Penny stocks have continued to show resilience and growth in 2024.

As of the close of trading on Friday, December 13, 2024, 23 of these low-cost shares, often valued below N5.00, recorded year-to-date (YTD) gains above Nigeria’s November 2024 inflation rate.

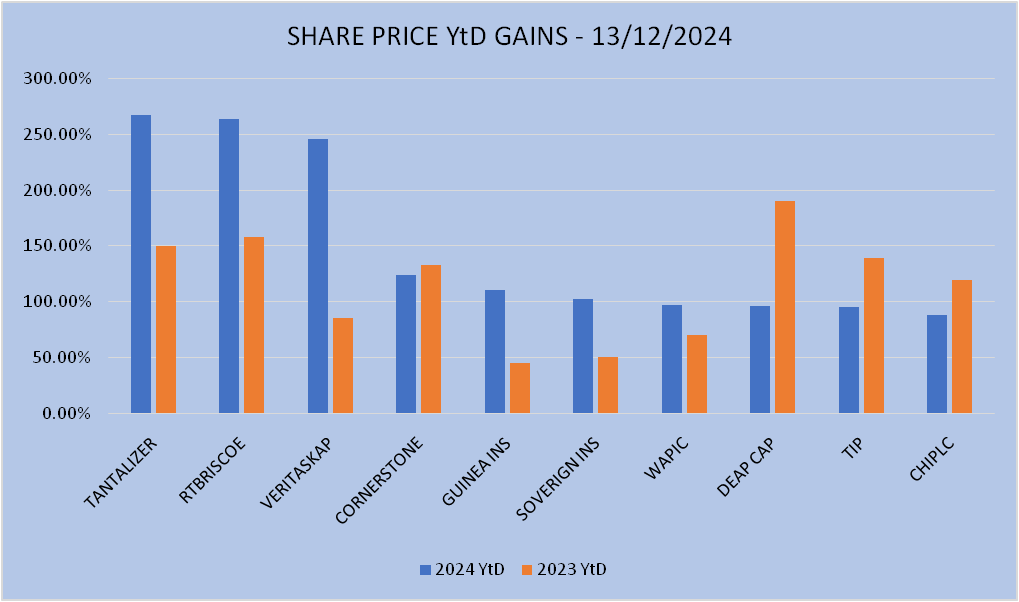

The top ten standout performers include Tantalizers Plc, RT Briscoe, Veritas Assurance, Cornerstone Insurance, Guinea Insurance, Sovereign Insurance, WAPIC, Deap Capital, TIP Initiatives, and Consolidated Hallmark.

These stocks have not only outpaced inflation but also demonstrated impressive growth during challenging economic conditions.

Nigeria’s headline inflation rate surged to 34.60% in November 2024, up from 33.88% in October 2024, marking the highest level in 26 years.

On a year-on-year basis, the headline inflation rate rose by 6.40% from 28.20% in November 2023.

Such high inflation significantly erodes the purchasing power of money, making it vital for investors to focus on real returns, which adjusts nominal returns for inflation.

Inflation and Real Returns on Investments

In an inflationary environment, nominal returns; the actual percentage gain or loss on an investment, can be misleading.

Real returns, which account for inflation, provide a more accurate picture of the true increase in purchasing power.

This distinction is particularly critical as traditional asset classes like bonds and cash equivalents often struggle to deliver positive real returns during inflationary periods.

- Stocks, on the other hand, generally have the potential to outperform inflation and deliver positive real returns, though individual stock performance can vary widely.

- Some stocks may record negative real returns if their growth does not outpace inflation. For investors, understanding the total return of stocks—including capital gains and dividend yields is essential.

- This dynamic played out in 2023, when some stocks achieved positive real returns, outperforming the inflation rate of 28.93%, while others fell short.

- For example, within the penny stock category, Prestige Assurance Plc achieved a total return of 23.84% in 2023.

- However, with inflation closing at 28.93%, Prestige Assurance recorded a real return of -5.09%. This underscores that even positive nominal returns can result in negative real returns due to inflation.

- In contrast, larger-cap stocks like Cadbury Plc demonstrated strong performance in 2023, with a trailing total return of +62%. After adjusting for inflation, Cadbury secured a real return of 33.17%, highlighting its ability to provide substantial growth during the period.

Against the backdrop of the current inflation rate, these penny stocks have not only weathered the economic storm but have also surpassed the rising inflation:

Guinea Insurance: +110.34% YtD

Guinea Insurance is one of the top-performing penny stocks in 2024, with a YTD share price gain of 110.34%, making it the 5th best-performing penny stock on the Nigerian Exchange (NGX).

- The stock also commands trading liquidity, with a trading volume of 305 million shares over the past three months, ranking it the 27th most traded on the NGX.

