At the 34th Annual General Meeting of Zenith Bank Plc, the Group Managing Director and Chief Executive Officer, Dame Dr. Adaora Umeoji, OON, delivered a strong message of confidence and commitment to shareholders, emphasizing the bank’s readiness to deliver higher and more sustainable dividends in the years ahead.

“For the question of dividend, I am sure that is what excites shareholders… We need to pay more dividends. If you look at the dividend payment trajectory over the years, we have always increased what we paid and we will continue to do that,” she told shareholders.

Addressing the packed AGM floor, Dr. Umeoji reaffirmed Zenith Bank’s strategy of building an efficient, resilient, and sustainable institution, one that would not only thrive in the face of macroeconomic challenges but also “outlive generations to come.”

This forward-looking assurance resonated strongly with investors, particularly against the backdrop of the bank’s recent recapitalization exercise, which the CEO revealed was 160% subscribed, far exceeding expectations.

“We are not under pressure to go for a second plan to raise money. We have a robust capital buffer. Which means we are ready to delight our shareholders,” she assured.

In doing so, Dr. Umeoji struck a balance between long-term strategic resilience and short-term shareholder reward expectations, describing the prospect of a “quantum leap” in dividend payouts not just as a possibility, but as a firm commitment:

“I know shareholders are looking for a quantum leap, and we are equal to the task.”

Dividend track record supports future confidence

While many institutions speak about rewarding shareholders, Zenith Bank has built a consistent track record of actually delivering strong returns.

The bank has consistently raised its dividend over the years, even in the face of macroeconomic uncertainty.

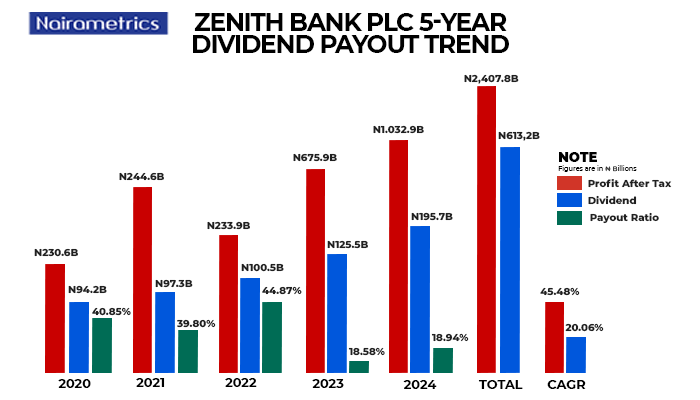

In the 2024 financial year, Zenith Bank paid both interim and final dividends totaling N5.00 per share, amounting to N195.68 billion, one of the highest total payouts in the Nigerian banking sector.

This came from a profit after tax of N1.03 trillion, translating to a payout ratio of 18.94%.

At current market prices, this gives investors a dividend yield of 10.53%, one of the most attractive in the market.

However, the total shareholder return in 2024 goes even further. Combining both capital appreciation and dividends, Zenith Bank delivered a 70.2% total shareholder return for the year.

The bank’s market capitalization grew from N1.213 trillion at the start of the year to N1.869 trillion at year-end.

Looking at the longer-term trend, between 2020 and 2024, Zenith Bank paid out N613.25 billion in dividends from cumulative profits of N2.41 trillion.

This represents a 5-year compound annual growth rate (CAGR) of 20% in dividend payments, a clear demonstration of commitment to shareholder returns.

The 2024 payout alone grew by 55.81% to N195.676 billion compared to the N125.58 billion paid in 2023, meaning the bank not only maintained its track record but outperformed its own 5-year dividend growth rate.

Strong start in 2025: Momentum already building

Backing up this dividend optimism is a strong start to 2025. In the first quarter alone, Zenith Bank reported a 20.7% growth in profit after tax, reaching N311.83 billion, already accounting for over 30% of 2024’s full-year earnings.

This early performance signals that the bank is well-positioned to sustain or even exceed its dividend trajectory in the current year.

Zenith Bank’s message to shareholders is loud and clear: expect more. With a strong capital base, consistent earnings growth, a proven dividend track record, and bold new leadership, the bank appears firmly on course to deliver the “quantum leap” in dividend payouts that shareholders were promised at the AGM.