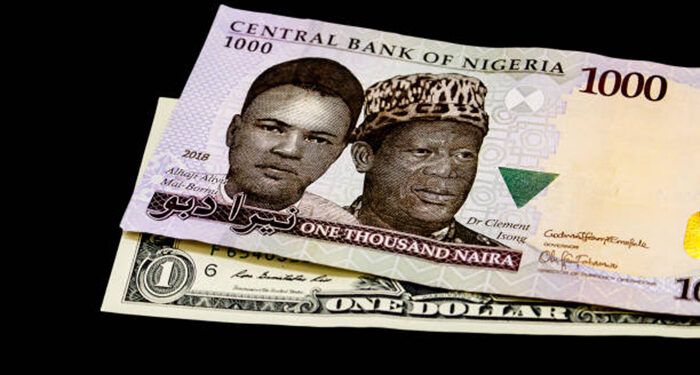

The naira posted impressive gains against the haven currency amid increased inflows from the CBN, recording its best gains since March.

The apex bank is also poised to raise headline interest rates one last time to support the naira and throttle inflation, which is near a three-decade high, before ending its aggressive tightening campaign.

Data from FMDQ revealed the naira gained nearly N100/$ as the local currency exchanged hands for N1,500.32 on Monday, representing a whopping 640 basis points increase higher than the N1,596.92/$ quoted last Friday.

In the black market, a popular medium for trading FX among the populace, the local currency settled at N1,570 per dollar, gaining less than 100 basis points compared to N1,580 on Friday

The CBN sold roughly $106.5 million to registered foreign exchange dealers over two days late last week to support the country’s failing foreign currency market.

Nigeria’s apex bank claims that the primary drivers of the most recent fluctuations in the foreign exchange market are the increased demand from business organizations and the expected seasonal rise in the summer.

MPC Meeting

Nigeria’s MPC meeting will likely result in a small rate hike due to the country’s high inflation. The black market’s high price behaviour suggests that the naira will continue to face resistance near the 1,600/$ resistance line.

The Monetary Policy Committee (MPC) of the CBN increased the monetary policy rate (MPR) from 24.75% to 26.25%, a 150-basis point increase, during its most recent meeting on May 21, 2024. The previous MPC sessions in 2024 resulted in three rate hikes, which helped the country’s foreign portfolio investments (FPI) increase but fell short of the inflation reduction aim.

The market has already priced in the possibility that the elevated inflation rate will lead to a fourth rate increase this year in the Monetary Policy Rate (MPR).

Nigeria’s inflation rate remains sticky and non-transitory

The MPC members’ choice to take a conventional approach to reducing inflationary pressure by utilizing the interest rate instrument has greatly influenced their decision to stick with their hawkish posture, yet Nigeria’s inflation hasn’t been contained. Since the last MPC MPR decision in May 2024, inflation has increased by 0.24% to 34.19% in June 2024.

Nigeria’s yearly inflation rate has remained high despite some steps taken by the Central Bank of Nigeria (CBN) to lower the consumer price index, which has been high for 28 years. As a result of the June inflation rate rising from 33.95% in May 2024 to 34.19%, the CBN’s Monetary Policy Committee (MPC) is anticipated to hike interest rates on Tuesday.

According to economist Andrew Matheny of Goldman Sachs Group Inc., “developments since the last meeting have been hawkish; inflation has not slowed at all. Above all, the value of the naira has declined once more. And it is undoubtedly inflationary. All of it suggests that the CBN will continue to lean hawkish.”

Numerous households are now below the poverty line due to the naira’s continued drop in value, the 18th consecutive month of price hikes, and a decline in purchasing power. World Bank data revealed the oil-rich West African nation has the second-highest poverty rate after India, with an estimated 87 million people living below the poverty line.

To stop inflation and alter the perception of foreign investors, Goldman is urging the central bank to do “something much bigger, much bolder, much more decisive.” According to Matheny, “an additional 50 or 100 basis points is not going to move the needle in the eyes of an investor.”

Since February, the Cardoso-led CBN has increased lending rates by a total of 750 basis points, to 26.25%. Synonyms and Definitions