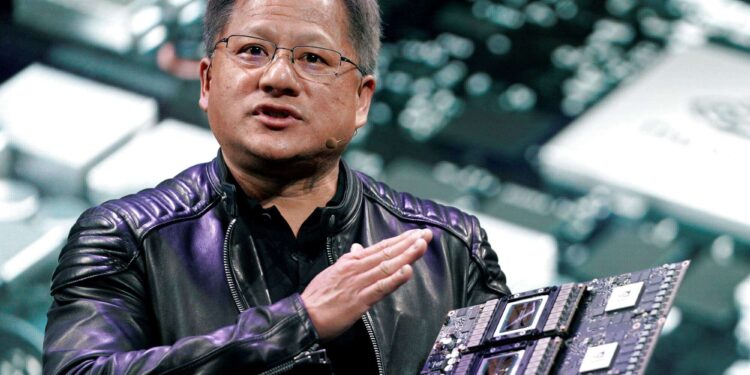

Jensen Huang, the billionaire co-founder and CEO of Nvidia, saw his net worth shrink by $9.5 billion in a single day after the chipmaker’s stock tumbled on Thursday.

According to Forbes’ real-time billionaires ranking, Huang, 62, is now worth an estimated $150.1 billion, reflecting the sharp decline in Nvidia’s share price.

Huang, who co-founded Nvidia in 1993, has led the company to dominate the graphics processing industry, first in gaming and later in artificial intelligence.

The company’s explosive growth propelled its market value past $3 trillion in 2024, making it one of the most valuable firms in the world. Huang, who owns about 3% of Nvidia, took the company public in 1999.

Born in Taiwan, Huang moved to Thailand as a child before his family sent him and his brother to the United States amid political unrest.

A graduate of Oregon State University and Stanford, Huang has donated $30 million to Stanford’s engineering center and $50 million to Oregon State for a research facility bearing his name.

More insights

Despite Nvidia reporting strong fourth-quarter earnings, its stock dropped 8.5% on Thursday after the company’s first-quarter gross margin forecast fell short of expectations.

Nvidia projected a gross margin of 71%, down from 73% in the previous quarter and below Wall Street’s estimate of 72.1%.

Analysts pointed to rising competition and increased costs as factors behind the company’s conservative guidance. Harlan Sur, an analyst at JPMorgan, noted that Nvidia is incurring expedite fees as it scales up shipments of its latest Blackwell AI chips to meet demand.

Even with the margin concerns, Nvidia’s revenue of $39.3 billion and earnings per share of $0.89 exceeded Wall Street’s estimates. The company forecasted a first-quarter revenue of $43 billion, slightly above analysts’ expectations of $42.3 billion.

What you should know

- Still, the stock’s decline suggests some investors remain cautious. Nvidia’s Blackwell AI GPUs, which were expected to contribute “several billion dollars” in sales, generated $11 billion in fourth-quarter revenue, marking the fastest product ramp-up in the company’s history, according to CFO Colette Kress.

- The sharp drop in Nvidia’s stock on Thursday brings its losses over the past five trading sessions to about 14%, pushing its market capitalization back below $3 trillion—behind both Apple and Microsoft.

- Among other noteworthy tech names, Tesla fell 3%, extending its year-to-date decline to 30%. Apple, Microsoft, Amazon, Alphabet, and Meta Platforms also retreated, as tech stocks broadly faced selling pressure amid market uncertainty.