President Tinubu has asked the Senate to amend the 2023 Finance Act to impose a one-time windfall tax on the foreign exchange gains realized by banks in their 2023 financial statements.

The President in a letter to the Senate explained that the funds generated from this tax would be used to support capital infrastructure development, education, healthcare access, and public welfare initiatives.

According to the President, these projects are essential components of the administration’s renewed hope agenda.

The letter reads, “Furthermore, the proposed amendments to the Finance Acts 2023 are required to a one-time windfall tax on the foreign exchange gains realised by banks in their 2023 financial statements to fund capital infrastructure development, education, and healthcare as well as welfare initiatives all which are components of the Renewed Hope Agenda,”

What you should know

The proposed amendment to the 2023 Finance Act to tax foreign exchange gains by banks stems from the huge gains recorded by Nigerian banks from foreign exchange revaluation.

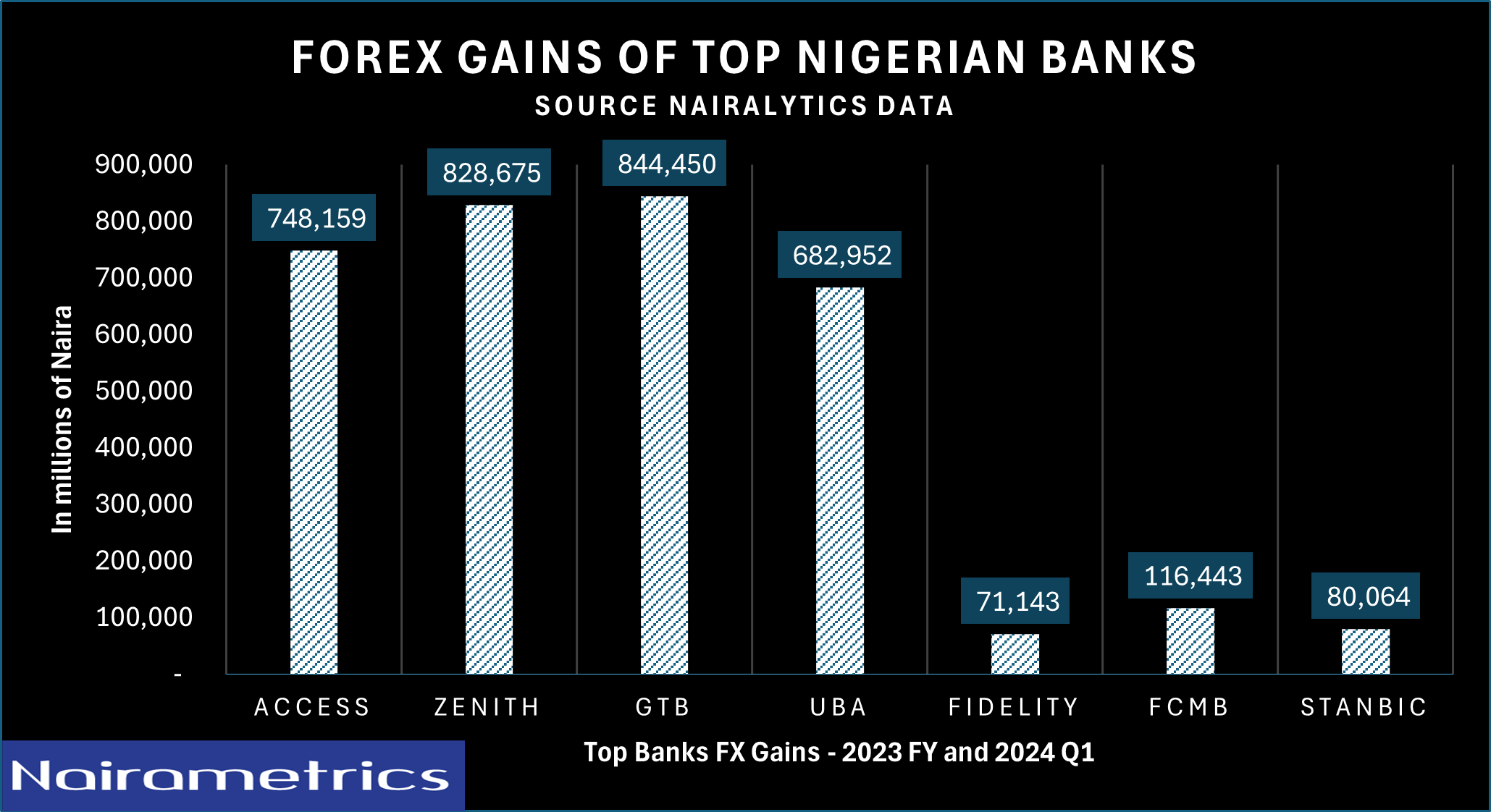

Nigeria’s leading commercial banks reported substantial FX revaluation gains in following the unification of the foreign exchange market. Data from Nairalytics reveals that for the full year 2023 and first quarter of 2024, major commercial banks listed on the NGX recorded FX revaluation gains totaling N3.37 trillion.

As a result, the Central Bank of Nigeria (CBN)declared that FX revaluation gains should be used as a buffer to mitigate significant movements in the FX rate and should not be allocated for paying dividends or operating expenses.

Impact of forex market unification

As part of reforms in the financial sector, the CBN in June announced the unification of the foreign exchange markets to reduce the chasm between the official market rate and that of the parallel market.

The changes in the forex market resulted in significant losses to businesses in the industrial and consumer goods sector of the economy while the banking sector saw significant gains. This is as the naira lost almost 100% of its value by the end of December 2023.

A review of the financial statements of leading Nigerian companies in 2023 revealed a cumulative foreign exchange revaluation loss of N1.7 trillion with MTN Nigeria as the biggest casualty at N740 billion. The telecommunications giant was followed by consumer goods majors such as Nestle Plc and Dangote Sugar Plc with N195 billion and N172 billion FX losses respectively.

On the other hand, the three tiers of government have been benefitting from the FX revaluation gains as it now comprises around 20% of federal allocations shared by the three tiers of government from the previous 1.32% earlier in 2023.