Loan apps or digital money lenders, as the companies behind them are known, have become essential in Nigeria’s informal economy by offering quick and accessible loans.

This is despite challenges around their operations, particularly in debt recovery practices, which has seen the Federal Competition and Consumer Protection Commission (FCCPC) placed some of them on its watchlist and directed the removal of 47 of them from the Google Play Store.

Nigerians’ continued reliance on these digital lenders shows the demand for quick financial solutions, even in the face of complaints about unethical practices like harassment and defamation.

However, many loan apps are operating legitimately, adhering to the FCCPC’s Limited Interim Regulatory/Registration Framework and other industry guidelines set by bodies like the Nigerian Communications Commission (NCC), the Central Bank of Nigeria (CBN), and the Economic and Financial Crimes Commission (EFCC).

With over 200 FCCPC-approved loan apps, one way to evaluate their reliability is through user ratings and reviews on app stores.

For this ranking, we focus on Google Play Store ratings, as most loan apps are unavailable on the Apple Store.

We first ranked loan apps in Nigeria based on this parameter in January this year. Interestingly, a look at the apps against their current ratings shows that there has been a lot of changes.

Here are the top 10 loan apps in Nigeria as of September 2024, based on their user ratings:

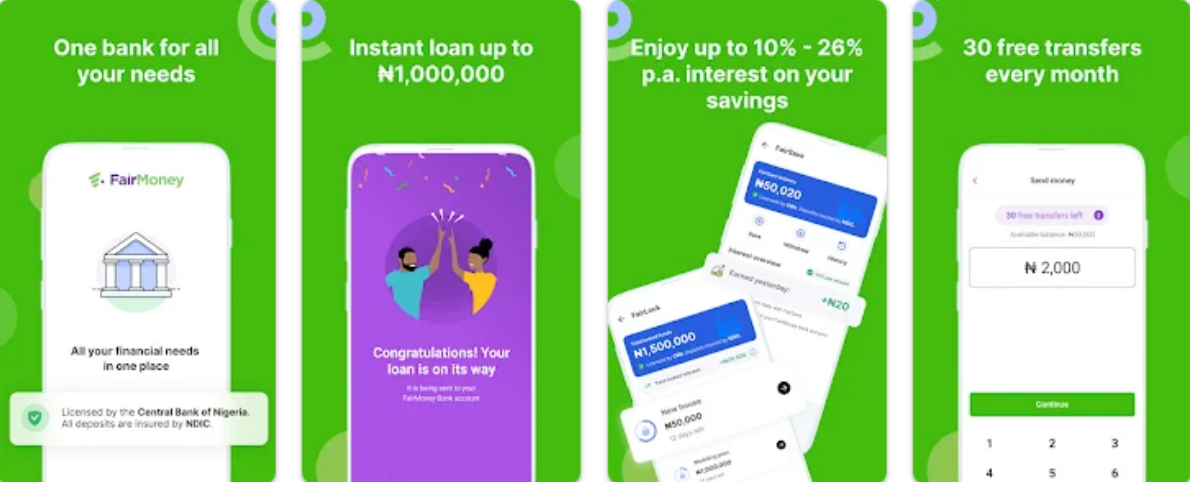

FairMoney is a digital bank focused on lending.

The company provides instant loans of up to one million naira, as well as a bank account and a debit card.

According to the company, FairMoney processes over 10,000 loans every day, with one loan disbursed every eight seconds.

This is reflected in the fintech app on the Play Store as it is one of the loan apps that have crossed 10 million downloads.

FairMoney app’s rating has improved from 4.2 in January this year to 4.4 in September even as the number of users who have reviewed the app increased to 690,000 from 587,808 in the last review period.

Good