The Petroleum Products Retail Outlets Owners Association of Nigeria (PETROAN) has said that the latest reduction of the ex-depot price of Premium Motor Spirit (PMS), otherwise known as petrol by the Dangote Petroleum Refinery may not reflect immediately in pump prices across the country.

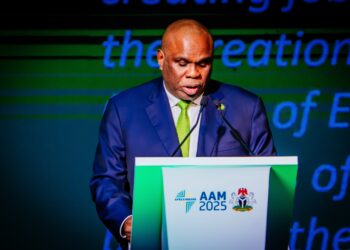

While speaking in an interview on Arise News (TV), the National President of PETROAN, Billy Gillis-Harry, welcomed the depot price reduction by Dangote but highlighted the challenges of implementing an immediate change in retail prices.

He explained that many filling stations still have stock purchased at the previous higher price, making it difficult to adjust pump prices immediately.

He said, “Price changes are not usually instantly applicable, but ultimately it will apply. You can’t see it immediately, because we have already bought products. We have already purchased different kinds of products in our retail outlets at the price it was prior to the changes made this evening.”

Dangote reduced the ex-depot price to N890

Nairametrics reported that the Dangote Refinery, on Saturday evening, announced the reduction of the ex-depot (gantry) price of petrol from N950 to N890 per litre.

According to the refinery, the price adjustment was influenced by a drop in global crude oil prices and an optimistic outlook for the international energy market, as reported by Nairametrics.

- This reduction comes just weeks after the refinery had raised prices due to earlier increases in crude oil prices in the global market.

- On December 19, 2024, the refinery reduced petrol prices by 7.5% to N899.50 per litre, but on January 17, 2025, it increased the price to N955 per litre, citing rising Brent crude oil prices as the primary reason.

In the statement issued by Anthony Chiejina, the Group Chief Branding and Communications Officer of Dangote Group, he noted that the refinery is committed to being transparent and fair in the pricing of petroleum products for Nigerians.

He expressed optimism that the price reduction would help lower petrol costs across the country, potentially easing the prices of goods and services.

PETROAN urges members to lower prices

While the PETROAN President said the price reduction may not immediately reflect in pump prices, he urged members of the association to reduce their retail price when they buy at the reduced price.

“But the only thing we will advocate is that anyone who starts buying at the new price from Sunday (today) should endeavor to reflect that price in their retail outlets,” he added during the interview.

Gillis-Harry reiterated PETROAN’s commitment to collaborating with the Dangote refinery and other stakeholders to ensure fair pricing and sustainability in the downstream petroleum sector.