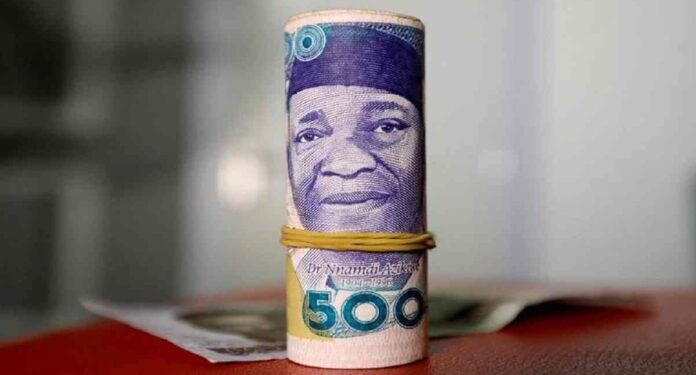

The naira remained stable at N1610–N1615 on the unofficial market as oil prices recovered above $61 per barrel, while the dollar index stayed stable in the global currency market.

Oil prices rebounded by over 1% on Tuesday, driven by technical corrections and dip buying, although concerns about a potential market surplus persisted.

Brent crude futures climbed above $61 per barrel on Monday following an OPEC+ decision over the weekend to accelerate oil production hikes for the second consecutive month—easing bearish sentiment surrounding the Nigerian naira.

Oil prices have declined by more than 10% over the last six consecutive sessions and have dropped over 20% since April, when U.S. President Donald Trump’s tariff announcements heightened fears of a global economic slowdown.

The moderation in energy prices is largely attributed to expectations that production will outpace consumption, which may weigh further on Nigerian government revenues.

Historically, oil prices and the Nigerian naira have shown a positive correlation: as oil prices decline, the naira tends to depreciate due to reduced dollar inflows, declining foreign reserves, and increased speculative pressure.

However, recent reforms by the Central Bank of Nigeria (CBN) have given the naira some support to hold key levels. Market observers, including Fitch Ratings—which recently upgraded Nigeria’s credit outlook—have commended the improved exchange rate stability.

Fitch cited several key reforms, including tighter monetary policy to control inflation, a new foreign exchange (FX) code to boost market efficiency and transparency, the introduction of an electronic FX matching platform, and the unification of exchange rates to eliminate arbitrage.

U.S. Dollar Index Holds Steady Amid Geopolitical Uncertainty

Persistent uncertainty around U.S.-China trade negotiations and anticipation of this week’s Federal Reserve meeting contributed to the dollar’s stability.

- Market holidays in South Korea and Japan limited regional trading volumes, while Chinese markets reopened after the Labor Day holidays.

- Speculation around U.S.-China trade talks boosted the yuan, which strengthened sharply in a catch-up rally.

- The dollar index steadied after gains earlier in the week, although it remained under pressure from losses suffered over the past three months. Remarks by President Trump and his cabinet did little to calm market fears about proposed tariffs.

- Both the dollar index and dollar index futures saw minimal movement in London trading, following recent gains.

Despite recent stabilization, the dollar remains under notable pressure due to the unwinding of long dollar positions, especially in Asian markets, amid declining investor confidence in the U.S. economy. This trend has been compounded by lackluster economic data releases.

All eyes are now on Wednesday’s Federal Reserve meeting, where the central bank is expected to maintain interest rates despite ongoing economic uncertainty and persistent inflation.

White House Pressures Fed as Trade Deal Hopes Lift Economic Outlook

President Trump has continued to pressure Fed Chair Jerome Powell to lower interest rates, making Powell’s upcoming remarks a key focus for markets.

Optimism increased after U.S. Treasury Secretary Scott Bessent suggested that the U.S. may finalize trade deals as early as this week. Excluding China, Bessent said that 17 trading partners have submitted “good” proposals currently under review.

He indicated that, if implemented, the proposals could help the U.S. achieve 3% economic growth by this time next year.

Bessent also outlined goals to reduce the federal deficit by approximately 1% annually and revise downward the Congressional Budget Office’s projections.

He noted that strong growth in private credit suggests U.S. banking regulations may be overly restrictive and should be loosened.

Additionally, he clarified that no private information has been shared with the U.S. regarding trade with China and that only public offers have been made in ongoing negotiations.