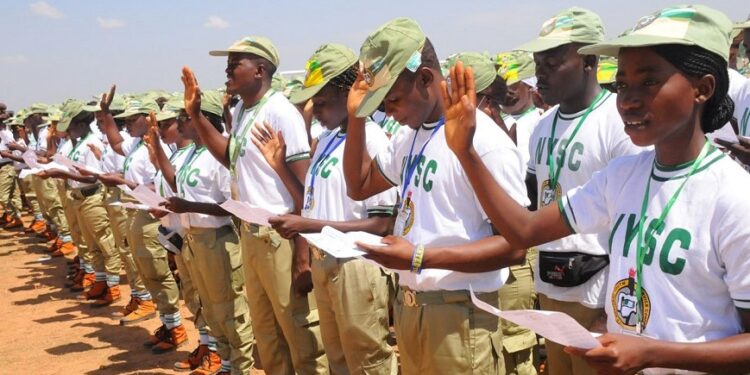

The National Youth Service Corps (NYSC) has been a cornerstone of Nigeria’s nation-building efforts since its inception in 1973.

Every year, thousands of young graduates are deployed across the country to contribute to national development while gaining valuable work experience.

Central to this program is the monthly allowance, popularly known as “allawee,” currently set at N33,000 by the Federal Government.

However, the uniformity of this allowance, irrespective of the varying economic realities across different states, has become a topic worth revisiting.

An outdated one-size-fits-all approach

Nigeria is a diverse nation with vast differences in cost of living, infrastructure, and security across its 36 states and the Federal Capital Territory.

Despite these disparities, NYSC members receive the same allowance regardless of where they serve.

This uniform stipend was perhaps appropriate decades ago, but in today’s economic climate, it fails to address the nuanced challenges faced by corps members in different locations.

For instance, a corps member serving in Lagos, where the cost of living is significantly higher, receives the same allowance as someone in a rural area of Sokoto.

This system is inherently unfair, as it does not account for the varying expenses and risks associated with different postings. It’s time for the NYSC to consider a differential allowance structure that reflects the realities on the ground.

Aligning allawee with inflation and living conditions

Nigeria’s inflation rate has been on an upward trajectory, further exacerbating the financial strain on corps members.

However, inflation is not uniform across the country. Cities like Lagos, Abuja, and Port Harcourt have higher inflation rates due to the concentration of economic activities, leading to increased prices of goods and services.

In contrast, some rural areas have lower inflation rates, but they often suffer from poor infrastructure and lack of essential services, making life equally challenging, if not more so, for corps members stationed there.

A differential allowance system would take into account these variations. Corps members posted to high-cost areas should receive higher stipends to offset the increased cost of living.

Similarly, those serving in regions with poor infrastructure, limited access to healthcare, or inadequate housing should be compensated for the hardships they endure.

This approach would not only be fairer but also more in line with the realities of the economic environment across Nigeria.

Incorporating risk premiums

Another critical factor that should influence the differential allowance is the security situation in the various states. Some regions in Nigeria are plagued by insecurity, ranging from insurgency and banditry to kidnappings and communal clashes.

Corps members deployed to these areas are often at greater risk and should be compensated accordingly. A risk premium added to their allowance would recognize the sacrifices they make and incentivize service in these challenging environments.

Moreover, it is worth considering the role that corps members play in different sectors of the economy. Those working in critical areas such as education and healthcare, particularly in underserved regions, should receive additional allowances.

Teachers in public schools and healthcare workers in government hospitals are not just fulfilling their NYSC obligations; they are also addressing vital needs in the country’s development agenda. Their allowances should reflect the importance of their contributions.

Beyond Allowances: The Need for Additional Incentives

While a differential allowance is a crucial step, it is also essential to consider additional incentives that would further enhance the experience of corps members, particularly those in challenging environments.

Improved insurance policies, such as enhanced health and life insurance coverage, should be introduced based on where corps members are stationed.

These policies would provide much-needed financial security and peace of mind, especially for those serving in high-risk or underserved areas.

The introduction of such benefits would require additional funding, which could be sourced creatively. One approach could involve the government offering tax breaks to corporations that sponsor these enhanced insurance programs on a state-by-state basis.

This would be similar to how companies sponsor popular sports and entertainment programs, but with a focus on national service. In exchange for their contributions, these corporations would receive tax incentives, and perhaps even public recognition, for their role in supporting the NYSC program.

This public-private partnership model would alleviate the financial burden on the government while ensuring that corps members are adequately protected and rewarded for their service.

It would also foster a sense of corporate social responsibility among businesses, encouraging them to invest in the nation’s future by supporting the youth who are actively contributing to national development.

Learning from state allowances

State governments currently supplement the Federal Government’s allawee with additional stipends, and these state allowances vary significantly.

For example, corps members in some states receive as much as N10,000 to N15,000 extra per month, while others receive little or no additional support. This system already acknowledges the disparities between states, albeit inconsistently.

A standardized federal approach to differential allowances would create a more equitable system and reduce the dependency on varying state allowances.

Furthermore, with the anticipated increase in the federal minimum wage, which could lead to an adjustment in the NYSC allowance, there is a prime opportunity to restructure the allawee in a way that addresses these long-standing issues.

An increased base allowance is welcome, but without considering the factors mentioned above, it will still fall short of addressing the inequities faced by corps members across different parts of the country.

A call for reform

The current one-size-fits-all approach to NYSC allowances is outdated and does not reflect the diverse realities faced by corps members across Nigeria.

Introducing a differential allowance system based on location, inflation rates, living conditions, risk premiums, and sectoral importance would be a more equitable and just approach.

Additionally, offering enhanced insurance policies and other benefits tailored to the specific challenges of different regions would further support corps members in their service.

Such reforms would not only ensure that corps members are adequately compensated but also incentivize service in areas that are critical to national development. By encouraging corporate sponsorship and offering tax incentives, the government can fund these initiatives without placing undue strain on public finances.

As Nigeria continues to grapple with economic challenges and regional disparities, the NYSC program must evolve to remain relevant and effective.

Differential allowances and additional incentives would be a significant step in the right direction, ensuring that the sacrifices made by young Nigerians during their service year are duly recognized and rewarded.

It’s time for the NYSC to embrace this change and introduce a more fair and balanced allowance structure that reflects the true value of service in today’s Nigeria.