- Operating in the Financial Services/Insurance Carriers sector, Guinea Insurance is currently the 110th most valuable stock on the NGX, with a market capitalization of N3.745 billion.

- In the first nine months of 2024, the company’s pre-tax profit surged by 854% year-on-year to N568 million, surpassing its full-year 2023 pre-tax profit by 14%.

- However, some factors may temper its attractiveness for certain investors. The absence of dividend payments over the past five years limits its total return potential.

While its beta of 0.830 suggests lower market volatility, appealing to risk-averse investors, this feature must be weighed against its historical underperformance in 2023, when the share price recorded a 45% YTD gain compared to 2024’s impressive performance.

Cornerstone Insurance: +123.57% YtD

Ranked 4th among the top-performing penny stocks of 2024, Cornerstone Insurance achieved a remarkable 123.57% YTD gain, reinforcing its reputation for consistent growth following a 133.33% gain in 2023.

- With a market capitalization of N57.2 billion, it is the 48th most valuable stock on the NGX. The stock’s trading volume of 98.8 million shares in the past three months underscores strong liquidity.

- Cornerstone’s pre-tax profit surged 57% YoY to N26.59 billion in the first nine months of 2024, reflecting solid financial performance and investor confidence.

Trading just 6% below its 52-week high, reflects much of its recent growth, potentially limiting short-term upside.

VERITASKAP +245.95% YtD

Veritas Kapital Assurance Plc is currently the 76th most valuable stock on the NGX, with a market capitalization of N17.2 billion.

As of December 13, 2024, it has achieved a 245.95% YtD gain, making it the 3rd best-performing penny stock on the NGX, following an 85% YtD gain in 2023.

- Over the past three months, the stock traded 543 million shares valued at N762 million, ranking it the 18th most traded stock and highlighting strong investor interest.

- On December 16, 2024, Veritas Kapital closed at N1.24, 31.11% below its 52-week high of N1.80 set on October 3, 2024, reflecting a recent pullback, possibly due to profit-taking.

- The stock’s future performance depends on market sentiment, fundamentals, and demand, with the current price presenting a potential buying opportunity for investors.

- Veritas Kapital’s low beta of 0.63 indicates lower risk during market volatility, appealing to risk-averse investors, though it may lag during market rallies.

- The company has consistently reported pre-tax profits over the past five years. The trend continued in 2024 with a pre-tax profit of N2.96 billion in the first nine months of 2024.

However, the company does not have stable dividend payout records, which could be viewed as disincentive, especially for income-focused investors.

RT Briscoe: +264.18% YtD

RT Briscoe is currently the 2nd best-performing penny stock on the NGX, recording an impressive 264.18% Year-to-Date (YtD) gain as of December 13, 2024.

- This builds on the stock’s strong performance in 2023 when it achieved a YtD gain of 158%.

- However, on Monday, the share price closed at N2.44, which is 43.65% below its 52-week high of N4.33, set on August 30, 2024.

- Trading well below its peak, this pullback could present an opportunity for value-seeking investors to enter at a discounted price

- A significant positive development is RT Briscoe’s return to profitability in 2024. Pre-tax profit stood at N843 million in the year, a notable recovery from the N513 million loss recorded previously.

This turnaround reflects improved company operations, potentially enhancing investor confidence and positioning RT Briscoe for further growth.

Tantalizers: +268% YTD

Tantalizers Plc is the best-performing penny stock on the NGX with a remarkable gain of 268% as of December 13, 2024.

On December 16, it closed at N1.85 per share, reflecting a slight 0.5% gain over its previous close of N1.84. However, it remains 5.64% below its 52-week high of N1.95, also set on December 16, 2024.

Trading activity has been robust, with a three-month trading volume of 499 million shares, indicating strong liquidity and market interest.

Despite the impressive share price performance, investors should approach Tantalizers Plc with caution. The positive momentum appears to be driven by other factors rather than solid fundamentals.

- The company reported a pre-tax loss of N231.56 million in the first nine months of 2024, continuing its loss-making trend from 2023 and 2022.

Without clear signs of an operational turnaround or improved profitability, the current price surge may not be sustainable over the long term.

Additional Top-Performing Penny Stocks in 2024:

- Sovereign Insurance: +102.38% YtD

- WAPIC: +97.06% YtD

- Deap Capital: +96.55% YtD

- TIP Initiatives: +95.65% YtD

- Consolidated Hallmark: +88.44% YtD

These stocks have delivered impressive gains in 2024, reflecting strong investor interest in penny stocks despite underlying market conditions.

Investors are advised to assess each company’s fundamentals, market trends, and liquidity to determine sustainability before taking positions.