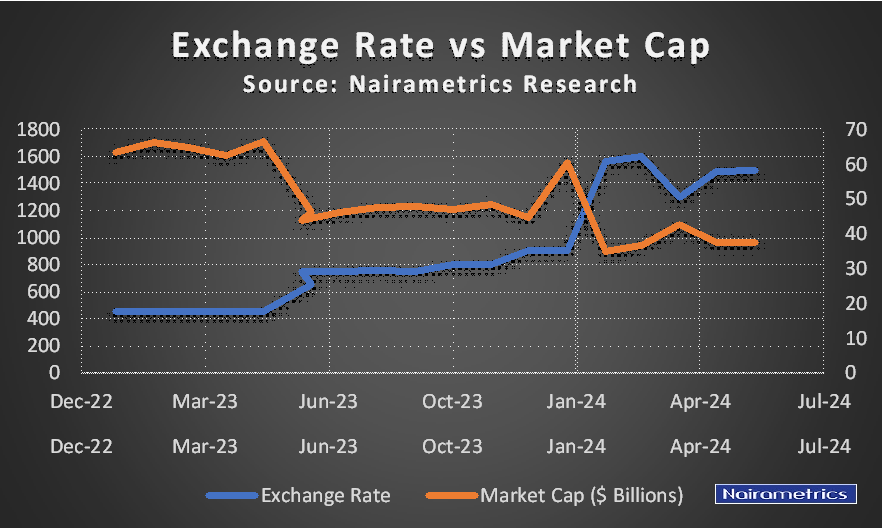

About one year after the move by the Central Bank to float the Naira and achieve a unified exchange rate, the market capitalization of the Nigerian Exchange (NGX) has declined by $27.8 billion.

Less than two weeks after assuming the presidency, President Bola Tinubu moved the CBN to unify the exchange rates in the parallel and official markets. This led to a depreciation in the value of the Naira on June 9, 2023, from N465/$ to N756/$.

On June 9, 2023, the Nigerian Exchange (NGX) closed with a market capitalization of N30.45 trillion, which was about $65.5 billion at the old exchange rate. And in 2024, the NGX closed the first half of the year with a market capitalization of N56.6 trillion, about $37.7 billion.

Hence, the disparity between both periods amounted to $27.8 billion, thus pushing the NGX out of the list of top five largest stock markets in Africa.

After the forex unification move

On the first trading day after the unification move, June 13, the NGX appreciated by 3.99%, its highest gain recorded in a single day last year. That day, the market cap appreciated by N1.216 trillion to close at N31.670 trillion.

In Naira terms, that was a significant gain, however, in USD terms, the market capitalization crashed by 36%, from $65.49 billion to $41.89 billion. Trading volume was also significantly higher that day, as foreign investors were propped up about the prospects of the NGX after that move.

Between June 9 and June 30, 2023, the NGX gained 9.01%, thus propping the market capitalization, from N30.45 trillion to N33.20 trillion within the period. Considering the volume of the appreciation, analysts opined that efforts to stabilize the exchange rate regime in Nigeria were yielding results in the NGX.

The second half of 2023 was quite bullish for the NGX, as the market gained 22.64% within that period. However, while the NGX was posting gains, the Naira was sliding down as it depreciated by 17% within the period to end 2023 at an exchange rate of N912/$.

At the end of 2023, the NGX closed with a market capitalization of N40.92 trillion, in USD terms, around $44.9 billion. Essentially in 2023, the NGX market cap declined by $20.6 billion after the unification of the Naira.

However, in the first half of 2024, this disparity was widened as the Naira further declined, with its depreciation outpacing the growth in the NGX. While the All-Share Index appreciated by 33.81% to close at 100,057.49 points, the Naira depreciated by 39.20%, thus taking the loss to $27.8 billion.

More insights

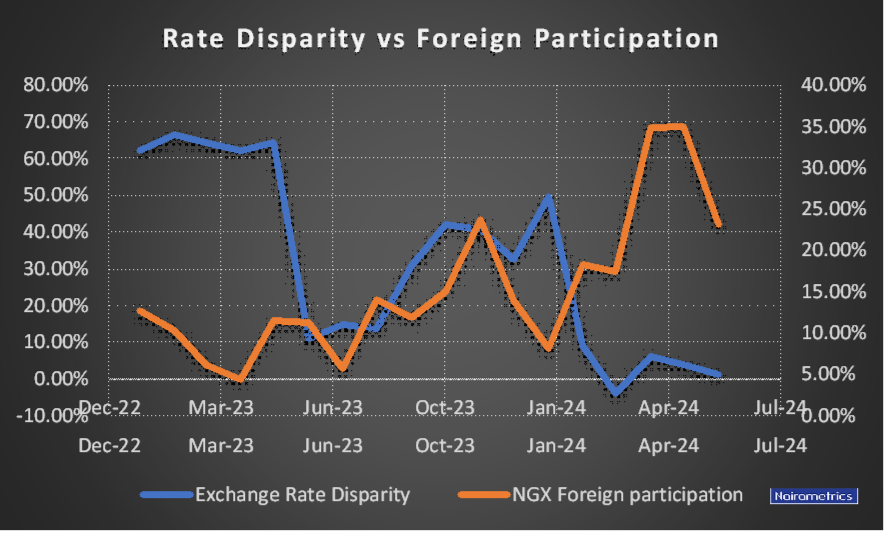

Prior to the unification move by the CBN, the disparity between the parallel and official market rates was over 60% as Naira was selling as high as N760/$ in the parallel market. The disparity coupled with a scarcity of forex in the Nigerian economy placed a red flag on the NGX as foreign participation in that market dropped to as low 4.4% in April 2023.

The move to unify the rates initially excited foreign participants, causing foreign participation to increase to 11.25% in June. However, as the market failed to achieve unity, investors were spooked, thus leading to a drop in foreign participation in July 2023.

In 2024, there was an overall increase in foreign participation, reaching 34.97% in June 2024, as the disparity between the parallel and official market rates dropped to about 1%.

The removal of currency issues as part of the factors affecting the growth of the NGX has led other issues to take the front burner in the market. For example, with currency stability established, investor sentiment towards the announced recapitalization of banks took center stage in April, as investors were spooked about potential dilution of banking stocks.

The NGX is not the only African stock market affected by moves to achieve unified exchange rates.

In Egypt, the market capitalization of the Egyptian Exchange (EGX) experienced a significant decline of $26.6 billion, dropping from $67.2 billion to $40.6 billion. This downturn followed the country’s decision to float its exchange rate in March, which resulted in a 38% depreciation of the Egyptian Pound, from 30.9 EGP/USD to 50 EGP/USD.