge you to take ownership and work closely with the community to resolve long-standing infrastructure challenges,” he said.

Domestic capacity building

Echono addressed the recent suspension of the foreign component of the Academic Staff Training and Development programme, stating that TETFund is shifting focus to empowering local institutions.

“Although knowledge is universal, it must also be contextual. Our universities must be centres of excellence, not just hubs of aspiration,” he said.

He also disclosed efforts to provide hospital accommodation for medical students during clinical rotations, which he said will be scaled across institutions.

Reacting to criticism over the proliferation of tertiary institutions, Echono defended the government’s decision to expand educational access, citing Nigeria’s youth-heavy population.

“Our young people make up nearly 60 per cent of the population. If we don’t create space for them, the consequences will be dire.

We must ensure we increase enrolment because we want a large chunk of our students to get access to education,” he said.

More insights

The Executive Secretary of the National Universities Commission (NUC), Prof. Abdullahi Ribadu, represented by the National Project Coordinator, Joshua Attah, commended TETFund for its role in strengthening Nigeria’s higher education system.

He said the fund has significantly improved infrastructure, research, staff development, and academic standards across the country.

Also speaking, the Executive Secretary of the National Board for Technical Education (NBTE), Prof. Idris Bugaje represented by Prof. Bashiru Hassan called for transparent discussions on procurement challenges. He said institutions must comply with procurement rules and build institutional capacity to deliver on expectations.