Each time Nigeria’s Bureau of Statistics (NBS) publishes its monthly Inflation data, in its capacity as the Nation’s Official Statistics Agency there is a palpable sense of bewilderment amongst the populace.

Specifically, most of the populace immediately questions “How can the officially published inflation number be so different compared to what is being experienced at a micro-level by both individuals and corporations?”.

As an example, the August 2024 published data from NBS reflects that CPI is 784.4 (compared to CPI of 593.6 in August 2023) thus year-on-year price changes “aka inflation” is 32.15%.

In other words, if you paid N1,000,000 to purchase a Generator in August 2023 then NBS is saying you’ll have needed N1,321,500 to buy the same Generator set in August 2024…hmm…I already see households staring at me through the screen with a strong side-eye…like how? 😊

One reason for the befuddlement is that the headline number from NBS is simply just an average of averages.

That is, the number published at the top of the page just aims to provide summarized information for the entire country across an average of multiple items and categories AND serve as a quick guide regarding whether prices in the country are increasing or decreasing.

- Consequently, the headline inflation number of 32.15% for August 2024 only facilitates directional discussions on a macro-basis about whether prices are higher or lower compared to prior periods.

As a keen follower of Nairametrics and Nairalytics (research rm of Nairametrics), every time the inflation data is released, you should immediately ask what does this report means for me, as an individual or a business owner.

So, what does the inflation report mean for you?

The short answer to what the inflation report means for you is that “It Depends”….

- I know, I know, I know…that is a typical Nigerian answer to a question.

However, the reality is that every person has a unique inflation rate. Critically, your unique inflation rate is linked to the key inputs driving your lifestyle, as well as your focus areas for consumption.

For context,

- If you are a Lekki Big-boy/babe who shops for groceries in high-brow supermarkets in Agungi whereby you need to have your breakfast staple of tea, bread, eggs, and orange juice, then your unique inflation rate simply cannot be the same as someone in Ajangbadi who starts his/her daily routine with Pap and Akara (aka “Bean cake” for the posh ones amongst us).

- From a small business perspective, if you run a Restaurant, your unique inflation rate is completely different from someone who runs a School, especially as mandatory input costs differ across businesses

- For Restaurants: Mandatory input costs are Accommodation costs, Food, Beverage, Labor (whilst Fuel is likely an ancillary expense depending on clientele)

- For Schools: Mandatory input costs are Accommodation costs, Labour and Knowledge Delivery tools, and Stationery (whilst Food, Beverage, or Fuel are ancillary depending on clientele)

Therefore, to find what the Nigerian inflation report means to you or your small business (i.e. your unique inflation rate), you must dig into underlying data that NBS already makes available.

Interestingly, additional data abound from the NBS to help answer the question of what it means for your lifestyle. If you recall I already mentioned that the headline inflation numbers are an average of averages

Specifically, the monthly inflation report is averaged in multiple ways

- Firstly, it is averaged by a pre-determined selection of goods and services (i.e. a basket of pre-selected goods). Yes, we note that potentially not everyone uses all the goods in the basket every time or even at the same rate. But until the basket of goods is updated, the basket is what it is.

- Secondly, Price changes are averaged by if you are a City (Urban) dweller or whether you live in a village (Rural area)

- Finally (but not the least), Prices are also averaged by what state you reside in

Looking at the underlying data trend of averages can start to give additional insights to micro-entities such as individuals or corporations.

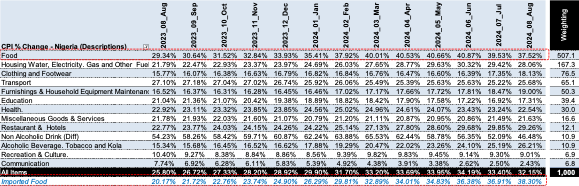

Inflation by Composition of Nigeria’s CPI: as referenced earlier, inflation tracks a predetermined suite of goods and services and then gives a degree of importance to each item.

- For context, Nigeria’s NBS Inflation report outlines about 12 to 13 categories (See below table), it also gives Food a 50% weighting or importance, then housing a 16.7% importance followed by clothing a 7.7% etc.

- Being aware of this composition can help you quickly zone into what areas matter to you.

- As an example, if 90% of your monthly income is spent on Food, then your inflation rate will be more skewed toward the 37.5% Food Inflation rather than the 32.15% inflation rate for All items

- But wait……this is the National Average for Food Inflation.

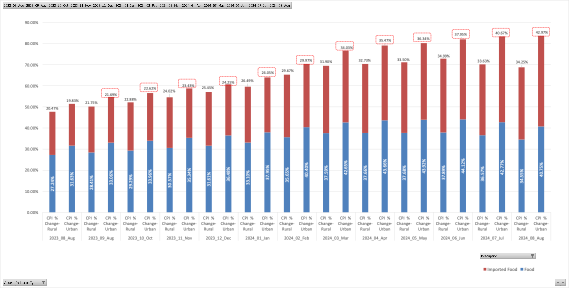

Inflation by Urban vs Rural: We now know there are 12 to 13 broad categories being tracked for Inflation. What if you live in a City and your Breakfast and Lunch lifestyle is akin to our Lekki big-boys and big-babes? Well NBS also tries to disaggregate this trend.

Available data shows that prices of goods and services are rising faster in the City (Urban) compared to Rural. There are a plethora of reasons why urban inflation is currently outpacing rural inflation not least because of farm-to-table costs such as logistics and higher demand. But the reason for the rapid pace of Urban inflation will be a separate article.

For now, suffice it to say if you live in Urban areas, you should absolutely expect your inflation rate to be very different from folks in the villages.

Notably, eagle-eyed members of our Nairametrics/NairaLytics audience will also spot that “Imported Food” subset for Urban dwellers has an Inflation rate of 42.97%.

- In other words, whilst headline inflation rate for August 2024 decelerated at the National level, unfortunately, folks who reside in the City AND have a concentration of expenses dependent on Imported Food are continuing to see their expenses spike!!

Inflation by State: This topic of different states having different levels of inflation is a topic frequently covered on Nairametrics. You can read more here or here.

One thing to note from the August 2024 report is that 20 States out of 36+FCT have inflation higher than the National Average. For Context, if you reside in Sokoto your food inflation is the highest at ~47% whilst Bauchi has the overall highest inflation at ~46%

So what is the point of knowing your inflation rate?

For Individuals, it is essential to be aware of how much income via Salary you need to generate as prices escalate in your vicinity. Alternatively, you may seek to relocate to more cost-effective locations in Nigeria.

For Small businesses, it is even more important to continually track price escalations in your locality. This is for dual reasons. Firstly, inflation rapidly erodes your profits if you fail to constantly adjust your service offerings to protect revenue.

Furthermore, for businesses, your greatest asset is people. To avoid attrition risks, you have a responsibility to be aware of when the salary being paid is becoming stale compared to market benchmarks and then immediately take action to adjust salaries. Otherwise, do not be surprised when key and talented members of staff depart for greener pastures

As folks start planning for 2025, it is important to use easily available data to build your forecasts whether personal or

corporate…..then as the inflation data gets updated, you can continually revise your budgets and forecasts.

In a high-cost economy, it is essential to continually plan for consumption patterns and changing habits to help thrive rather than just survive. Especially as business operating margins and household disposable incomes dwindle and face unrelenting pressures

So what is your unique inflation rate?