The Executive Chairman of the Federal Inland Revenue Service (FIRS), Zaccheus Adedeji, has been honored with the award for Excellence in MSME Tax Policy Intervention & Regulatory Support.

The award was presented at the inaugural Annual MSME Finance Awards program, which took place on Friday, September 27, 2024, at the Civic Centre, Victoria Island, Lagos.

Adedeji, who was unable to attend in person, was represented by Collins Omokaro, Special Adviser on Communications and Advocacy, FIRS.

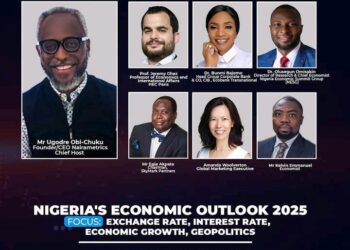

The award, jointly organized by Nairametrics and The Economic Forum Series, is designed to recognize and celebrate innovative models and the impactful contributions of financial sector players, non-financial institutions, and non-state actors in supporting MSMEs and influencing financial growth.

Adedeji’s recognition highlights his outstanding efforts in fostering tax policies that enable the growth of micro, small, and medium enterprises (MSMEs), particularly by easing their compliance with tax regulations.

Keynote Speech: Unlocking MSMEs’ Potential for Tax Revenue Growth

In his keynote address, delivered on his behalf by the special adviser on Communictions and Advocacy, Collins Omokaro, titled “Unlocking MSMEs’ Potential Impact on Tax Revenue Growth in a Changing Policy and Regulatory Environment,” Zaccheus Adedeji emphasized the pivotal role MSMEs play in the Nigerian economy.

Drawing on data from the United Nations Industrial Development Organization (UNIDO), he stated that MSMEs account for over 90% of businesses in the country, making substantial contributions to employment and economic diversification.

However, he noted that their potential in driving tax revenue remains largely untapped due to challenges such as access to finance, regulatory compliance burdens, and technological adaptation.

Adedeji highlighted the FIRS’s commitment to demystifying taxation for MSMEs through tax education programs and streamlined registration processes.

He stressed the importance of fostering an enabling environment for these businesses, saying, “To unlock this potential, we must adopt a holistic approach that simplifies tax compliance and provides incentives for growth, ensuring that our tax policies are reasonable and equitable.”

One of the most notable announcements from his speech was the ongoing proposal to increase the threshold for tax exemptions for small businesses, allowing even more MSMEs to benefit from these vital incentives.

He shared that this proposal is currently being reviewed by the National Assembly, and its approval would further ease the financial burden on MSMEs, helping them to thrive in an evolving regulatory environment.

He also discussed key government initiatives aimed at supporting small businesses, including exemptions from Company Income Tax and Value Added Tax (VAT) for businesses classified as small under the Company Income Tax Act.

A major focus of his speech was the use of technology to simplify tax compliance for MSMEs.

Furthermore, Adedeji encouraged businesses to leverage digital platforms such as YouTube, Instagram, and WhatsApp to expand their operations and enhance tax contributions.

He noted that the digitization of tax administration is a key initiative by FIRS, aimed at minimizing administrative burdens and making compliance processes more transparent.

As he explained, “This transformation in tax administration through technology will make it easier for MSMEs to meet their tax obligations while minimizing the administrative burden they face.”

Concluding his keynote address, the FIRS chairman called for stronger collaboration between government agencies, financial institutions, and the private sector to create a robust ecosystem that supports MSMEs.

He expressed confidence that such collective efforts would enable MSMEs to thrive and contribute more significantly to Nigeria’s tax revenue growth.