The Federal Government has ordered the immediate closure of the waterway between Eko Bridge and Carter Bridge in Lagos following structural damage to the Eko Bridge caused by dredging activities.

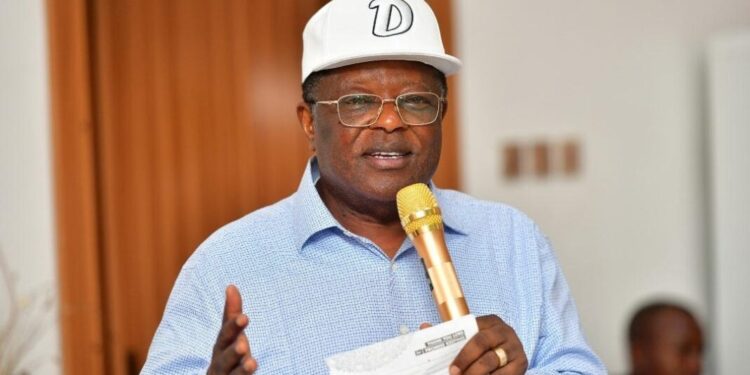

The Minister of Works, David Umahi, made this known during an inspection of key bridges in Lagos State on Saturday, as reported by the News Agency of Nigeria (NAN).

He revealed that a dredger had collided with a pier cap on the Eko Bridge, resulting in the tumbling and sinking of the pier.

“The Minister of Works, Sen. Dave Umahi, has called for immediate closure of the waterway between Eko Bridge and Carter Bridge due to damage on Eko Bridge by dredging activities,” the NAN report read in part.

Umahi noted that a recent incident involving a dredger led to serious damage after it struck a pier cap, causing the entire pier to collapse and sink. He expressed concern about the dangers posed by such reckless operations and disclosed that the dredger’s operator or owner had already been apprehended. He assured that the Federal Government would take firm action in response to the incident.

Umahi also called on Lagos State Governor Babajide Sanwo-Olu to enforce the closure of the affected waterway to prevent further accidents.

More insights

Furthermore, the Minister of Works condemned ongoing dredging activities near key bridges in Lagos, including the Third Mainland Bridge.

He noted that the Federal Executive Council had already banned dredging within a 10-kilometre radius of all bridges across the country.

- He described the continued dredging as a clear disregard for federal directives and warned that such activities could compromise the stability of the bridges.

- Additionally, Umahi urged Nigerians to stop parking and loading vehicles on bridges, stressing that the practice puts extra pressure on the structures and increases the risk of collapse.

He reaffirmed the federal government’s commitment to safety and warned that violators would face consequences.

What you should know

The FEC’s approval of a ban on dredging within a 10-kilometre radius of all bridges, made months ago, was intended to prevent incidents like the recent damage to the Eko Bridge.

- A dredger’s collision with a pier cap caused the collapse of the pier, highlighting the risks of such activities.

- Pier caps are critical structural components of bridges, as they support the weight of the bridge and transfer forces to the foundation. Damaging them can compromise the bridge’s stability, leading to potential collapse or long-term structural weakening.

The directive aims to protect the stability of bridges, but its success depends on strict enforcement to ensure compliance and prevent similar accidents in the future.